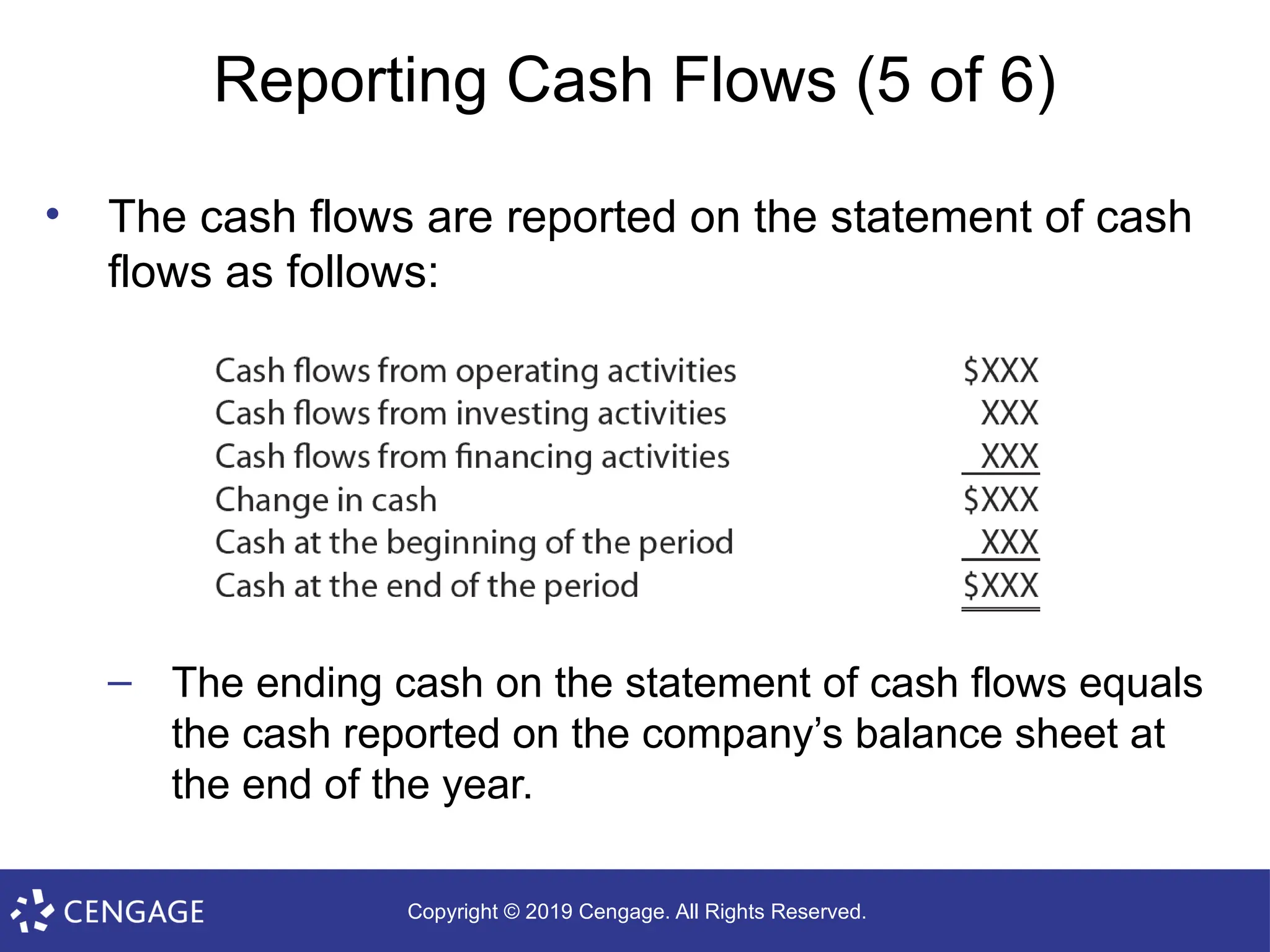

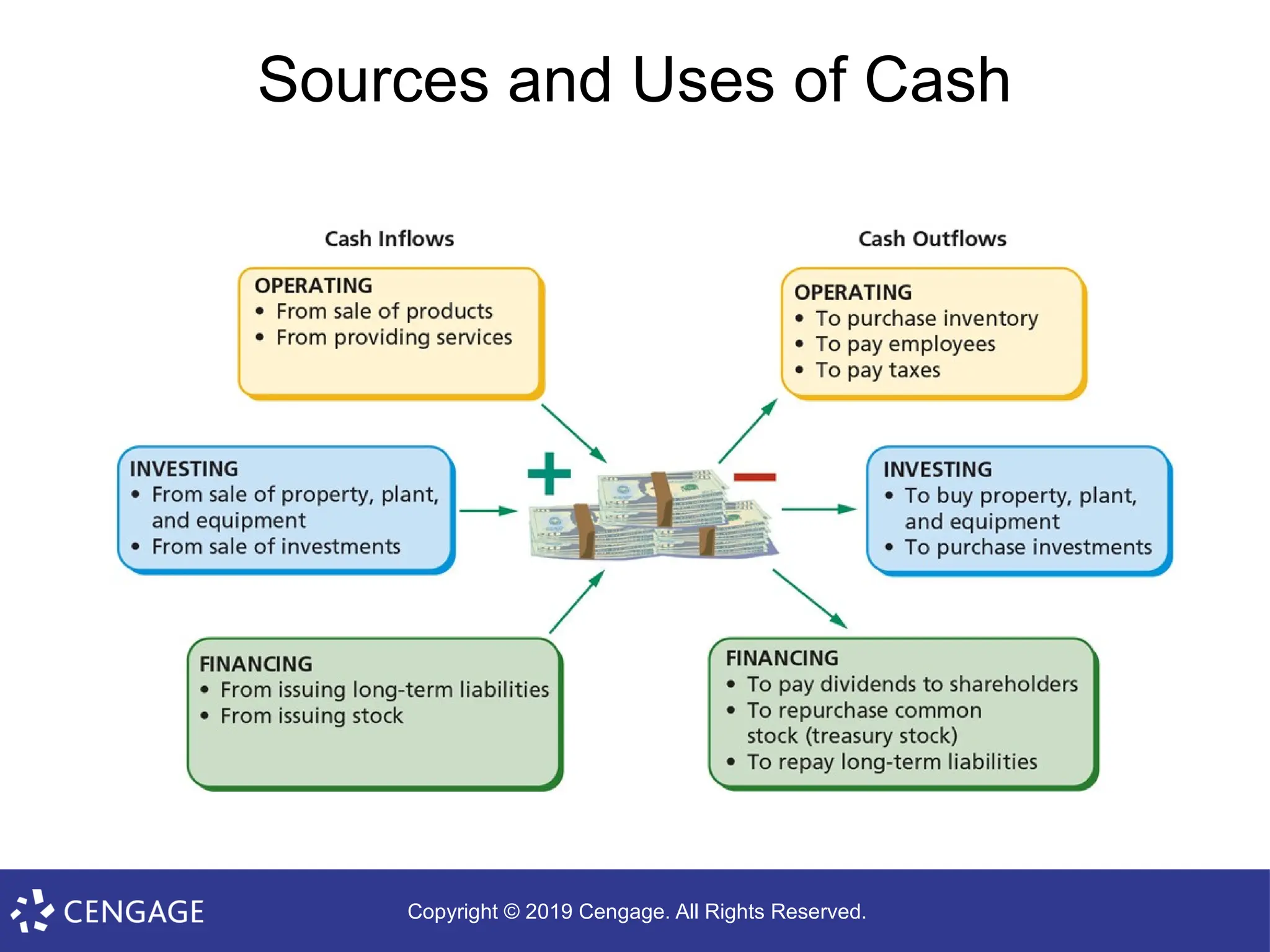

