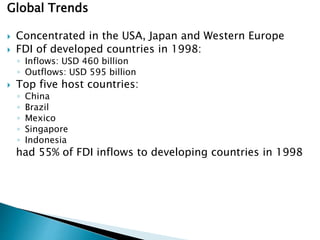

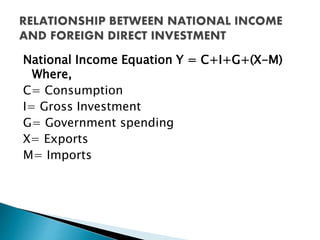

Foreign direct investment (FDI) is defined as a controlling ownership in a business by an entity based in another country. It is distinguished from foreign portfolio investment by the element of control. There are different types of FDI including horizontal, platform, and vertical FDI. Countries provide various incentives to attract FDI through low taxes, economic zones, subsidies, and more. While FDI can benefit an economy through jobs, investment, and technology, it also presents risks such as market dominance and cultural changes. On balance, the advantages of FDI generally outweigh the disadvantages.

![Foreign direct investment incentives

may take the following forms:

low corporate tax and individual income tax

rates

preferential tariffs

special economic zones

Bonded warehouses

Maquiladoras

investment financial subsidies[6]

free land or land subsidies

relocation & expatriation

infrastructure subsidies

R&D support

derogation from regulations](https://image.slidesharecdn.com/fdioriginal-150322052428-conversion-gate01/85/FDI-6-320.jpg)