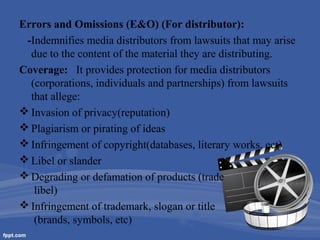

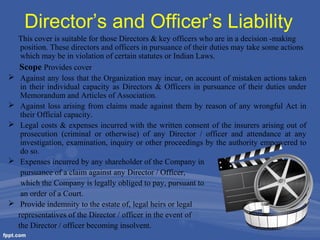

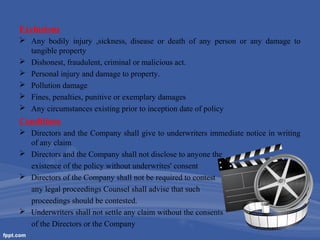

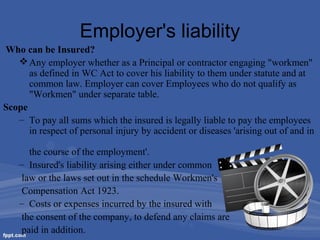

This document discusses various types of liability insurance coverage needed for films and TV productions. It outlines product liability, commercial general liability, property damage liability, errors and omissions, directors and officers liability, and employer's liability insurance. Examples are provided of claims related to wedding videos, documentaries, and film productions to illustrate how liability insurance can help cover legal costs and payouts if a party is found legally liable. The document also provides details on coverage and exclusions for each type of liability insurance.