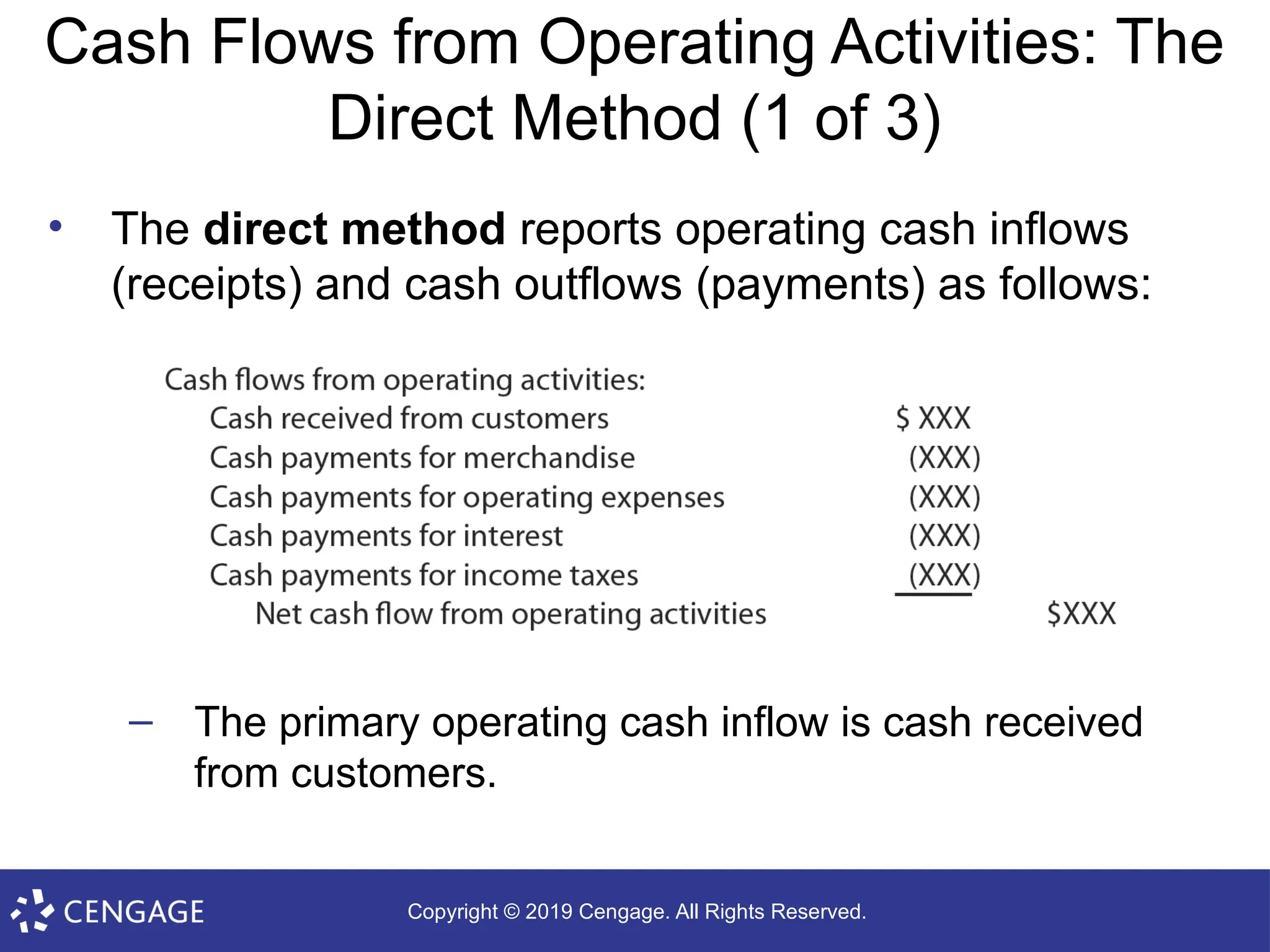

