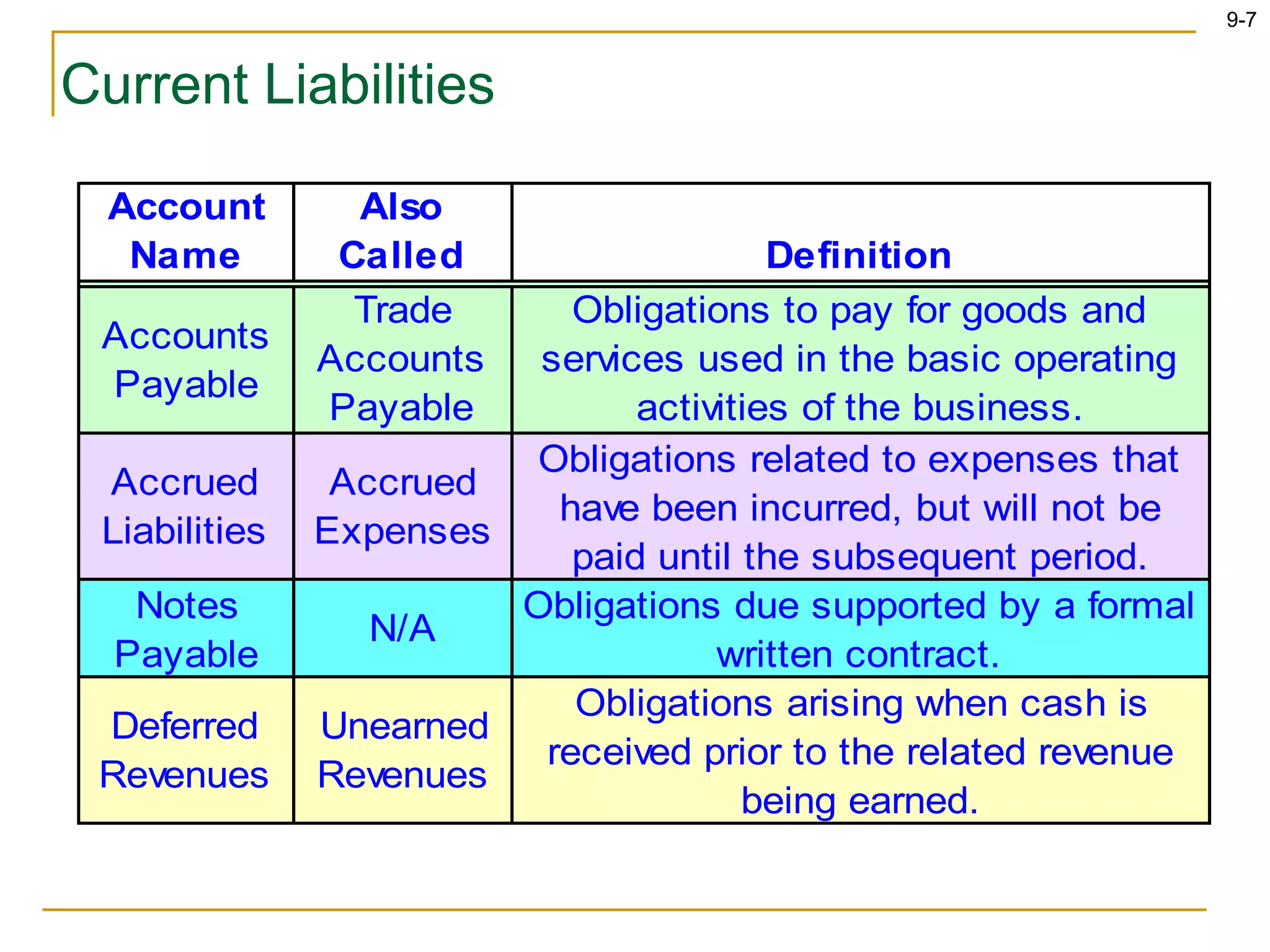

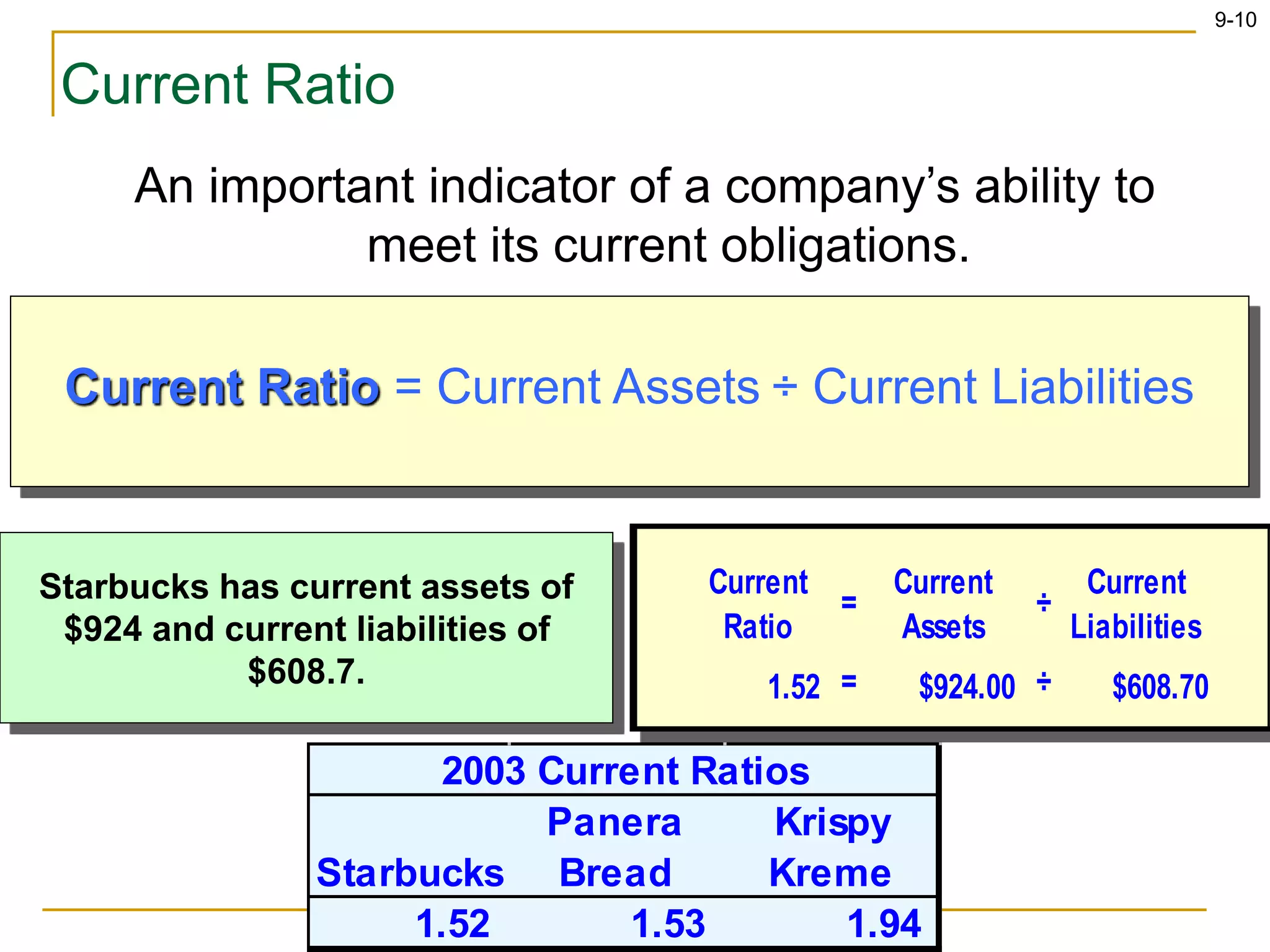

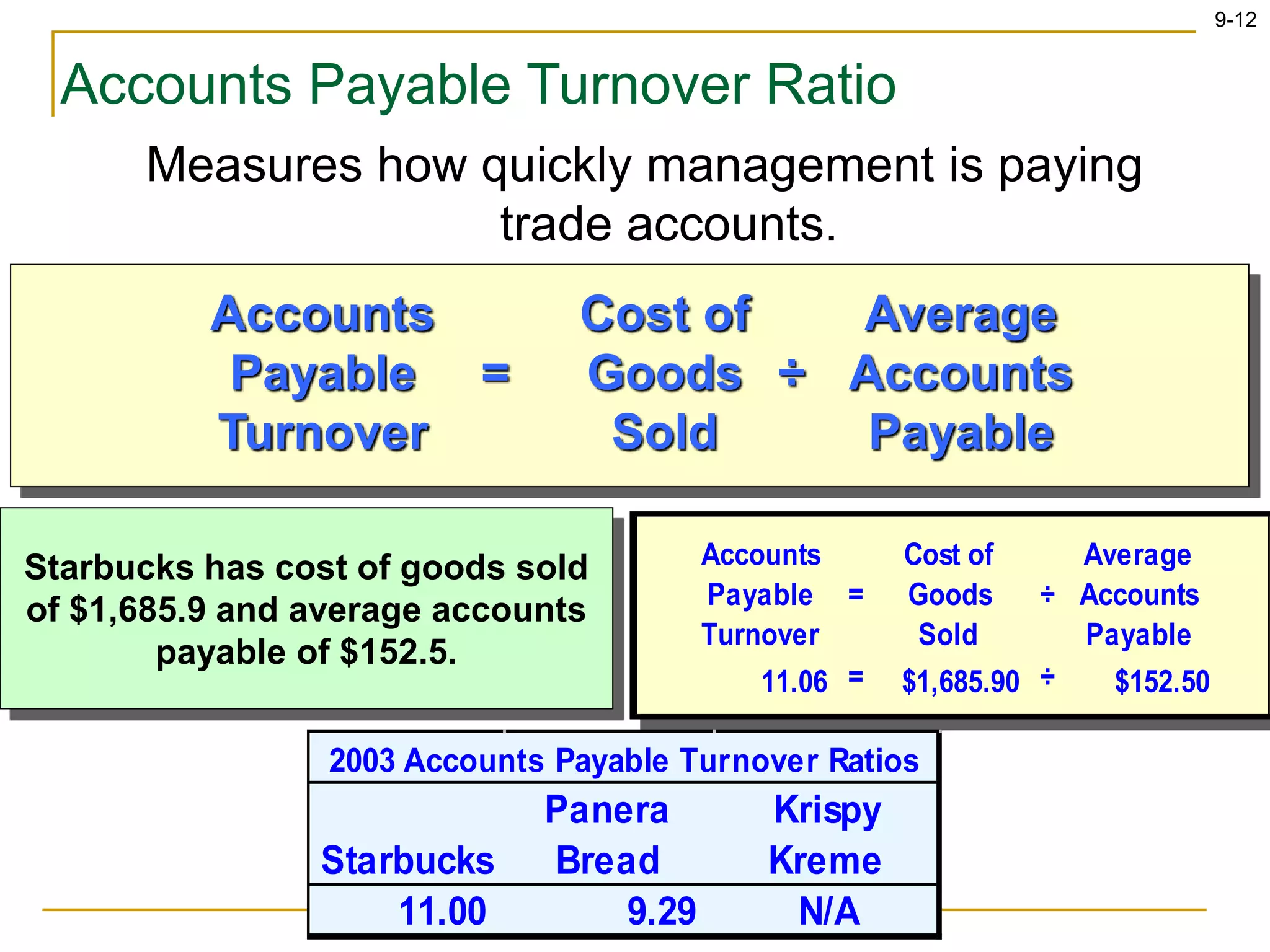

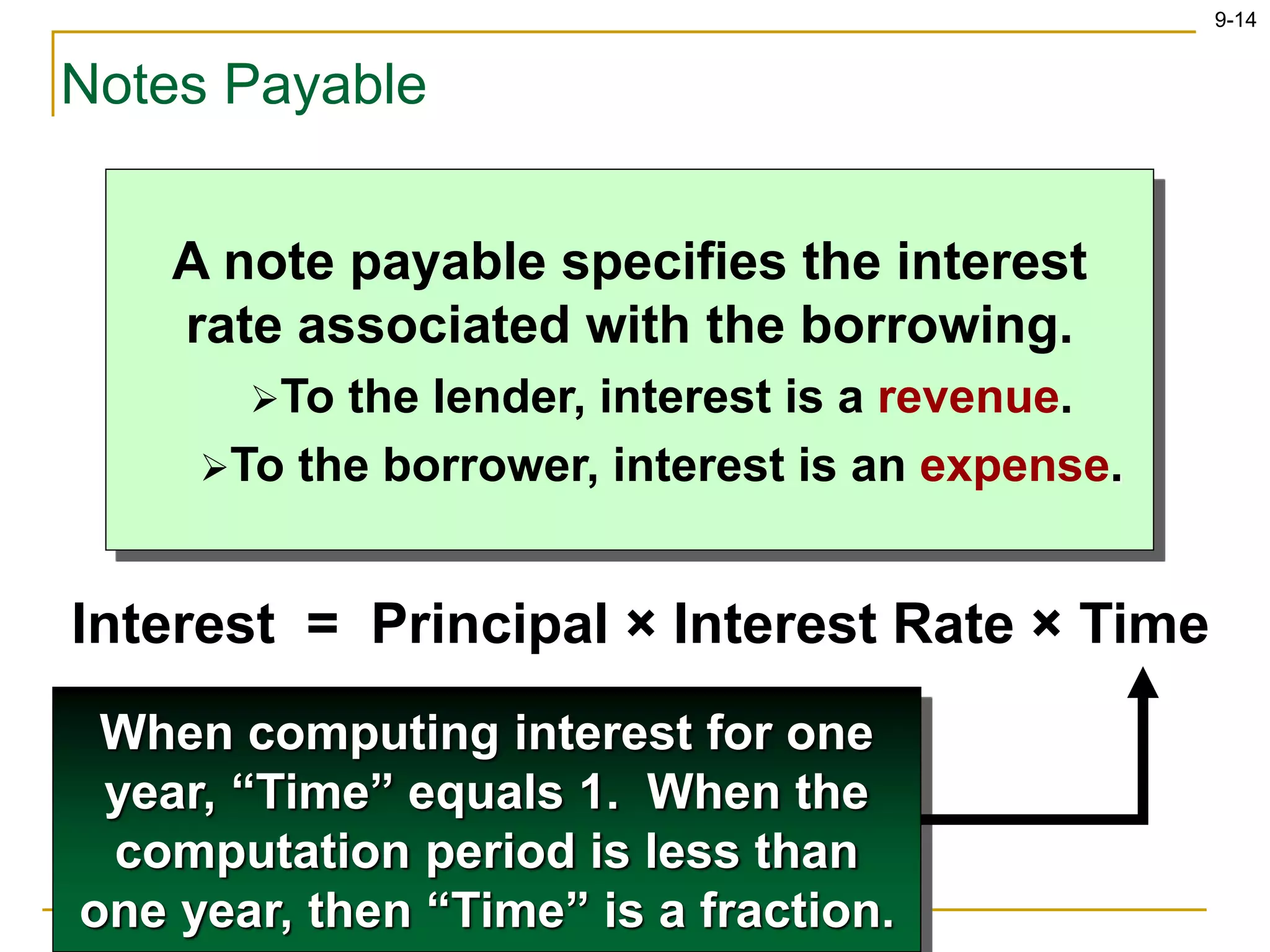

