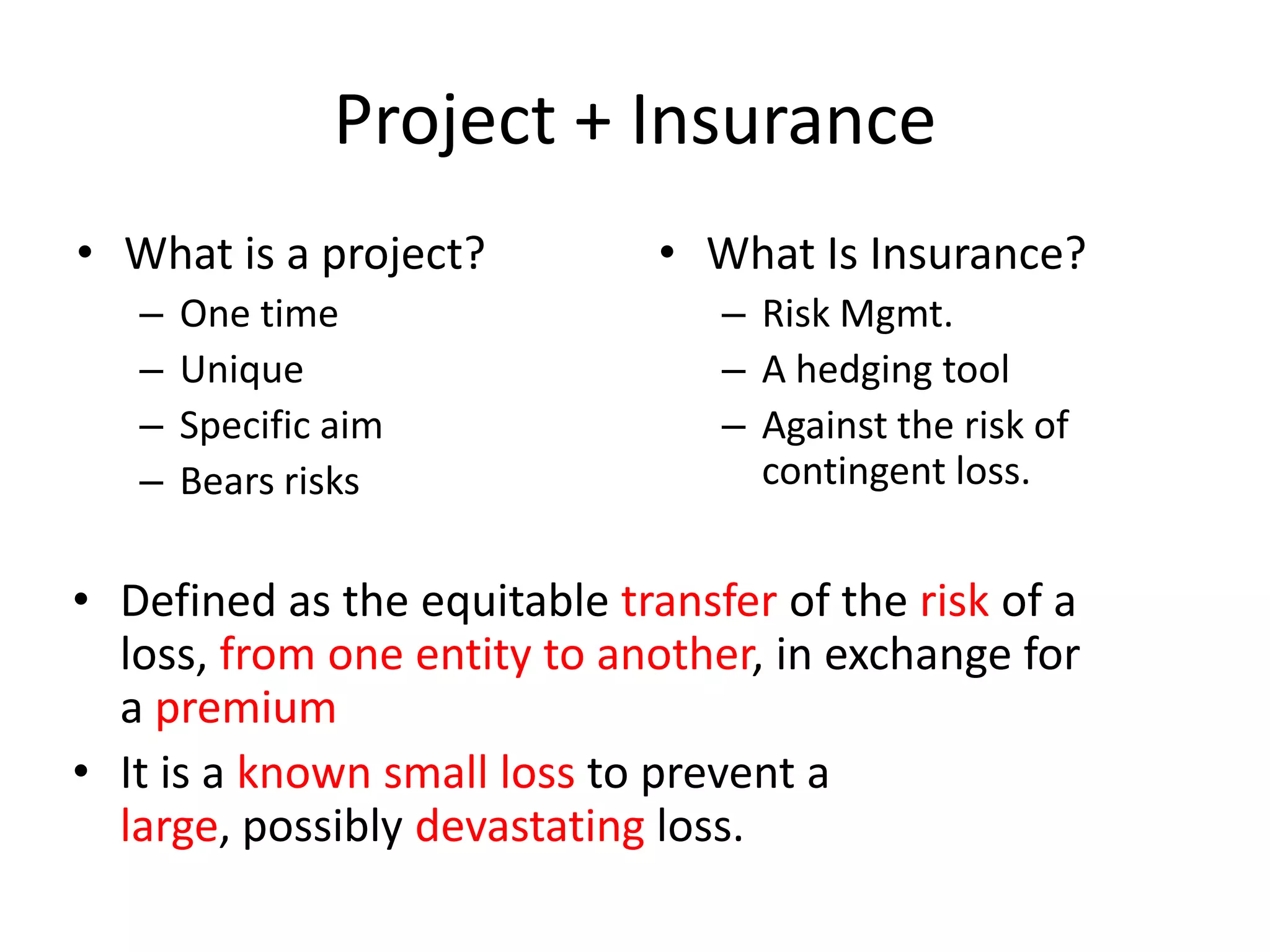

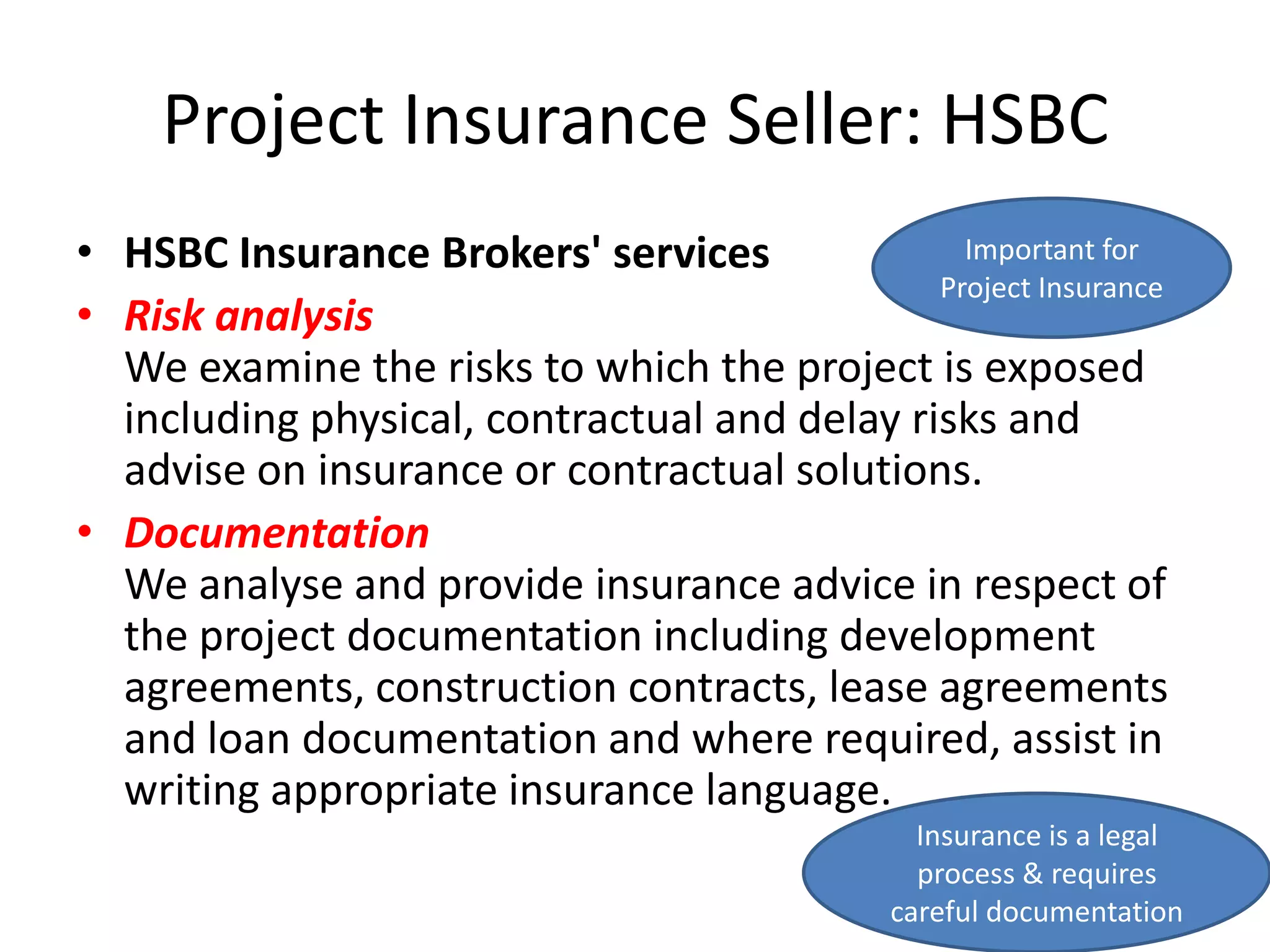

This document discusses project insurance and how it can help manage risks for projects. It defines what a project and insurance are, and explains that insurance is a way to transfer project risks to a third party like an insurer. It outlines different types of project risks and how insurance and contracts with vendors can help mitigate delays. It provides an example of HSBC offering customized project insurance services, including risk analysis, documentation, negotiated policies, and claims management to protect project companies and contractors. The goal of project insurance is to allow business to sustain even if risks occur through qualifying and transferring those risks.