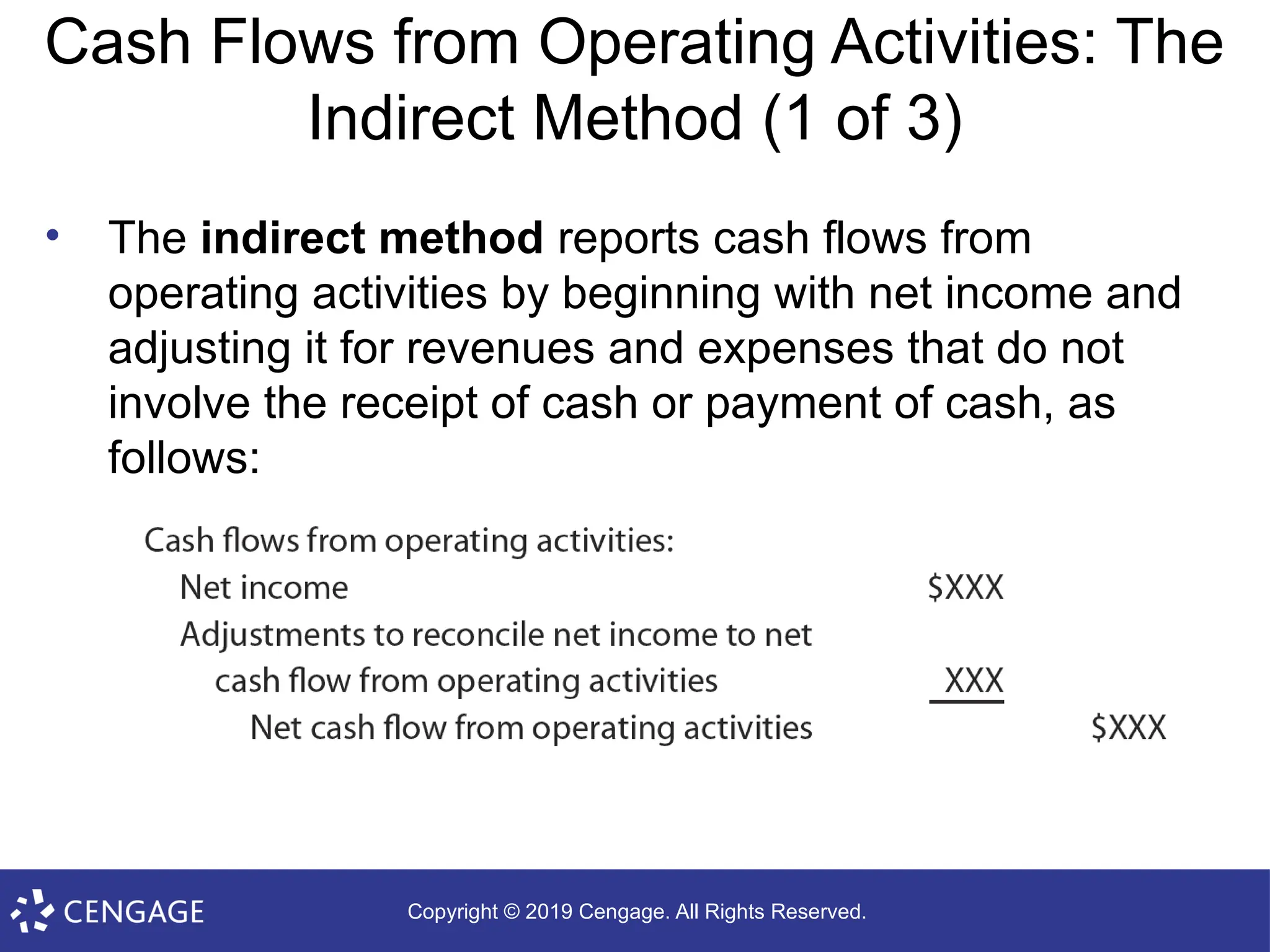

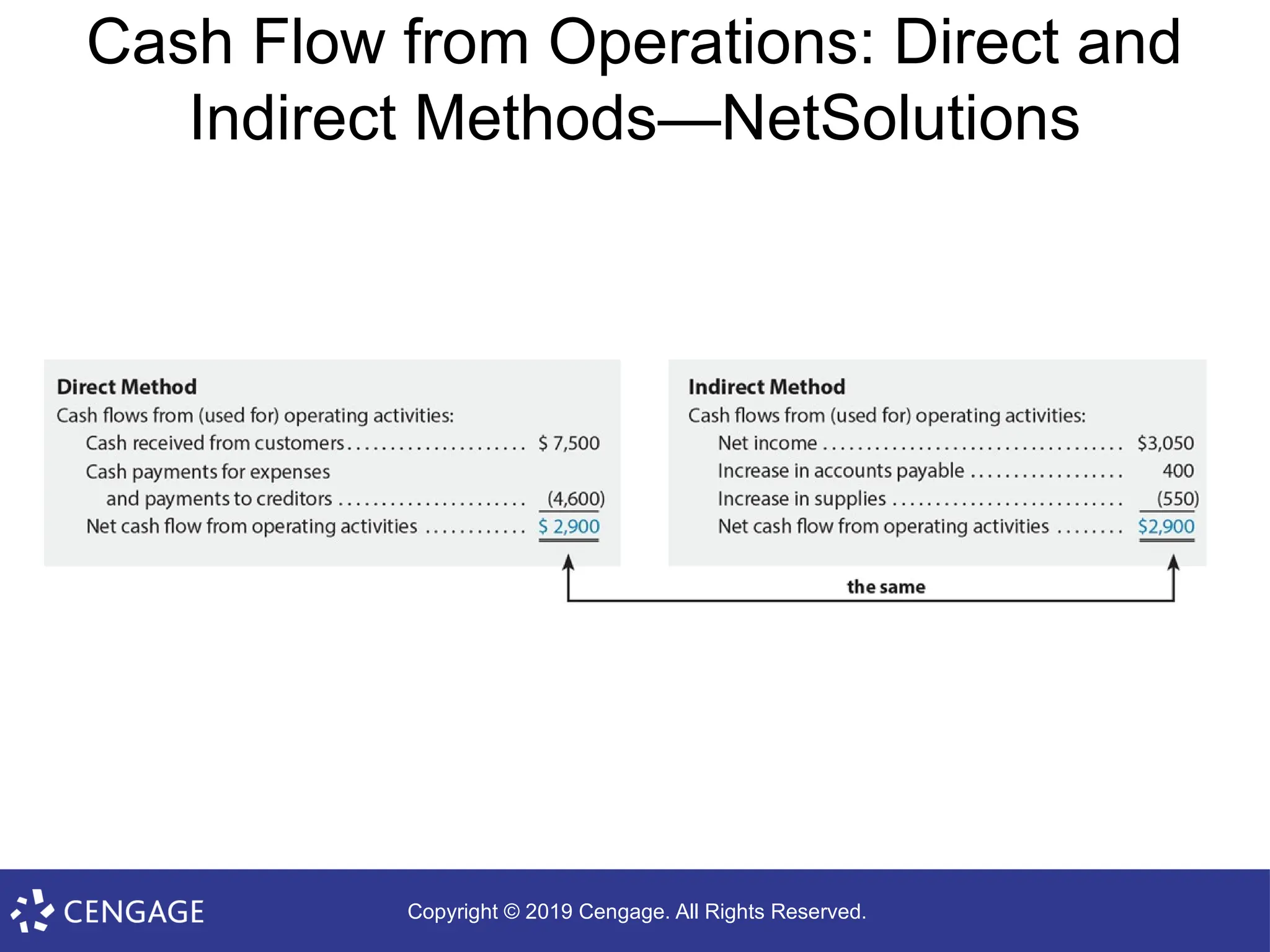

