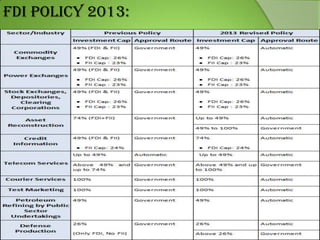

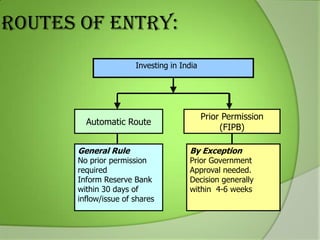

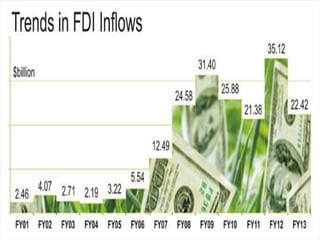

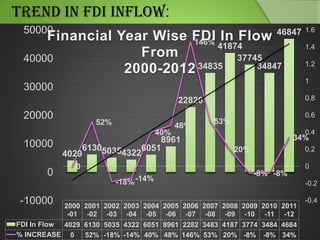

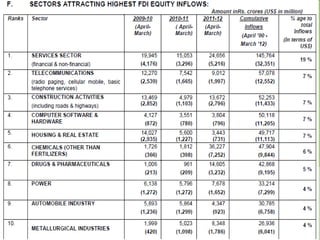

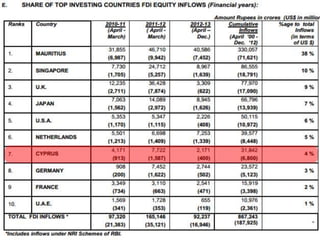

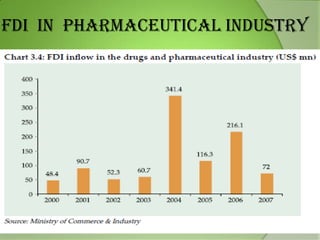

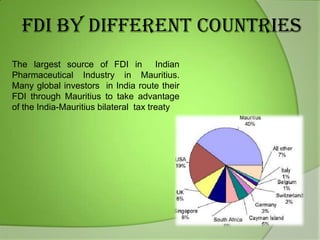

This document presents information on foreign direct investment (FDI) in India, with a focus on the pharmaceutical industry. It defines key terms like globalization, FDI, and portfolio investment. It describes the classification, objectives, advantages, and disadvantages of FDI. It provides data on FDI trends in India over time and top source countries. It also summarizes India's FDI policy and regulations, and analyzes FDI in the pharmaceutical industry specifically, including a SWOT analysis. The conclusion discusses the mostly positive impacts of FDI in India while noting some challenges remain.