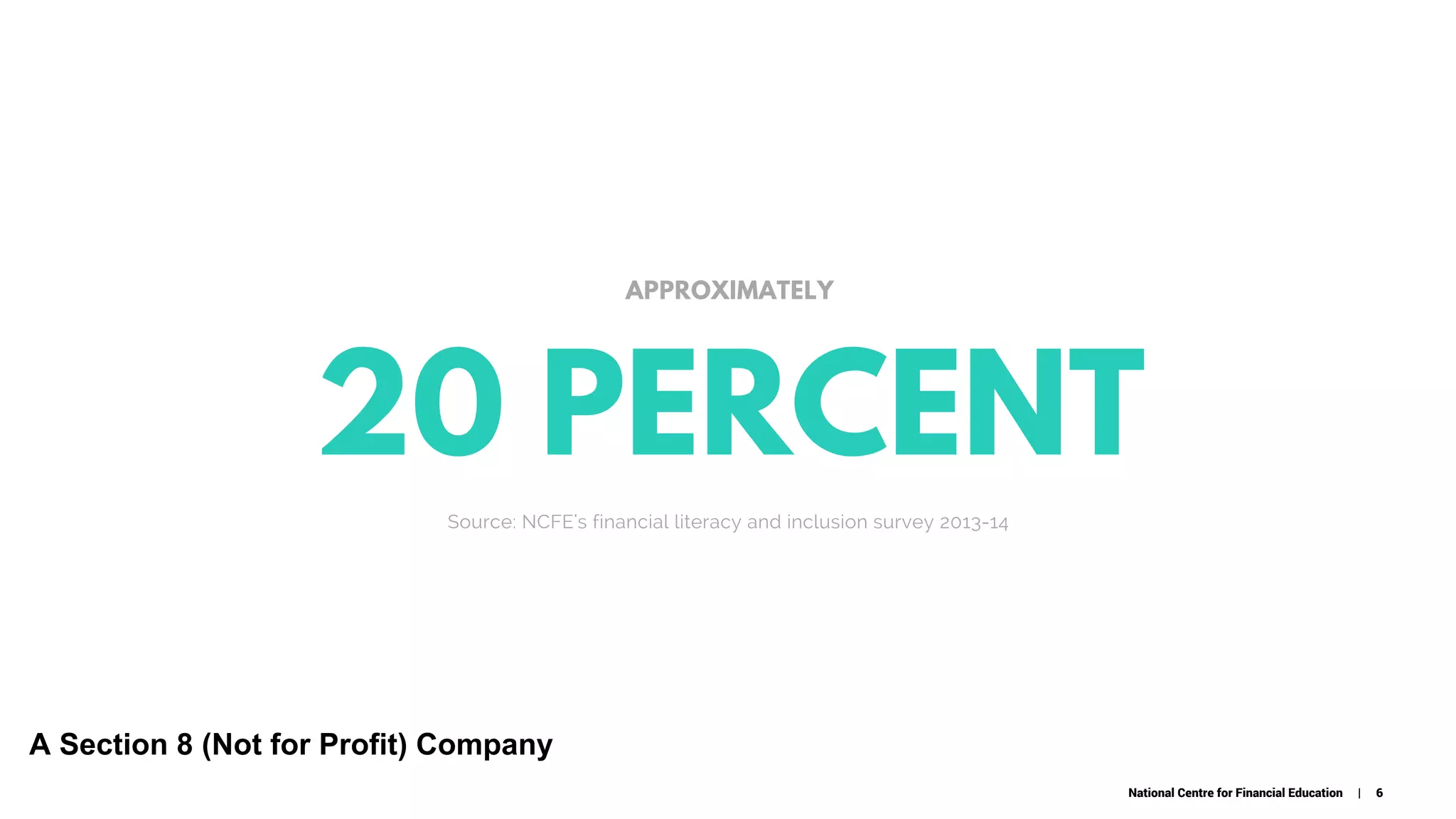

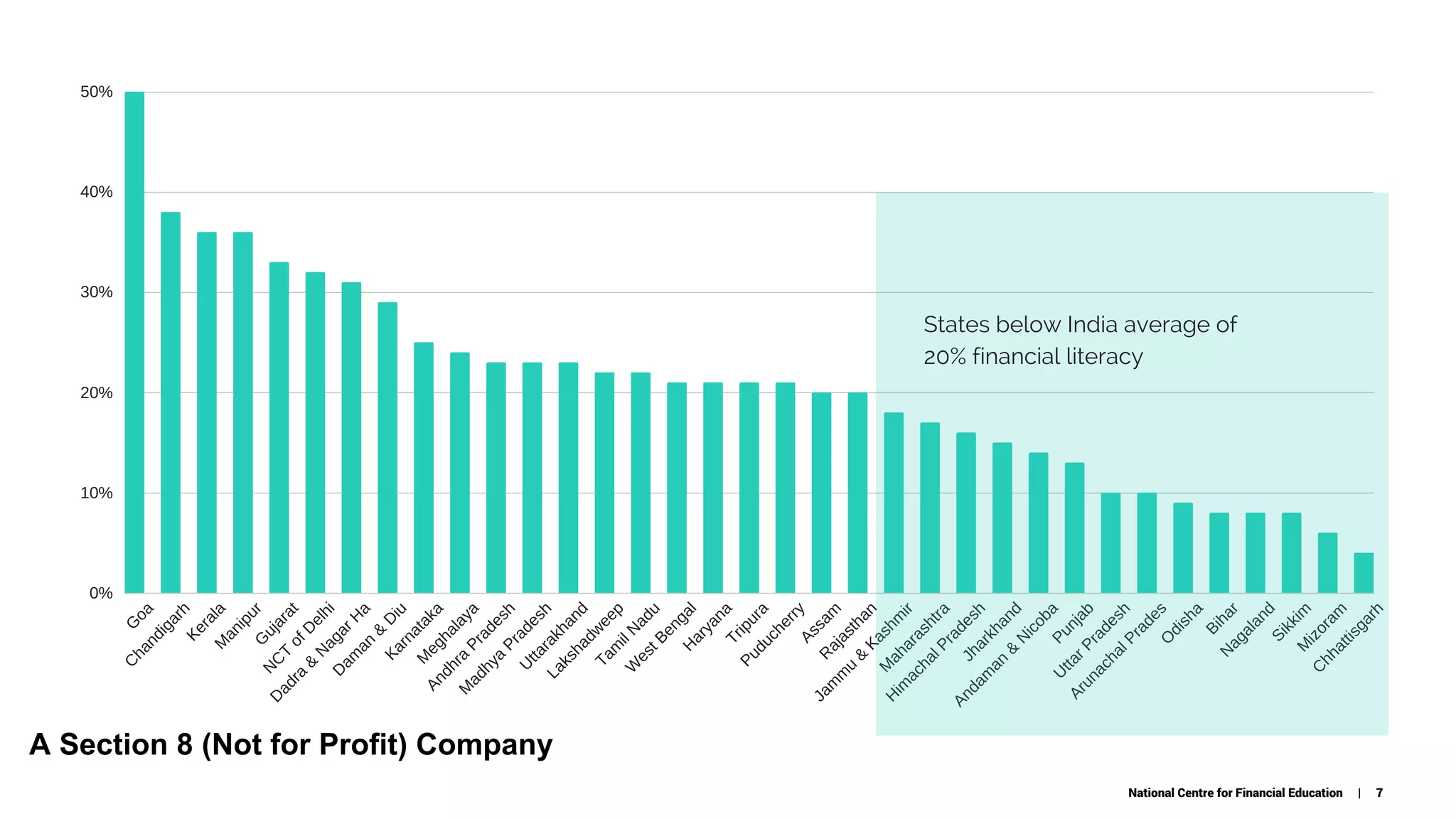

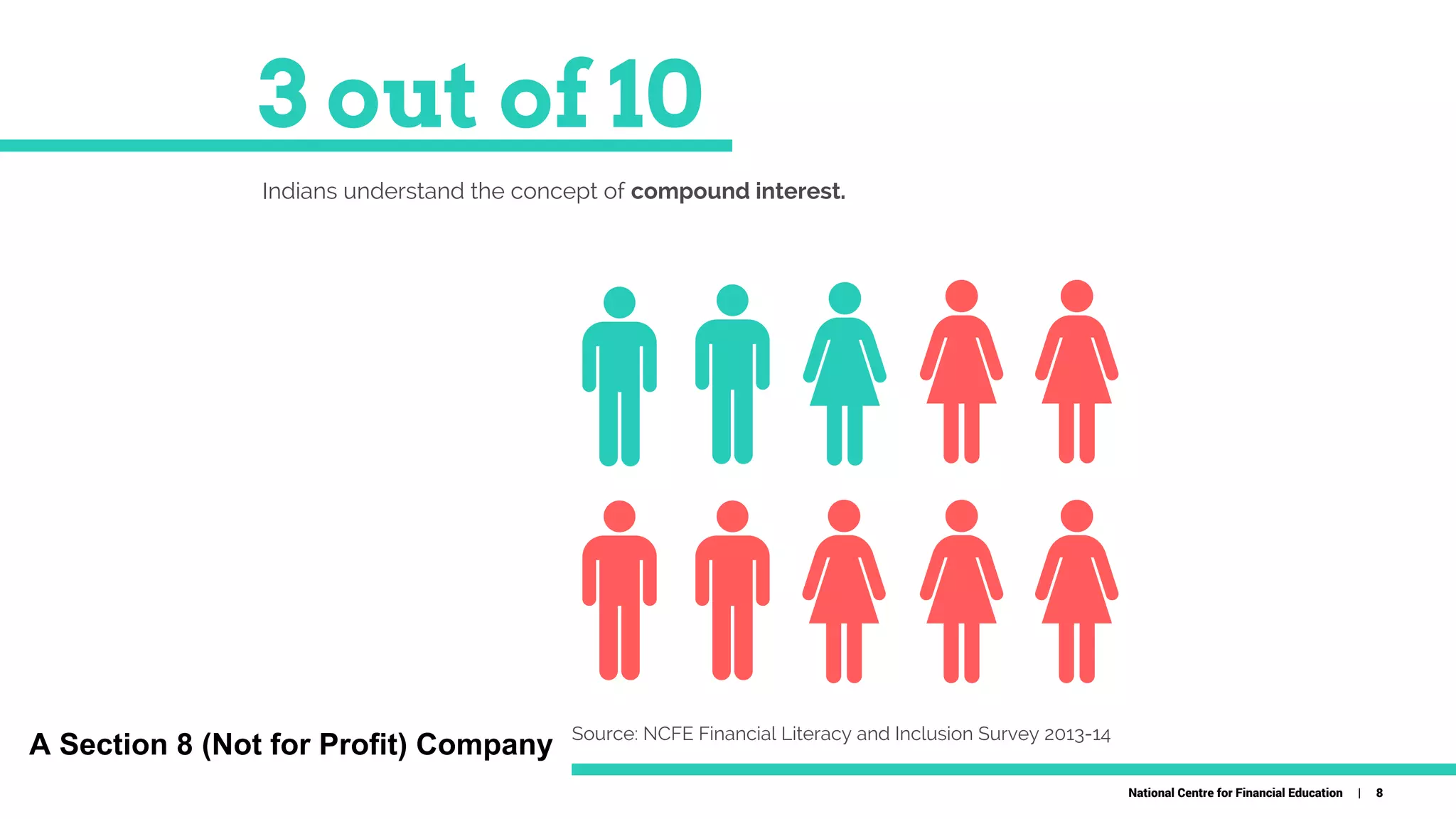

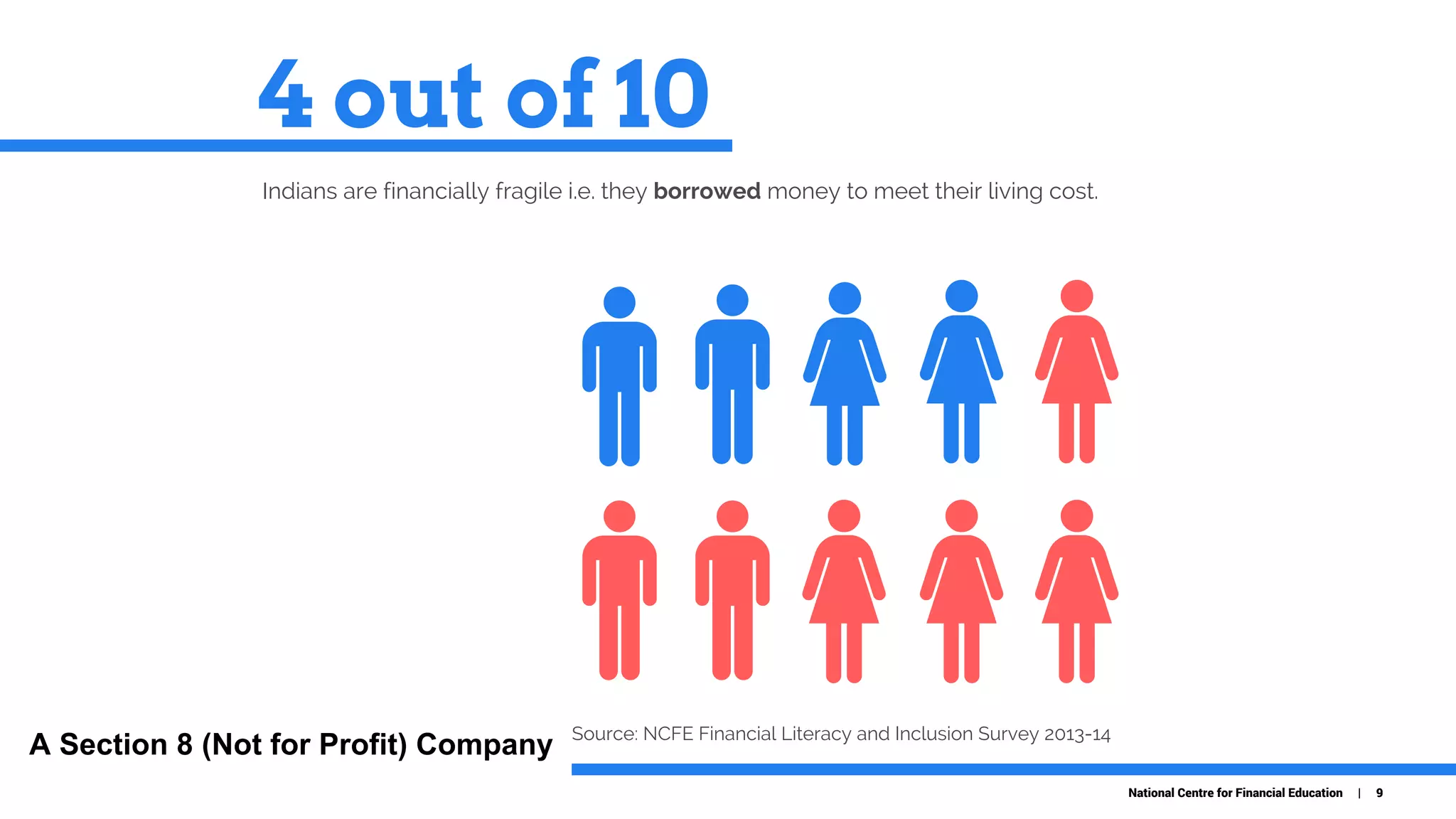

