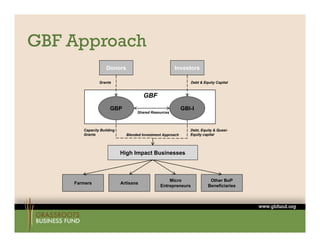

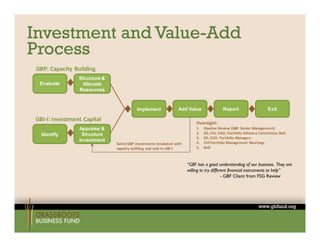

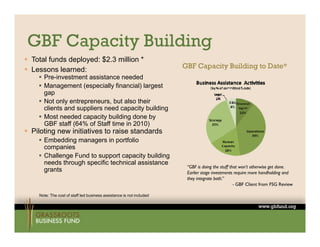

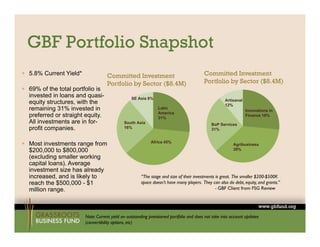

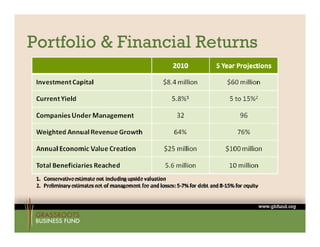

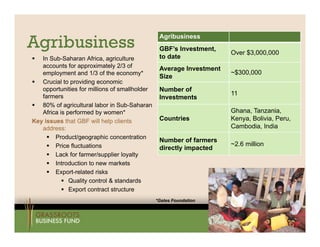

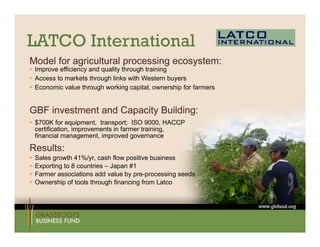

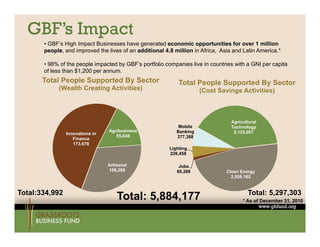

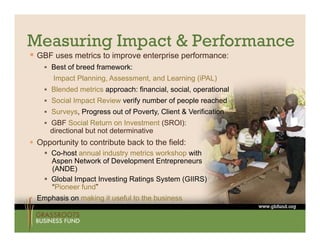

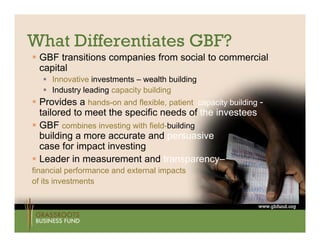

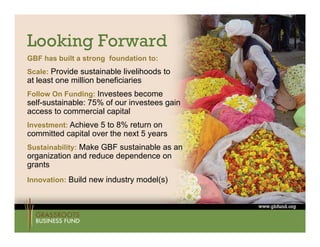

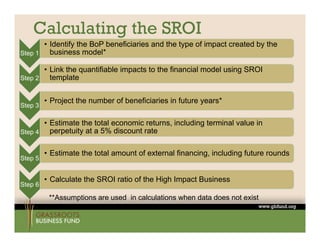

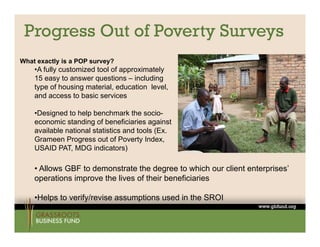

GBF provides capacity building grants and investment capital to high-impact businesses that create economic opportunities for people living at the base of the economic pyramid. This document summarizes an agenda for GBF that includes a video about GBF, an overview of their mission and approach, a discussion on how they measure impact, and a question and answer session. GBF's approach involves providing grants for capacity building, as well as debt, equity, and quasi-equity investments, to support businesses in sectors like agribusiness, financial services, and artisanal products that benefit smallholder farmers, the poor, and other base of the pyramid populations.