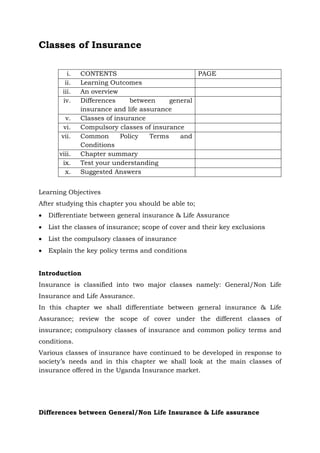

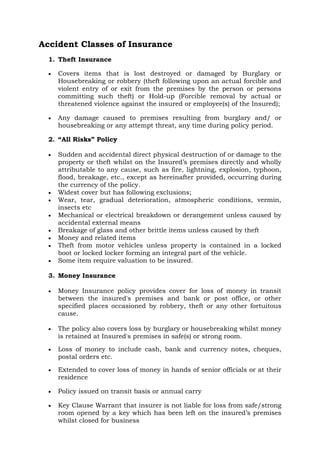

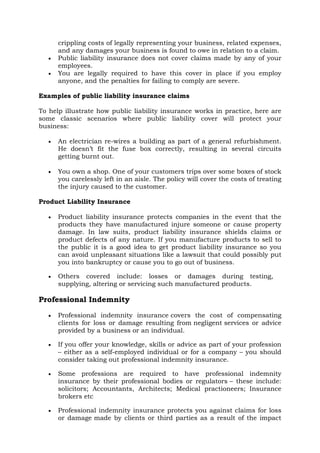

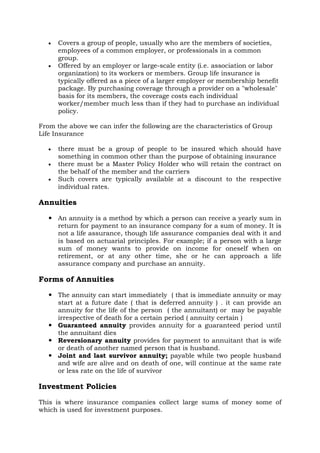

The document provides an overview of different classes of insurance, specifically differentiating between general/non-life insurance and life assurance. It discusses various categories of general and life insurance, including compulsory classes, and explains key policy terms and conditions relevant to the Uganda insurance market. Additionally, it covers specifics like property insurances, liability insurance, and workers' compensation, detailing the coverage, exclusions, and legal implications associated with each type.