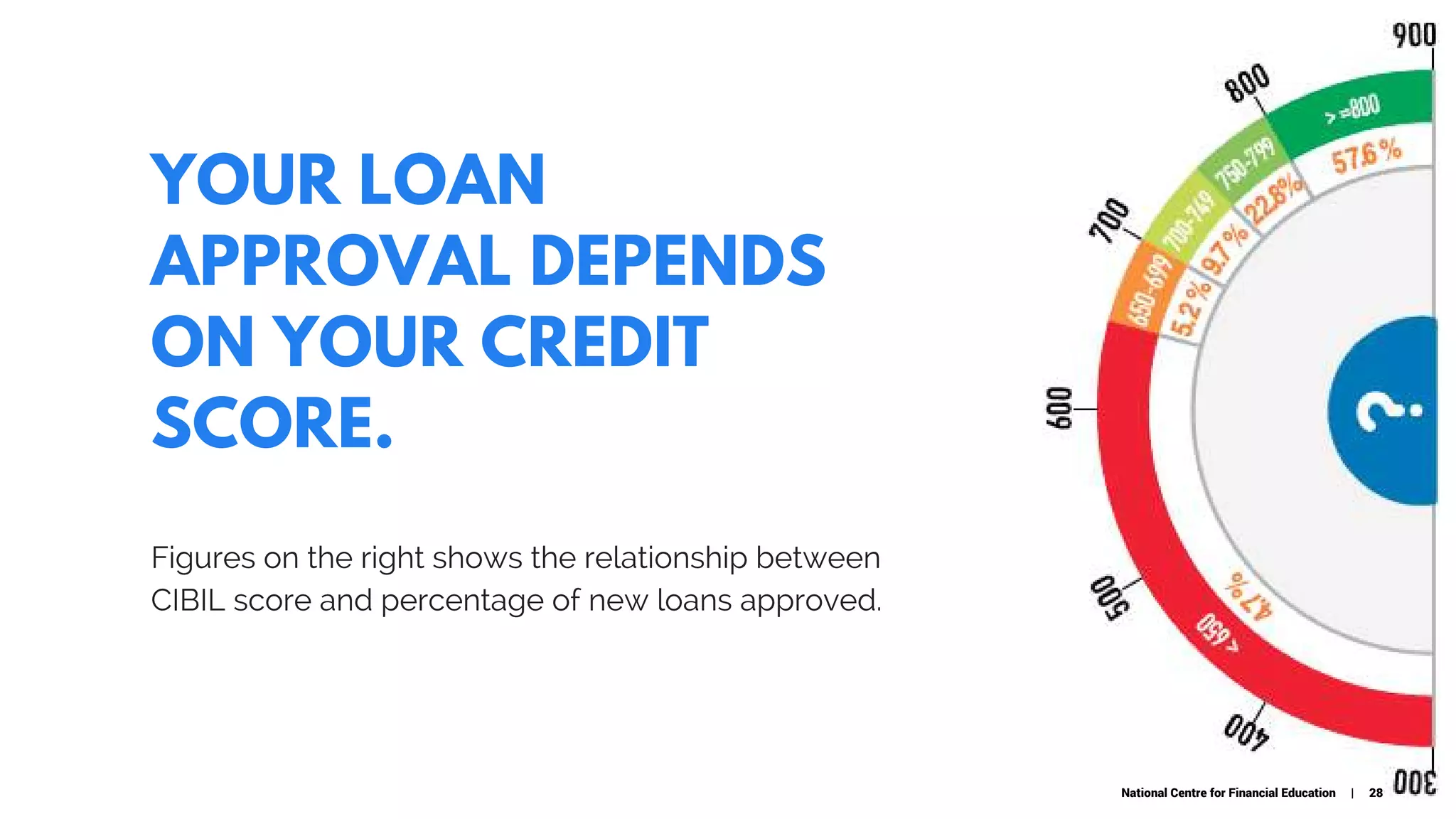

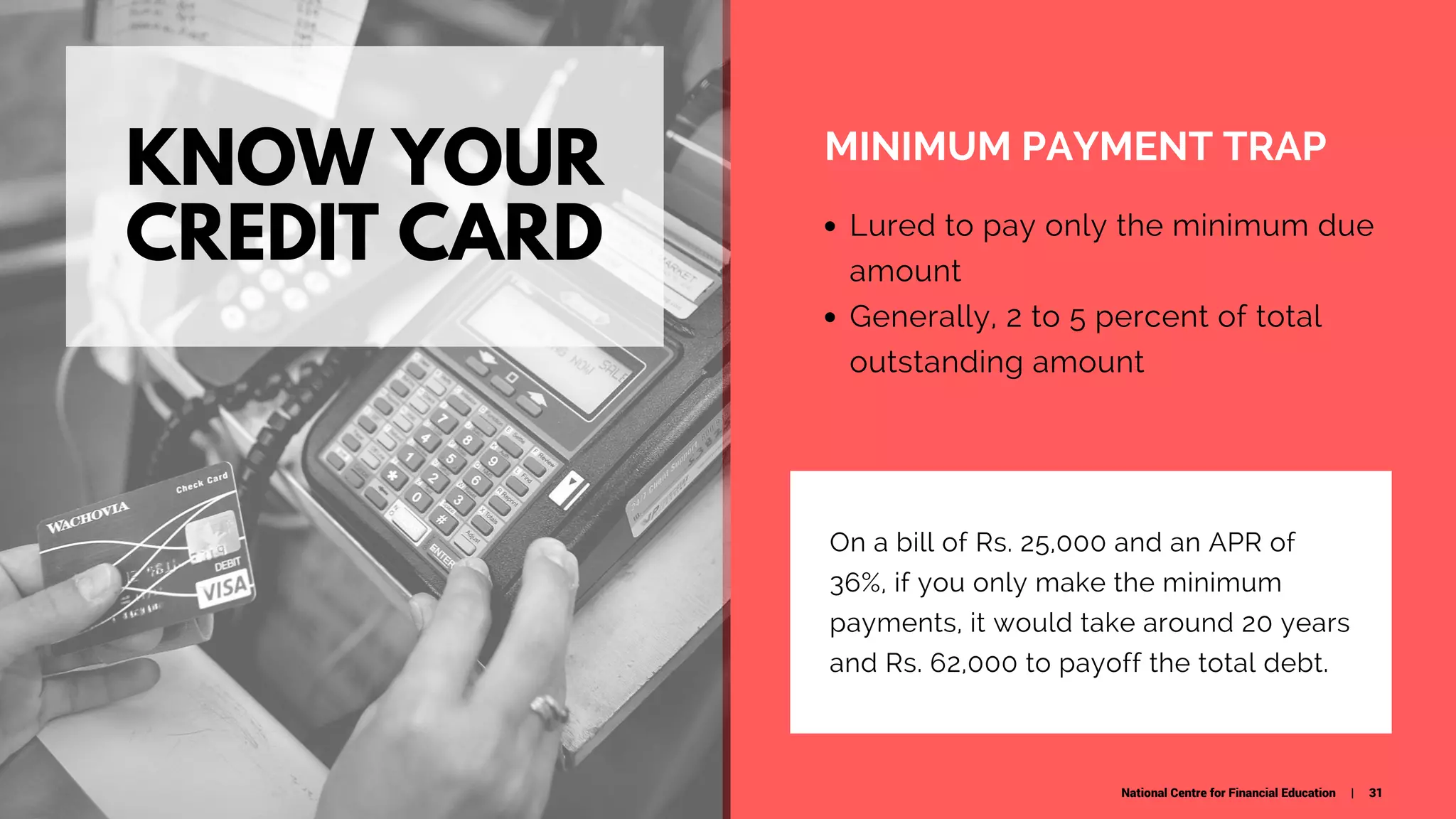

This document provides information on responsible credit card usage. It discusses how credit cards can help build credit scores and earn rewards if used properly, but can be dangerous if misused due to high interest rates and fees. These include annual fees, interest charges if balances aren't paid off monthly, penalties for late payments or exceeding the credit limit, and additional fees for cash withdrawals, foreign transactions, and only making minimum payments. The document advises using no more than 30% of the credit limit, paying balances in full each month, tracking spending, and being aware of marketing tactics to use cards responsibly.