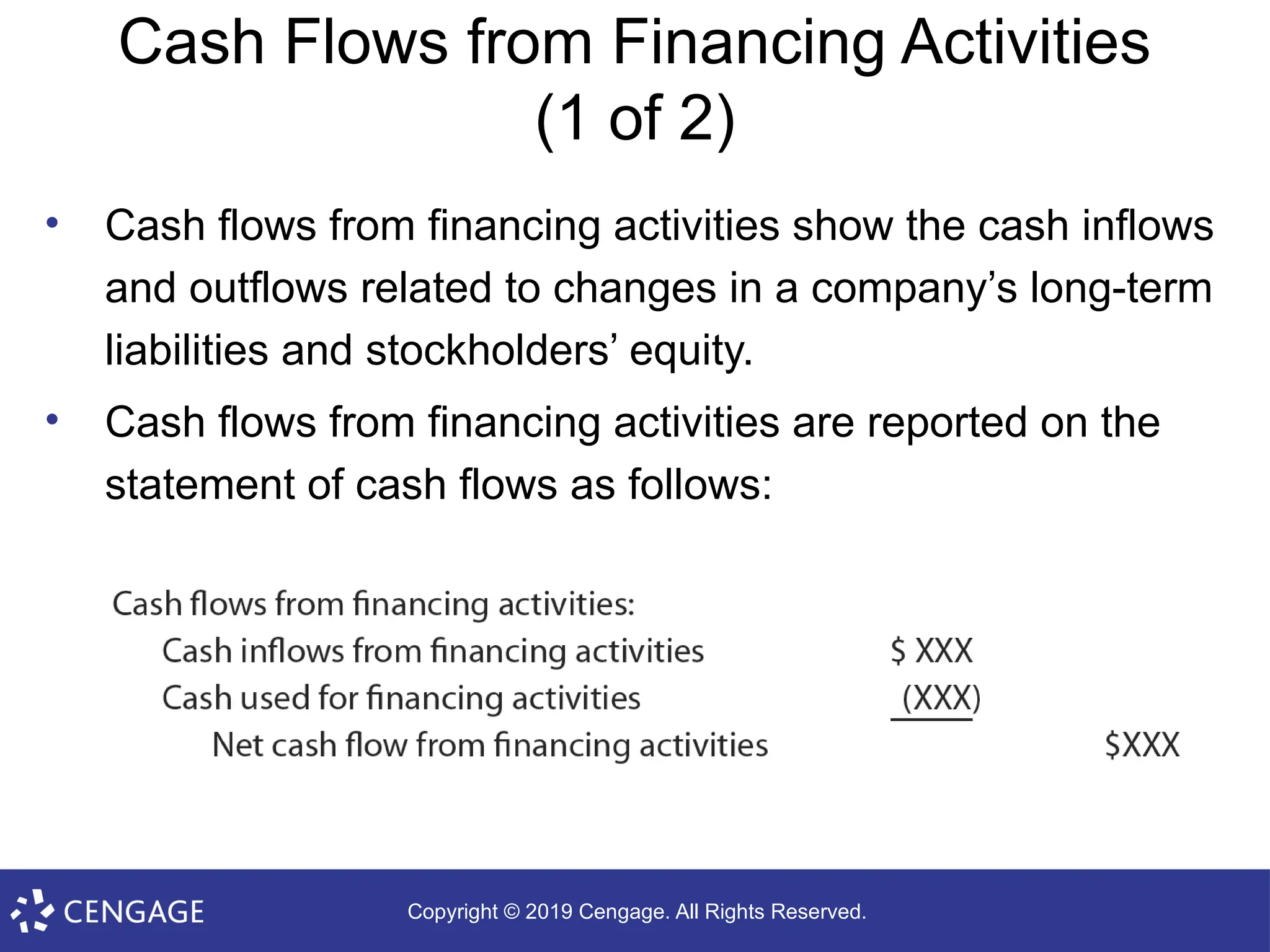

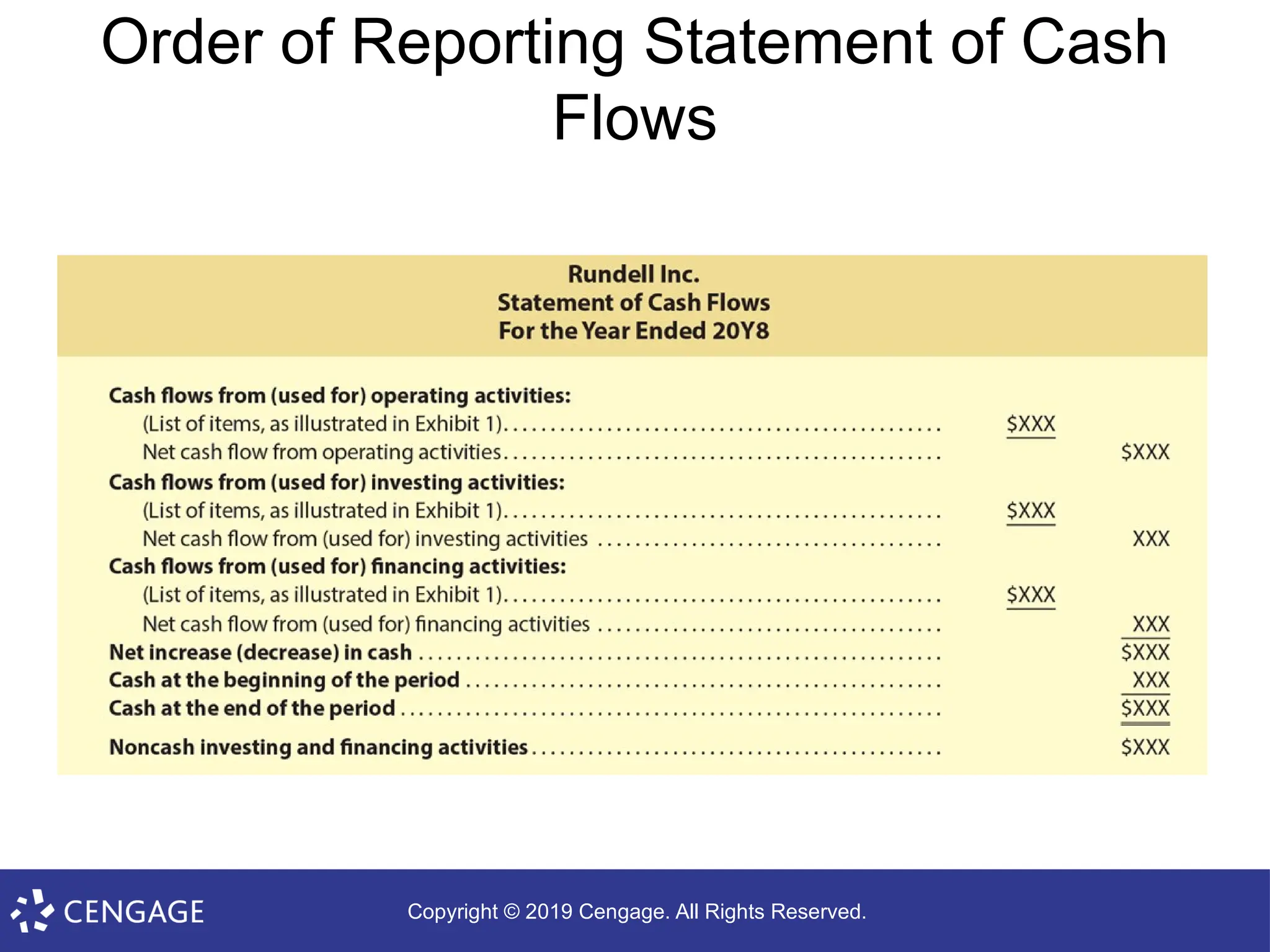