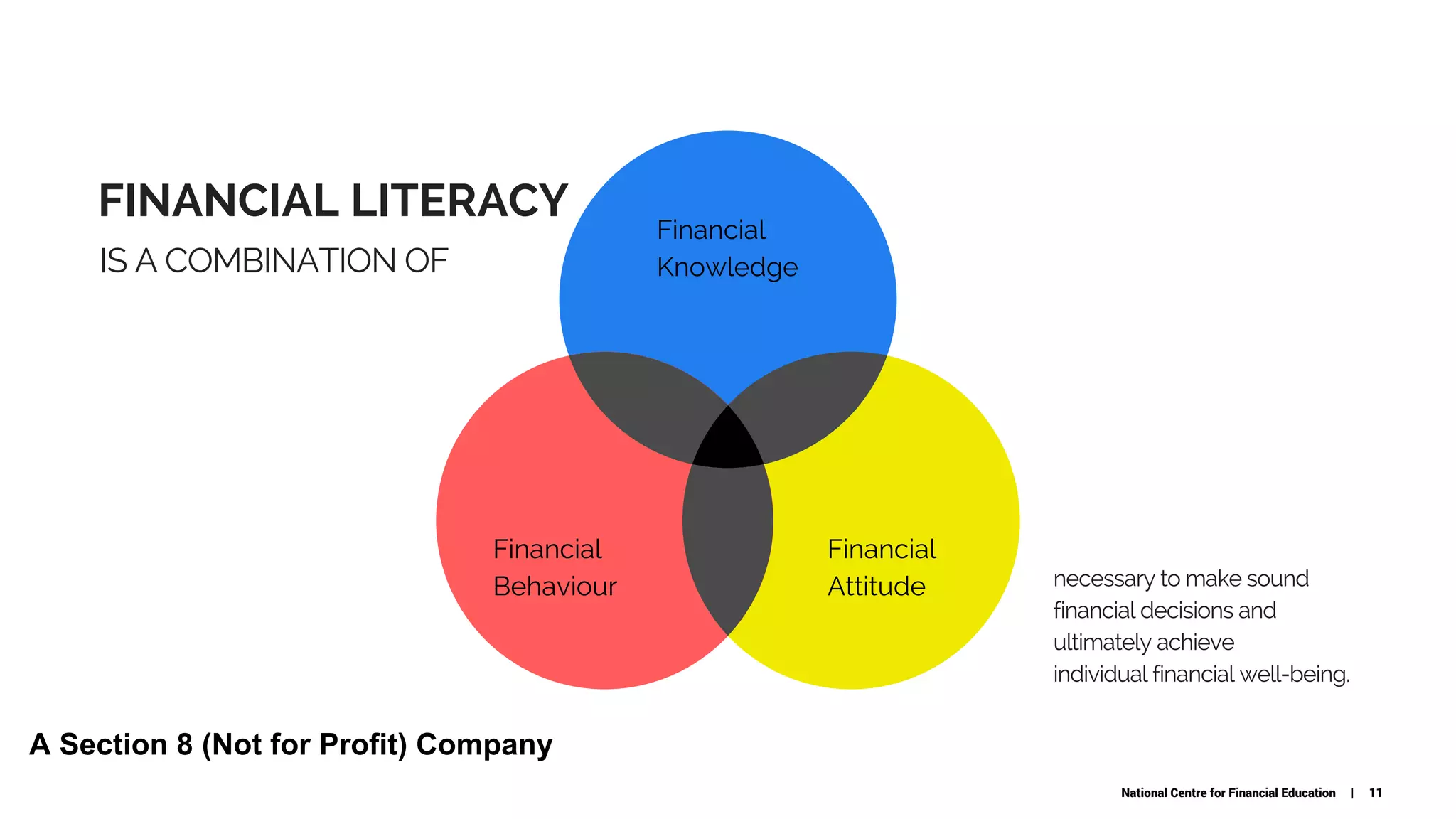

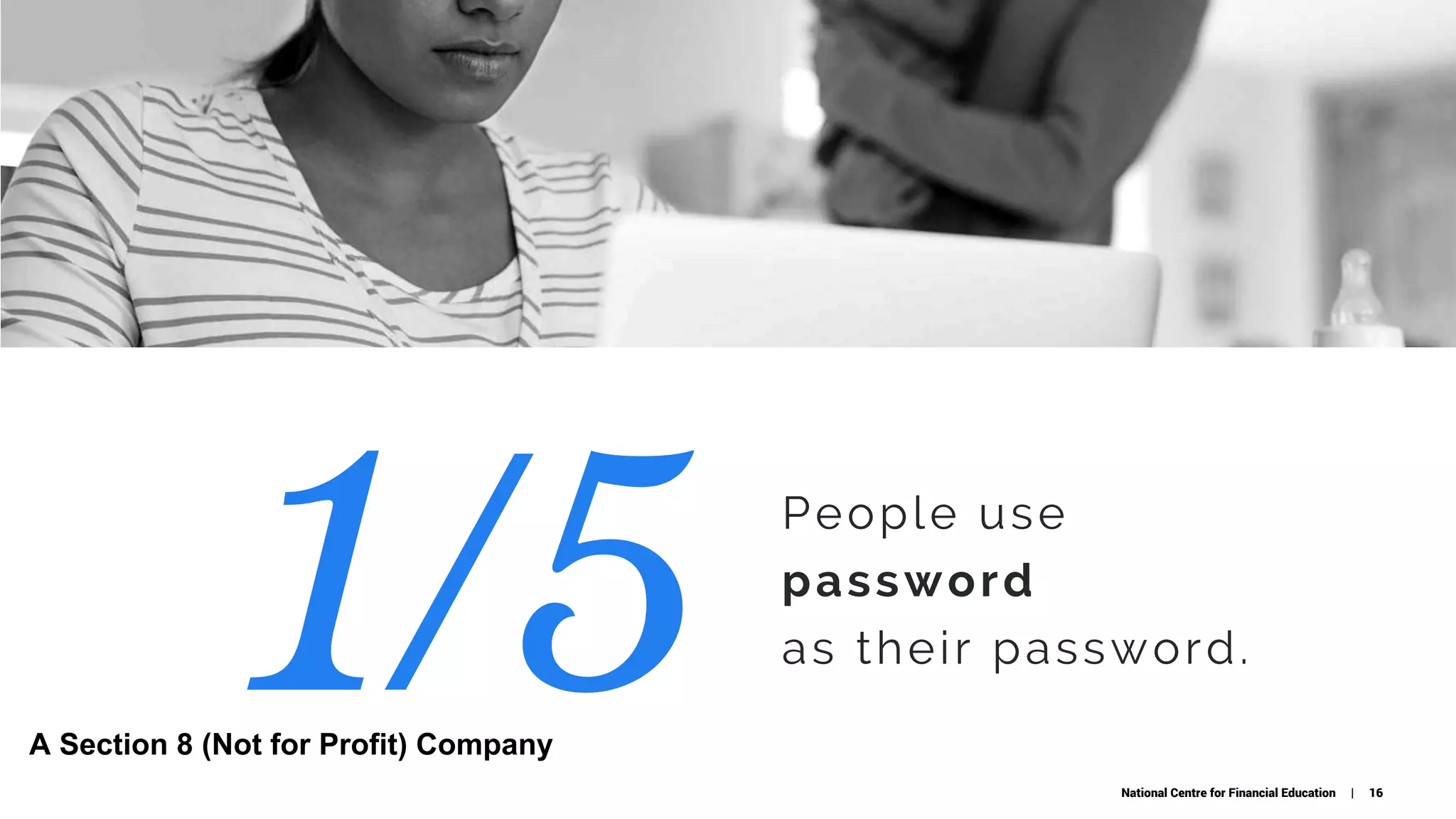

The document is about financial literacy and consumer training in India. It discusses the National Centre for Financial Education (NCFE), which was set up under government guidance to implement the National Strategy for Financial Education. The NCFE aims to make India financially aware and empowered by providing financial education campaigns. It also aims to help people access financial products and services through regulated entities with consumer protection. The NCFE finds that only about 20% of Indians are financially literate based on its survey, and many states are below this level. It discusses the importance of financial literacy and outlines some key topics to educate consumers.