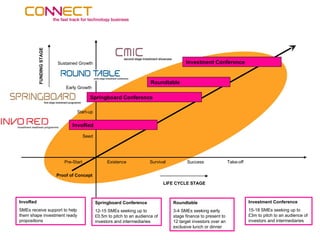

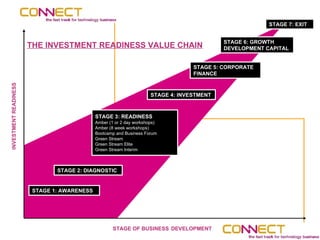

Connect Midlands welcomed Mr Manuel Urquijo, Vice Minister of Spain and Mr Iñaki Beristain Extabe, Director of Economic Planning of the Basque Country to discuss supporting companies in getting ready for investment. The presentation provided background on Connect Midlands and how it operates to connect entrepreneurs to resources through various programs, workshops, and events. It has helped raise over €70 million for 65 companies. Connect Midlands also discussed plans to expand the Connect model across Europe through a three phase plan to create new organizations, share best practices, and maximize the benefits of a European network.