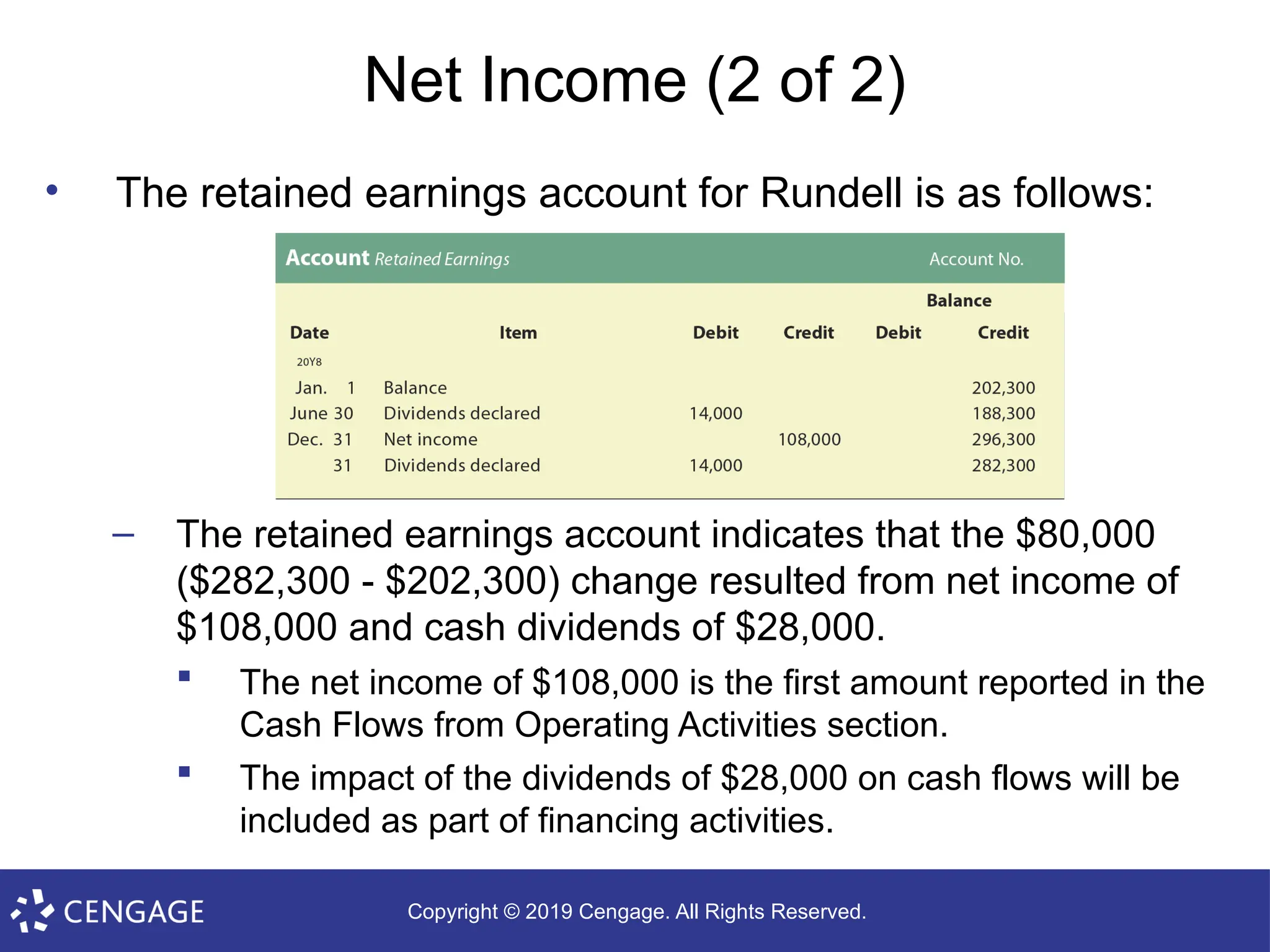