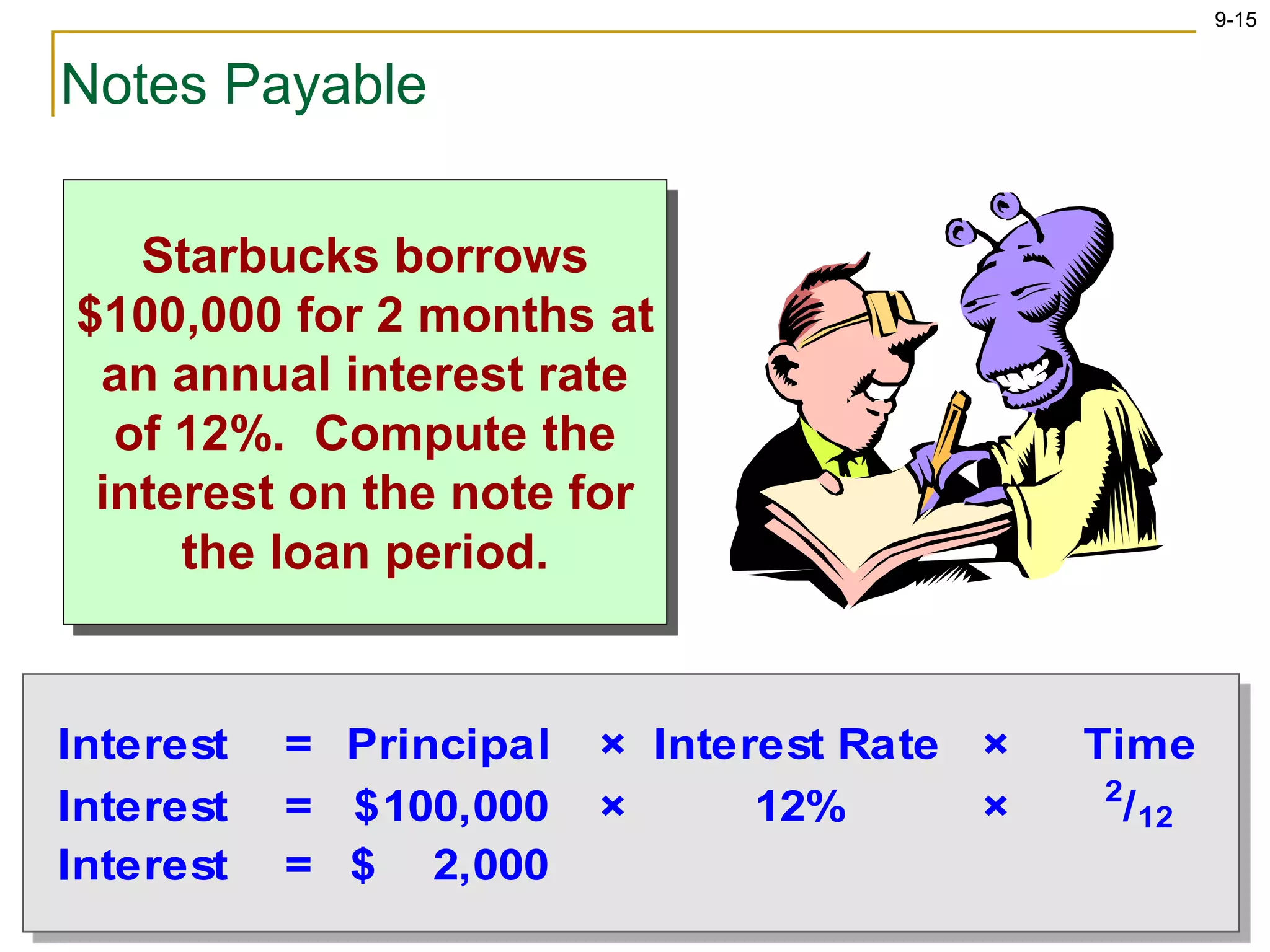

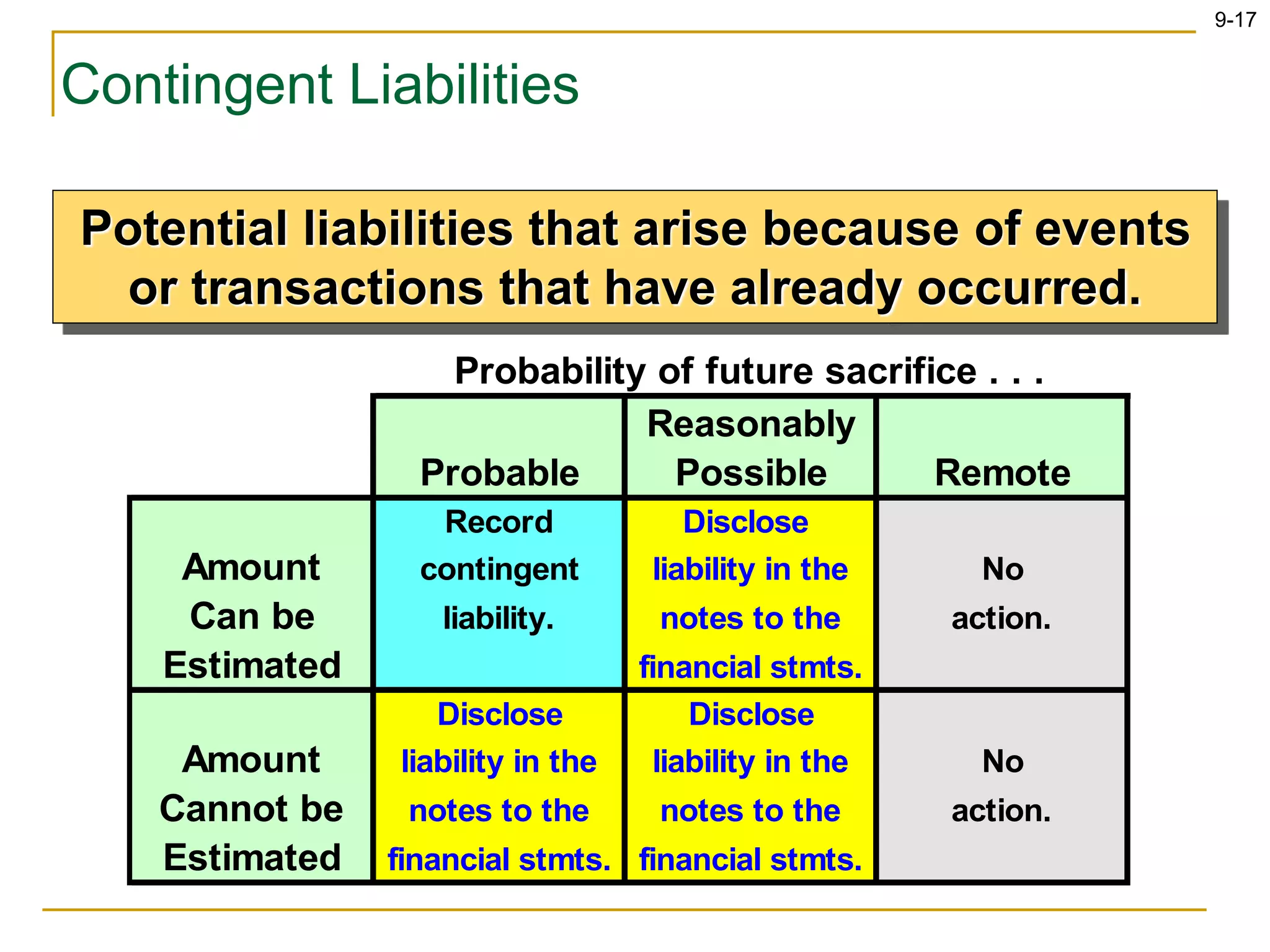

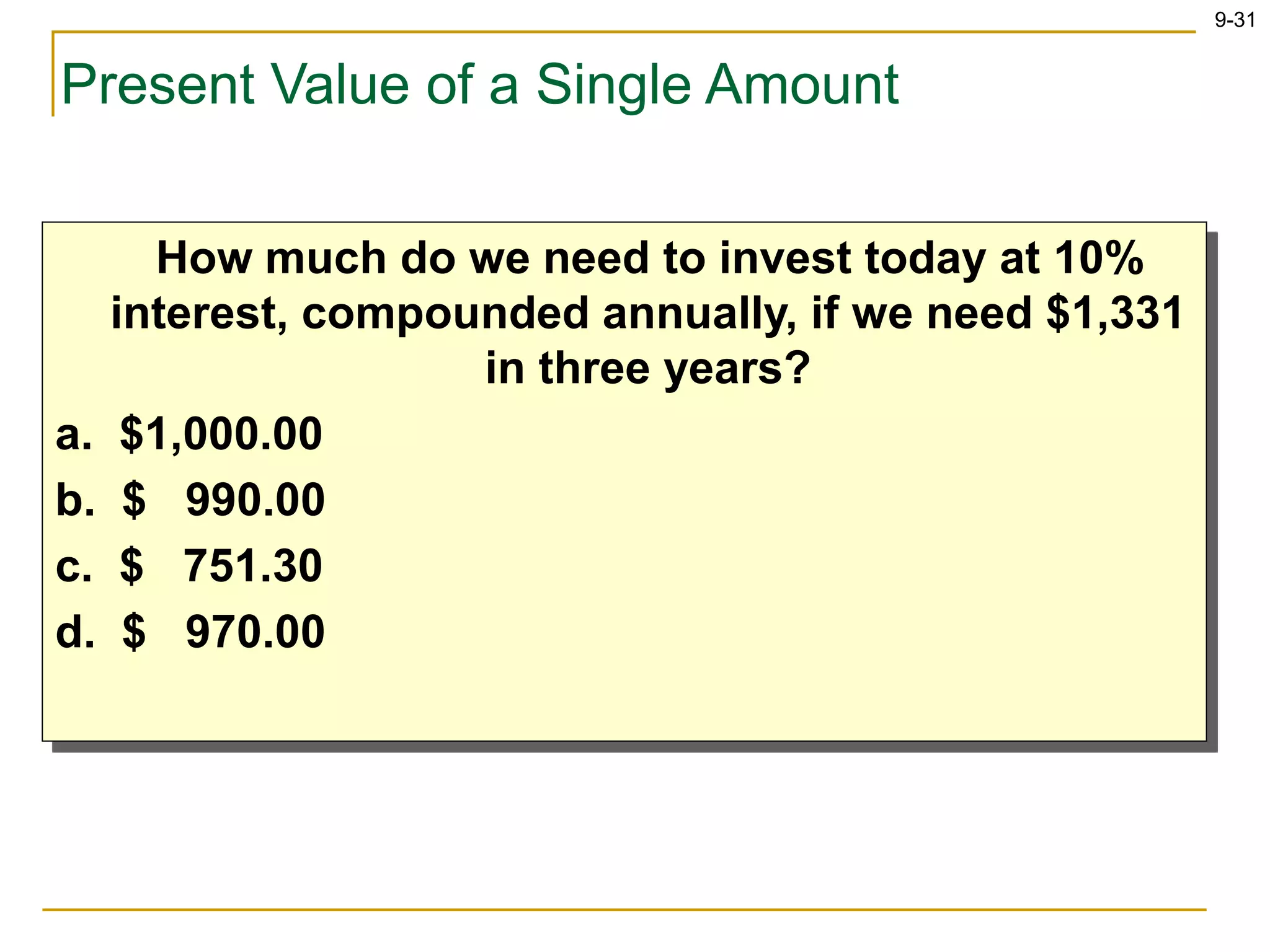

