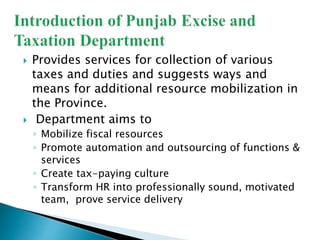

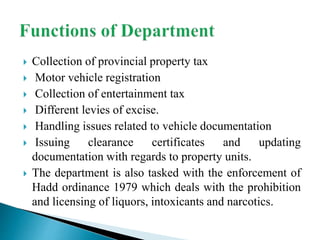

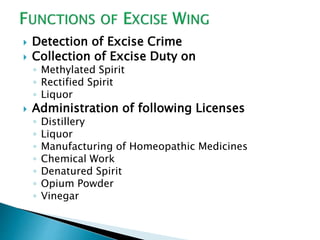

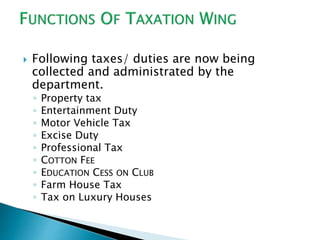

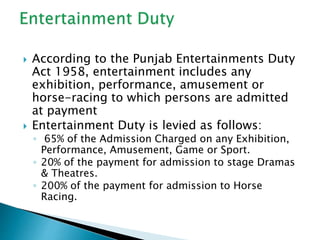

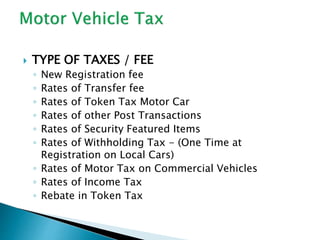

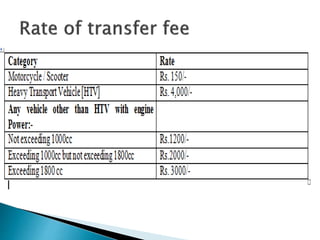

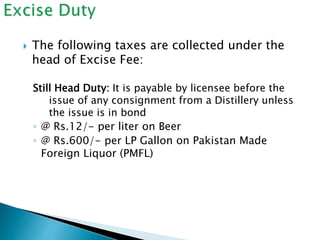

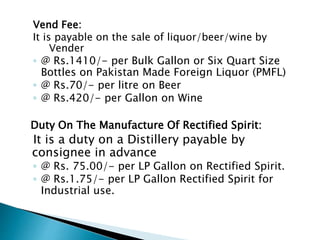

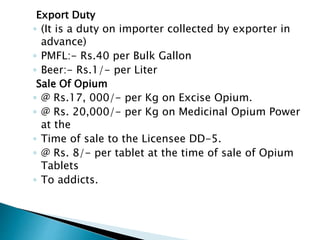

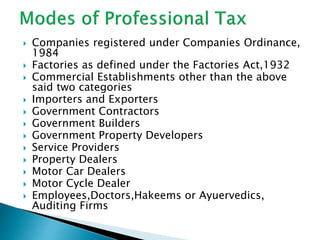

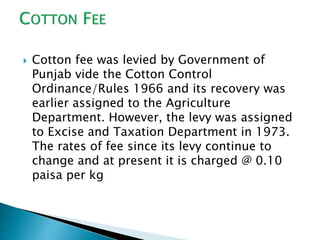

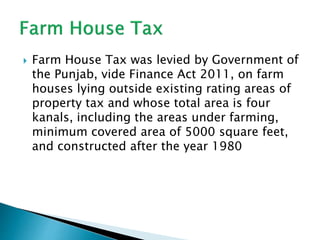

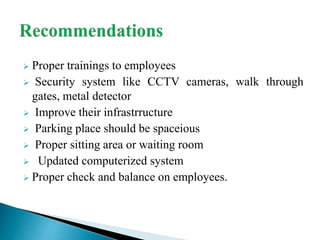

The document discusses the Excise and Taxation Department which is responsible for collecting various taxes in Punjab province including property tax, motor vehicle registration fees, and excise duties. The department aims to increase revenue collection, promote automation, and create a culture of tax compliance. It oversees the collection of multiple taxes and duties while working to improve service delivery and transform its human resources.