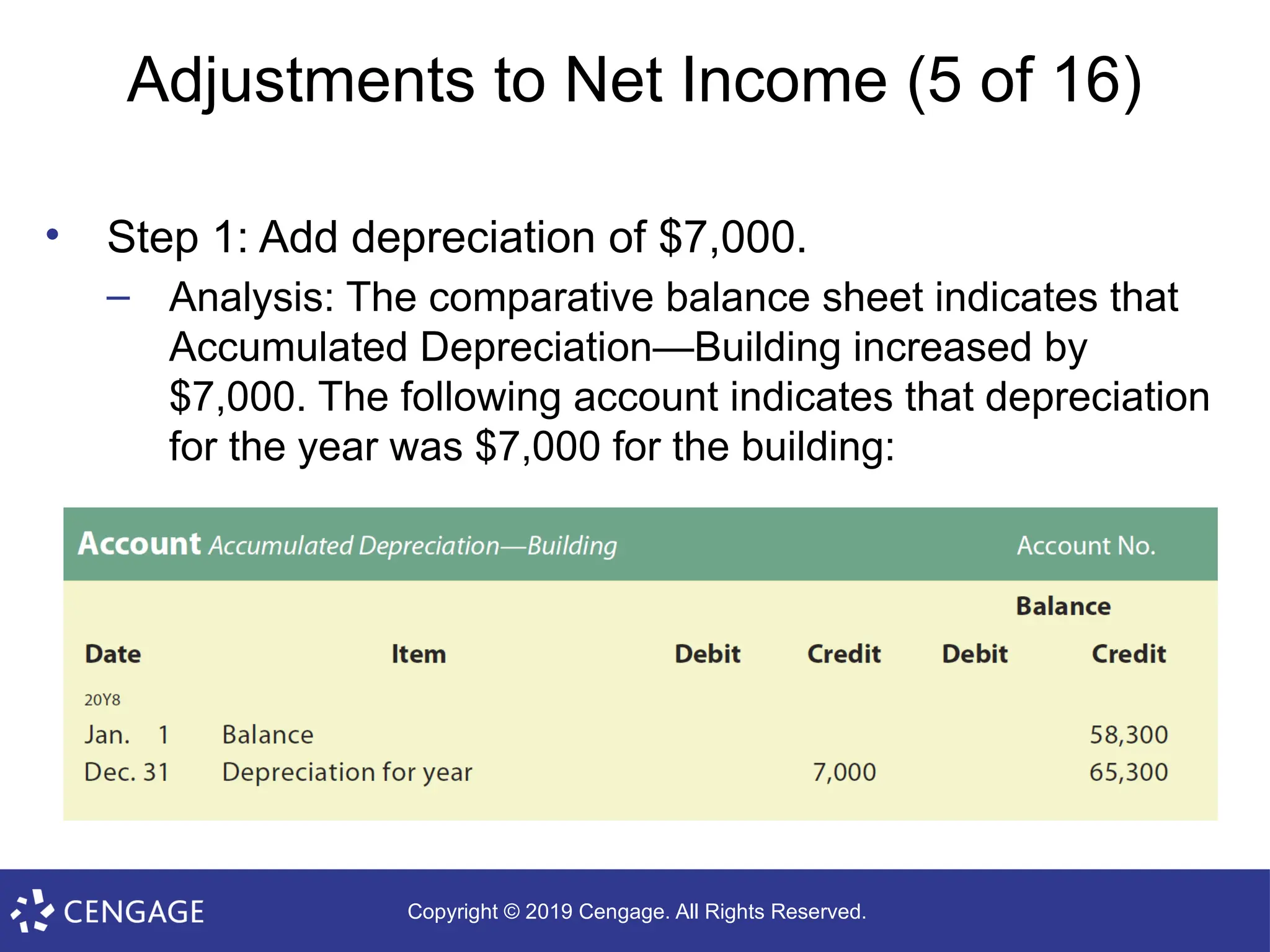

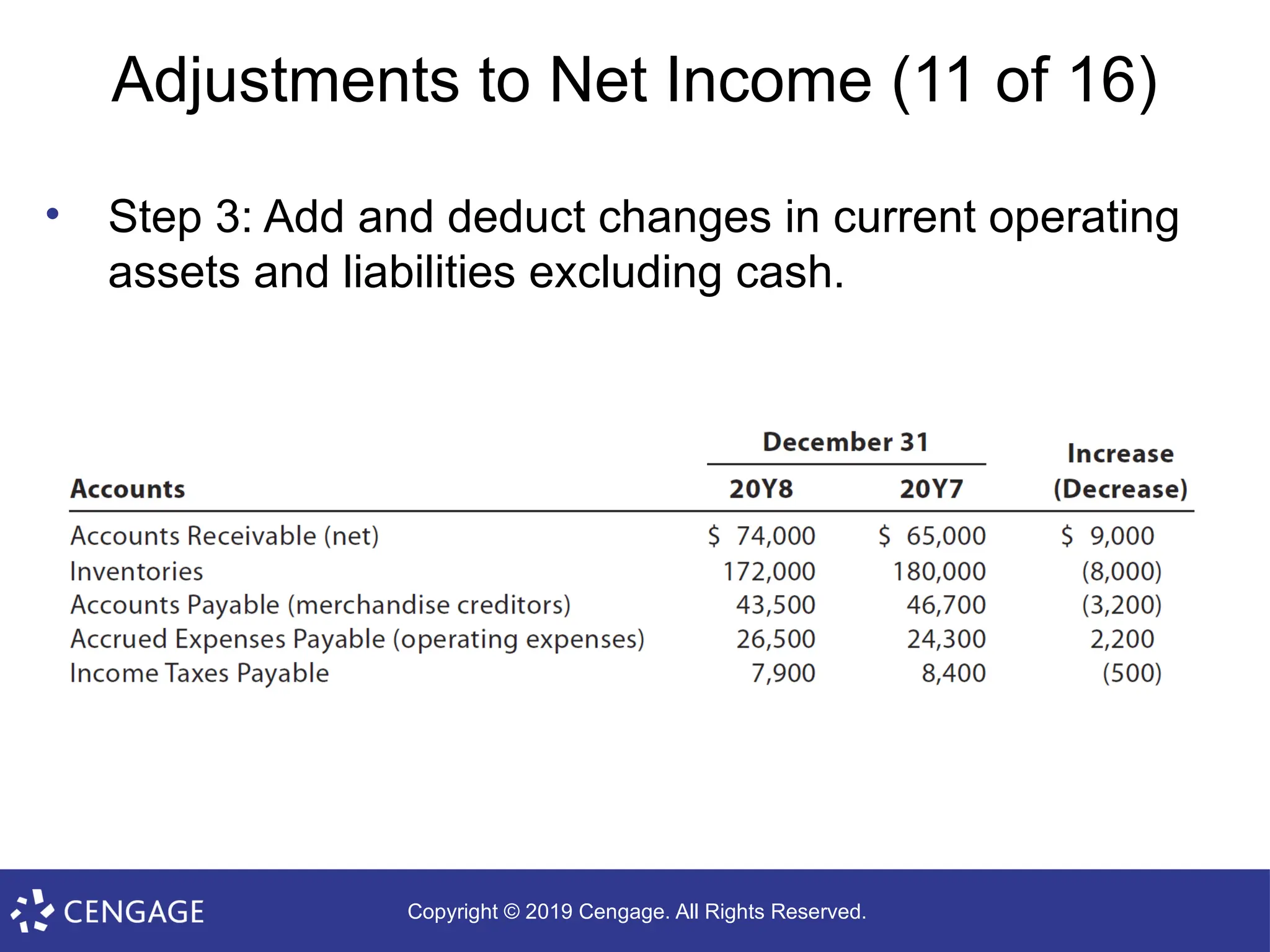