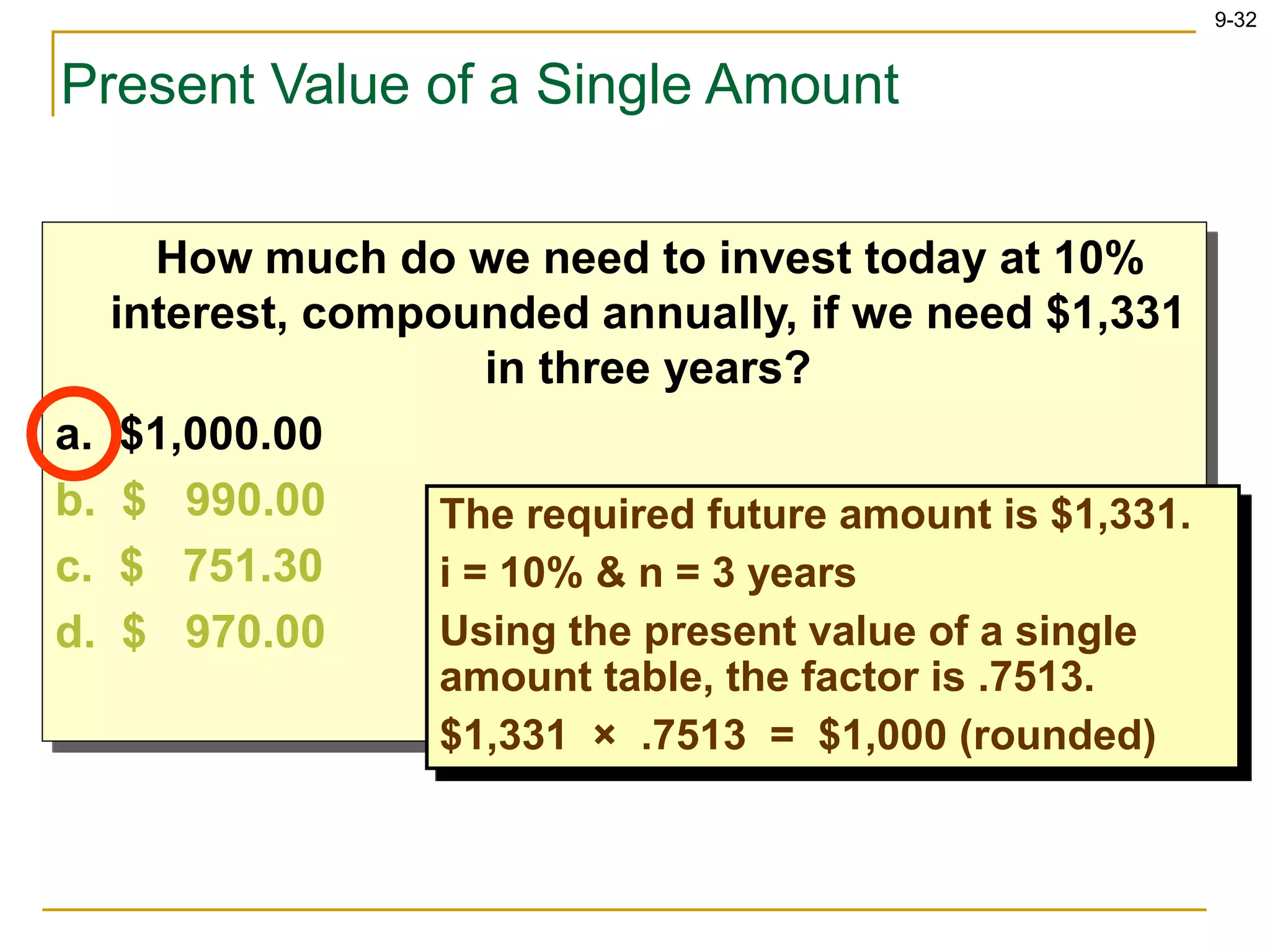

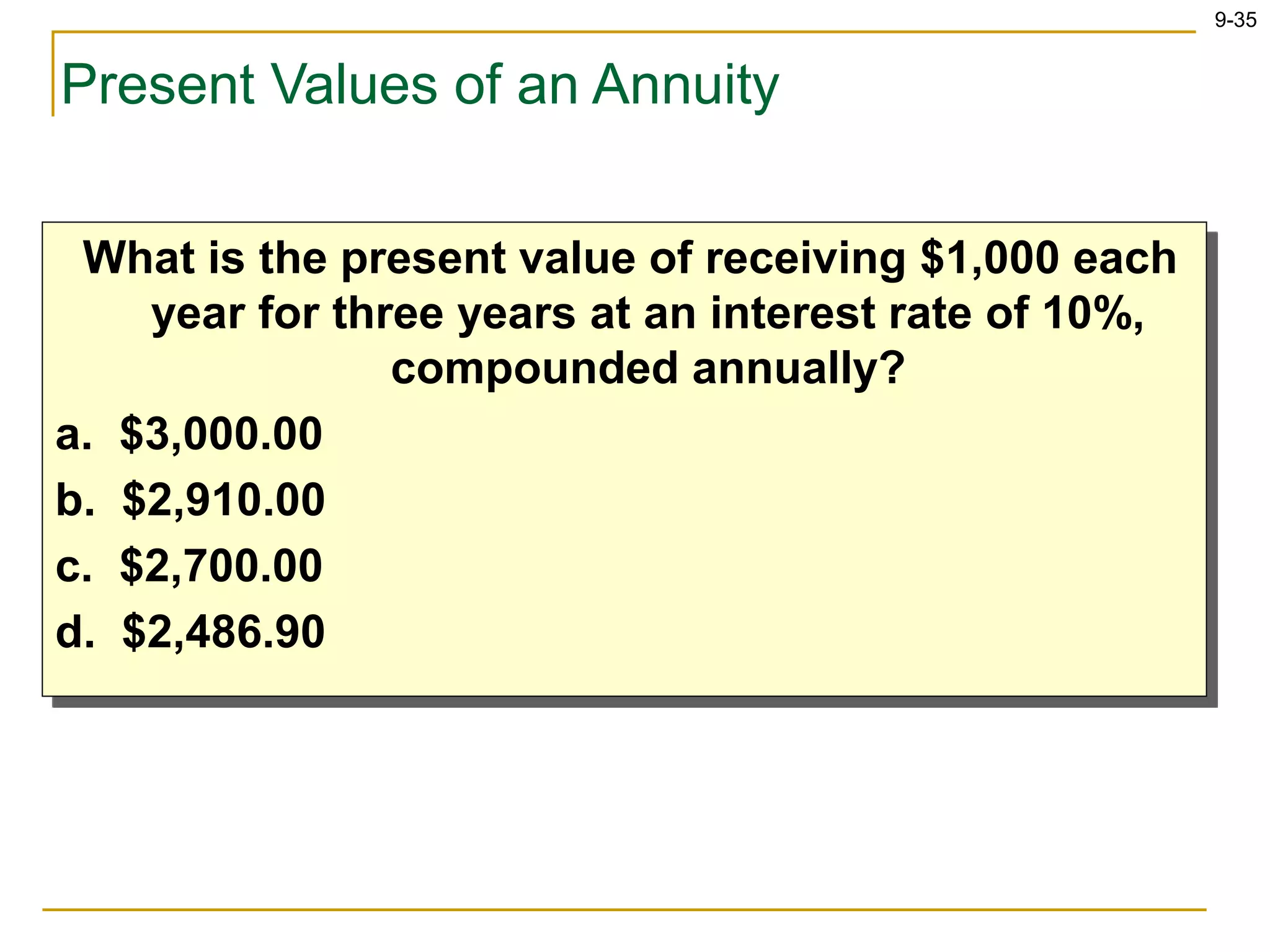

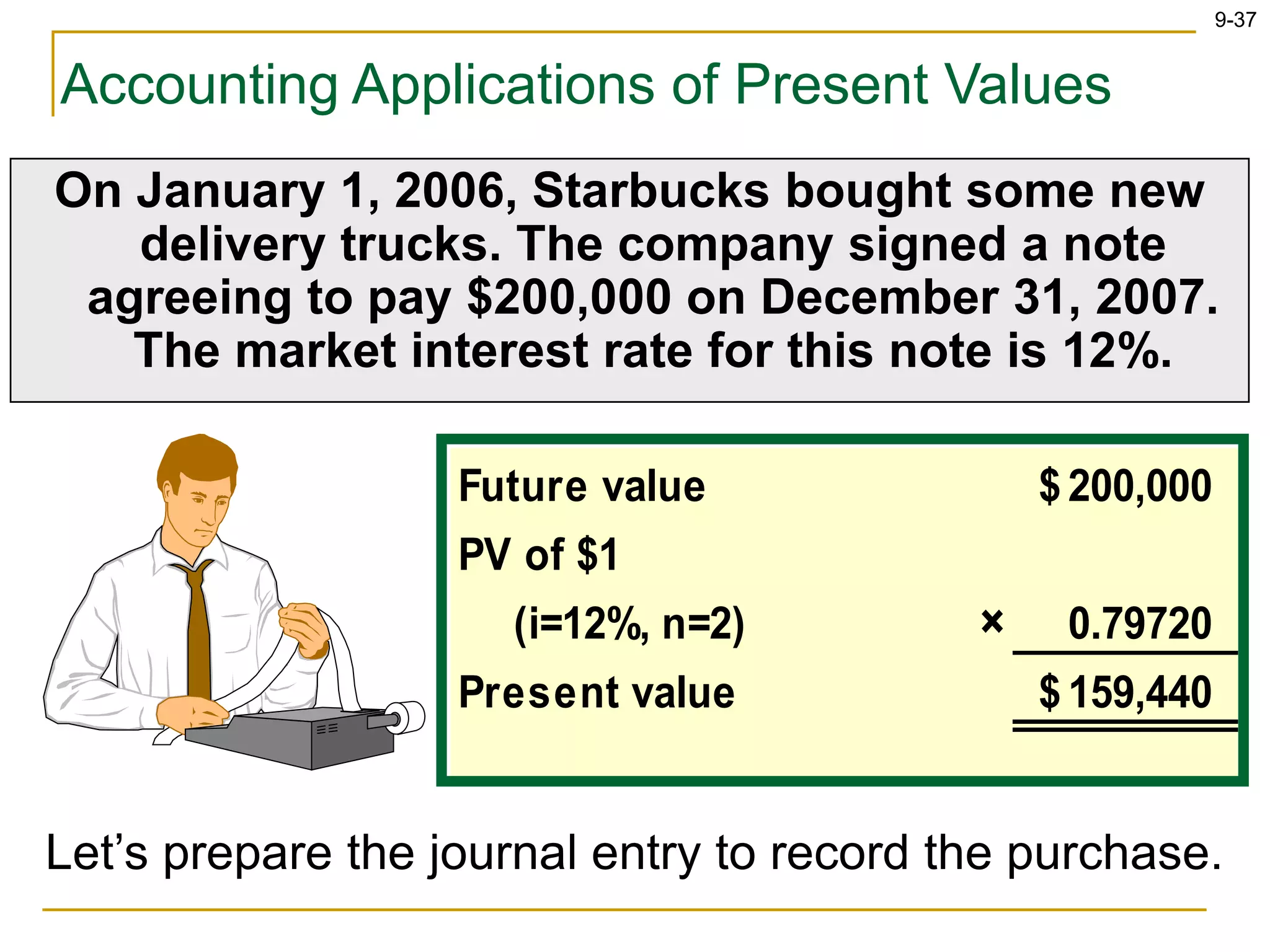

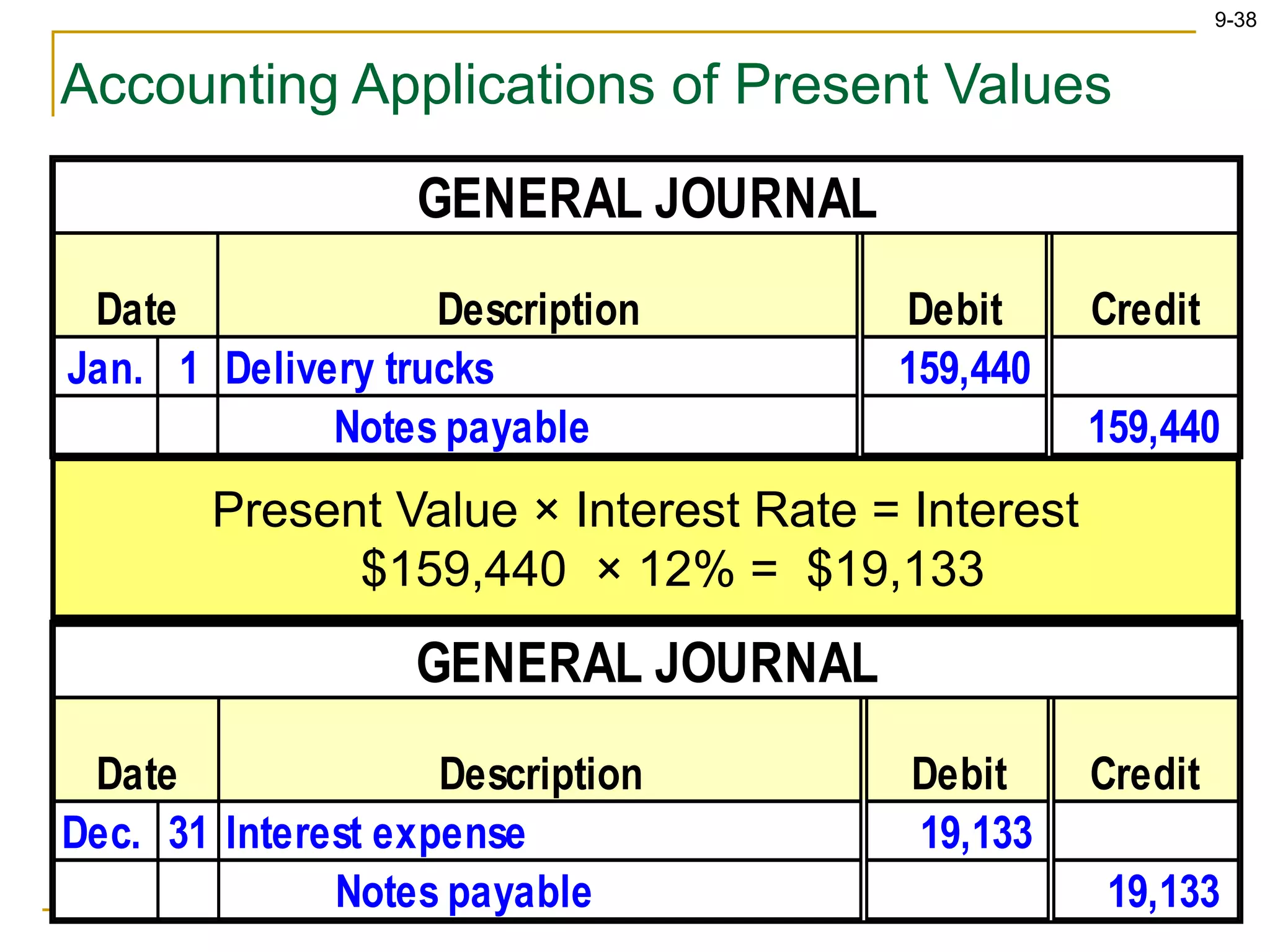

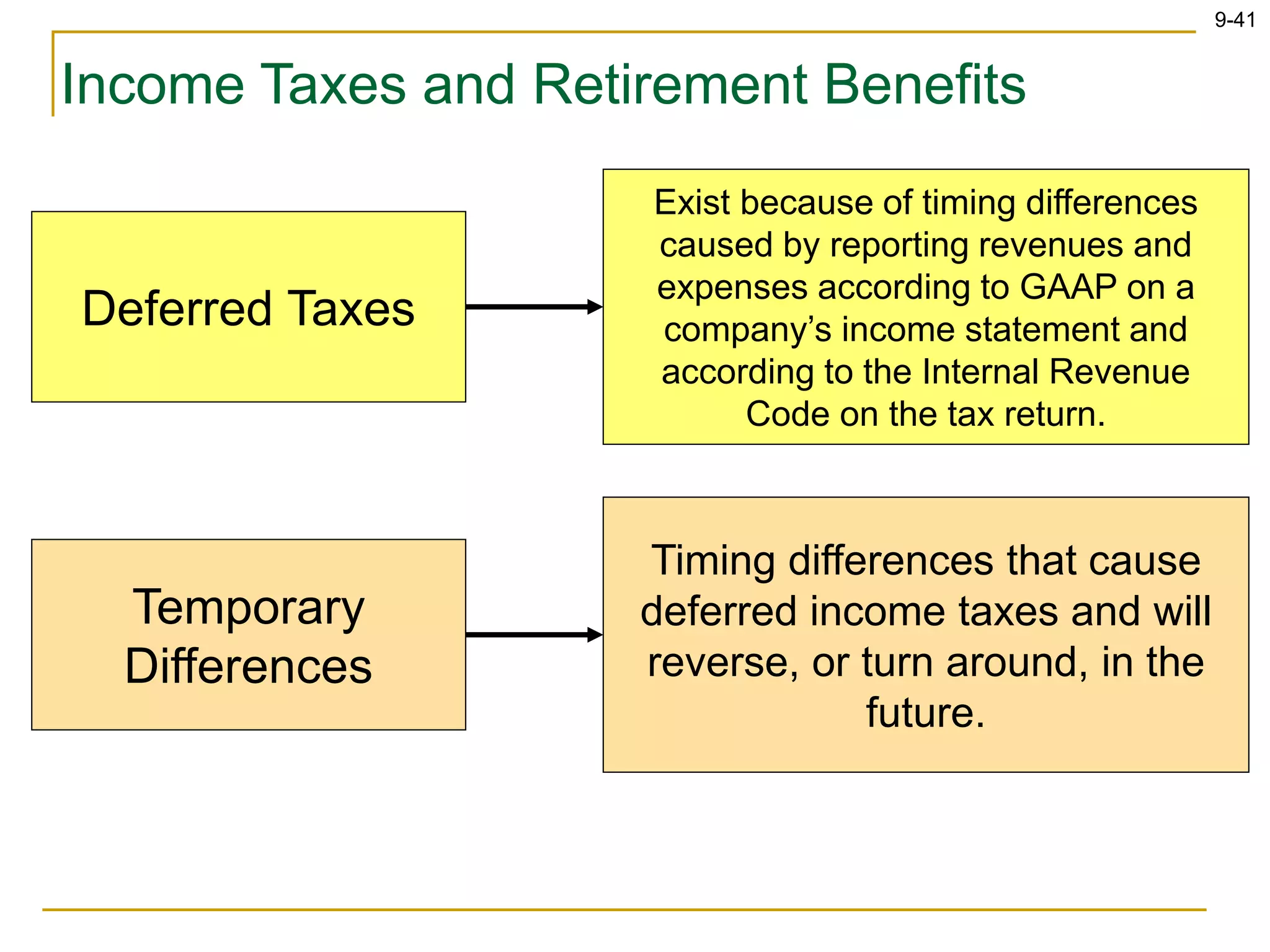

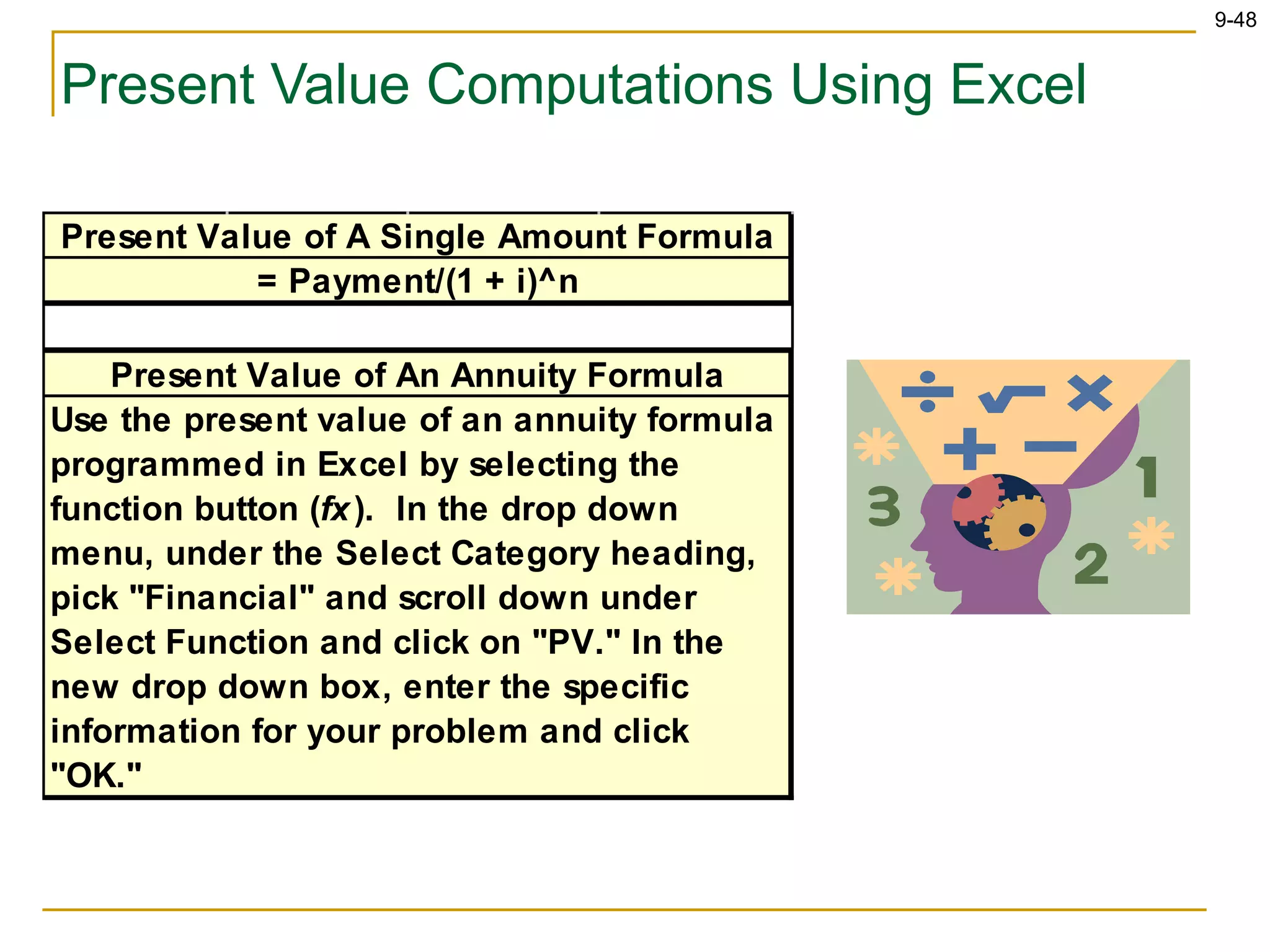

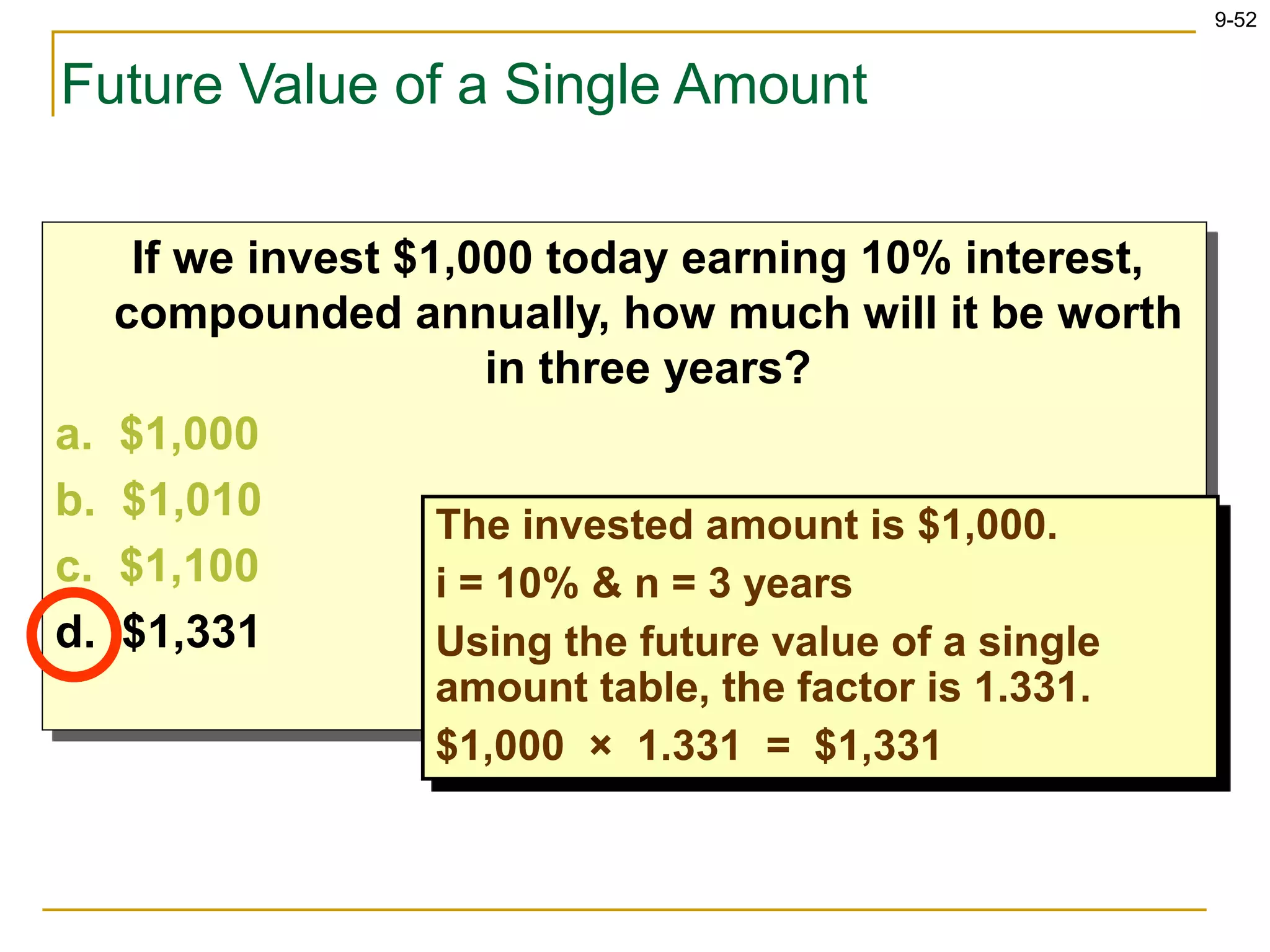