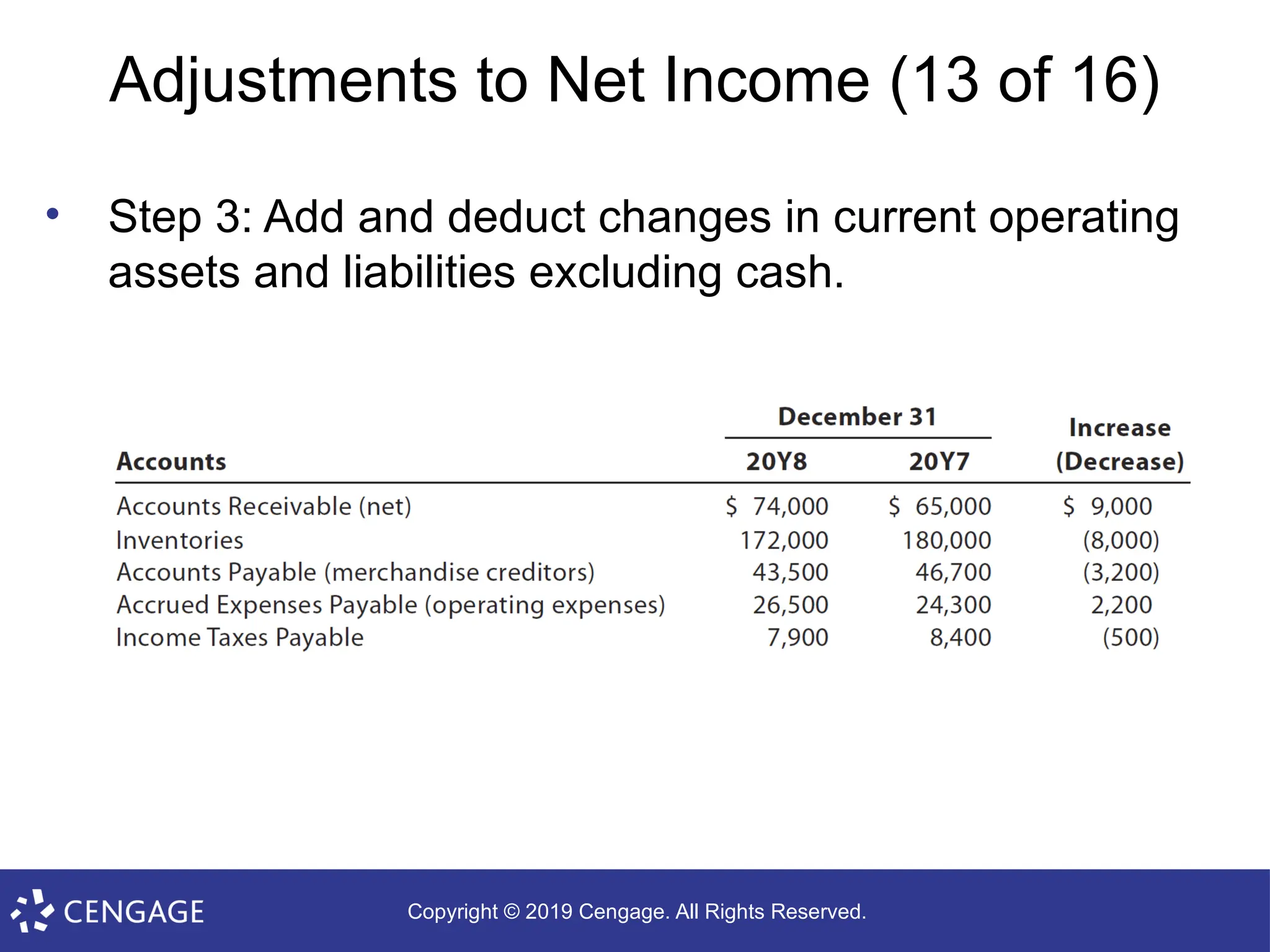