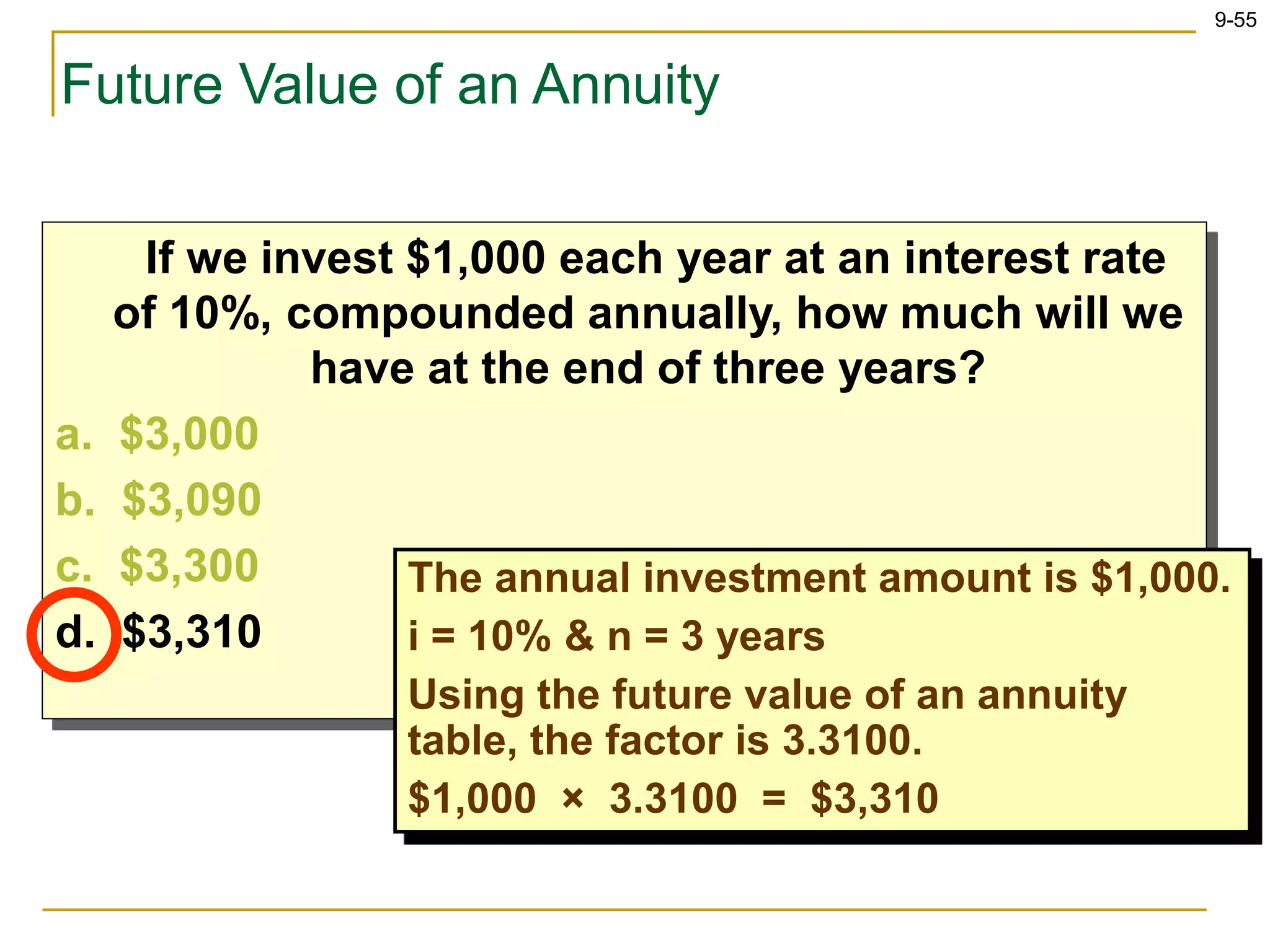

This document provides a summary of key concepts related to liabilities from Chapter 9 of an accounting textbook. It defines current and noncurrent liabilities, and discusses specific current liability accounts like accounts payable, accrued liabilities, and notes payable. It also covers liability ratios like the current ratio and accounts payable turnover ratio. Additionally, it discusses long-term liabilities such as notes payable, bonds, and capital versus operating leases. The chapter explores the time value of money concept of present value as it applies to liabilities.