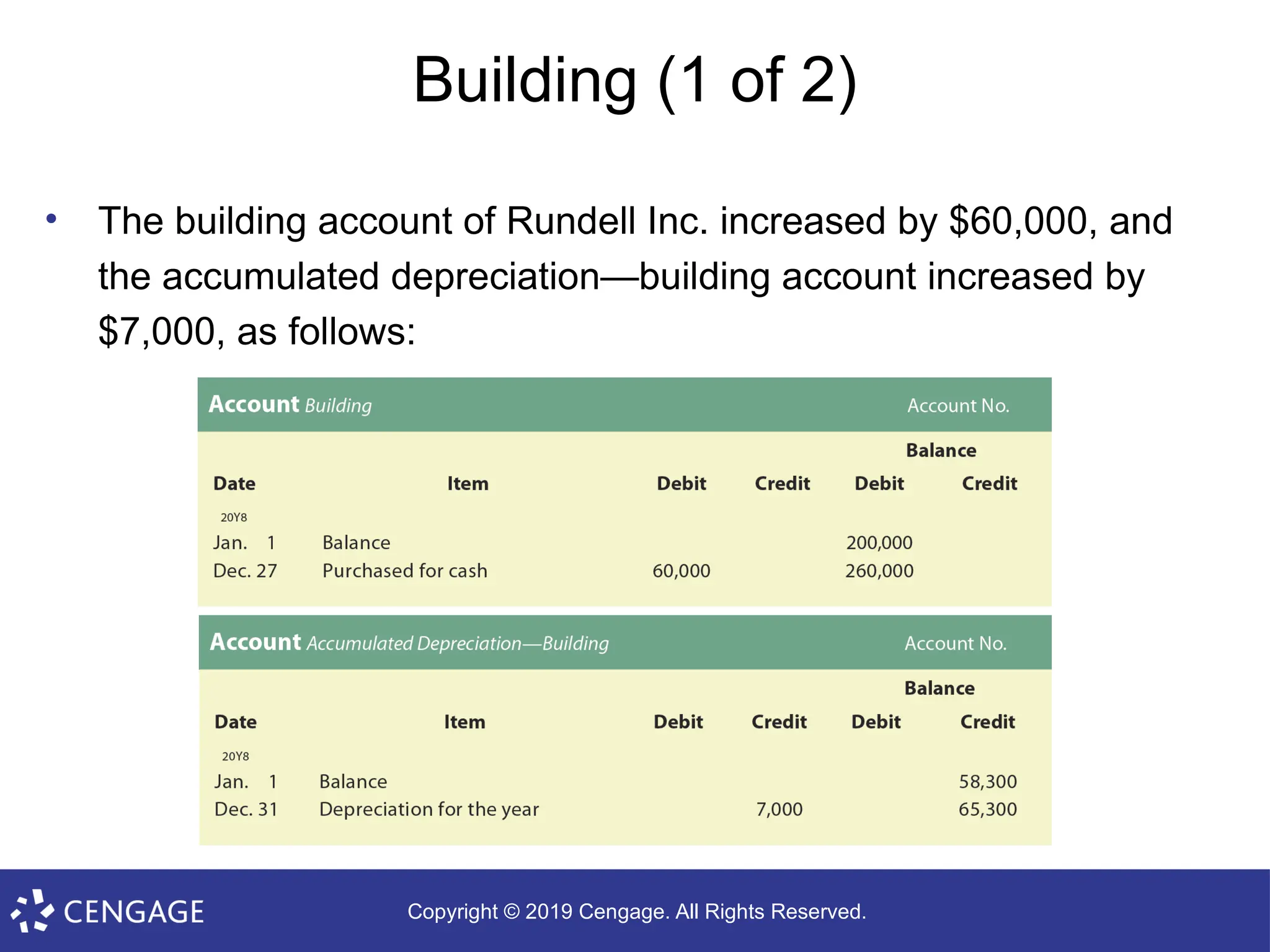

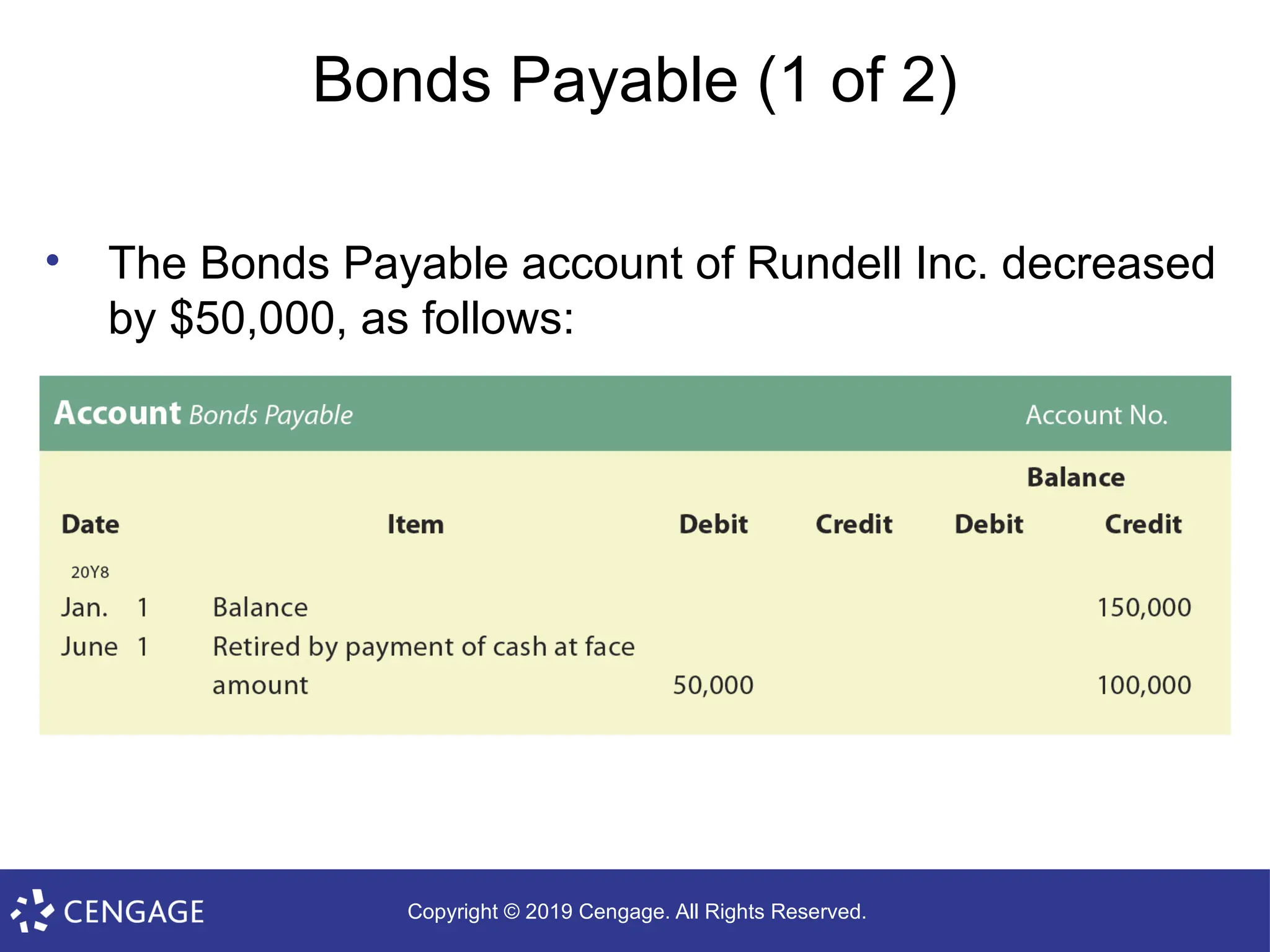

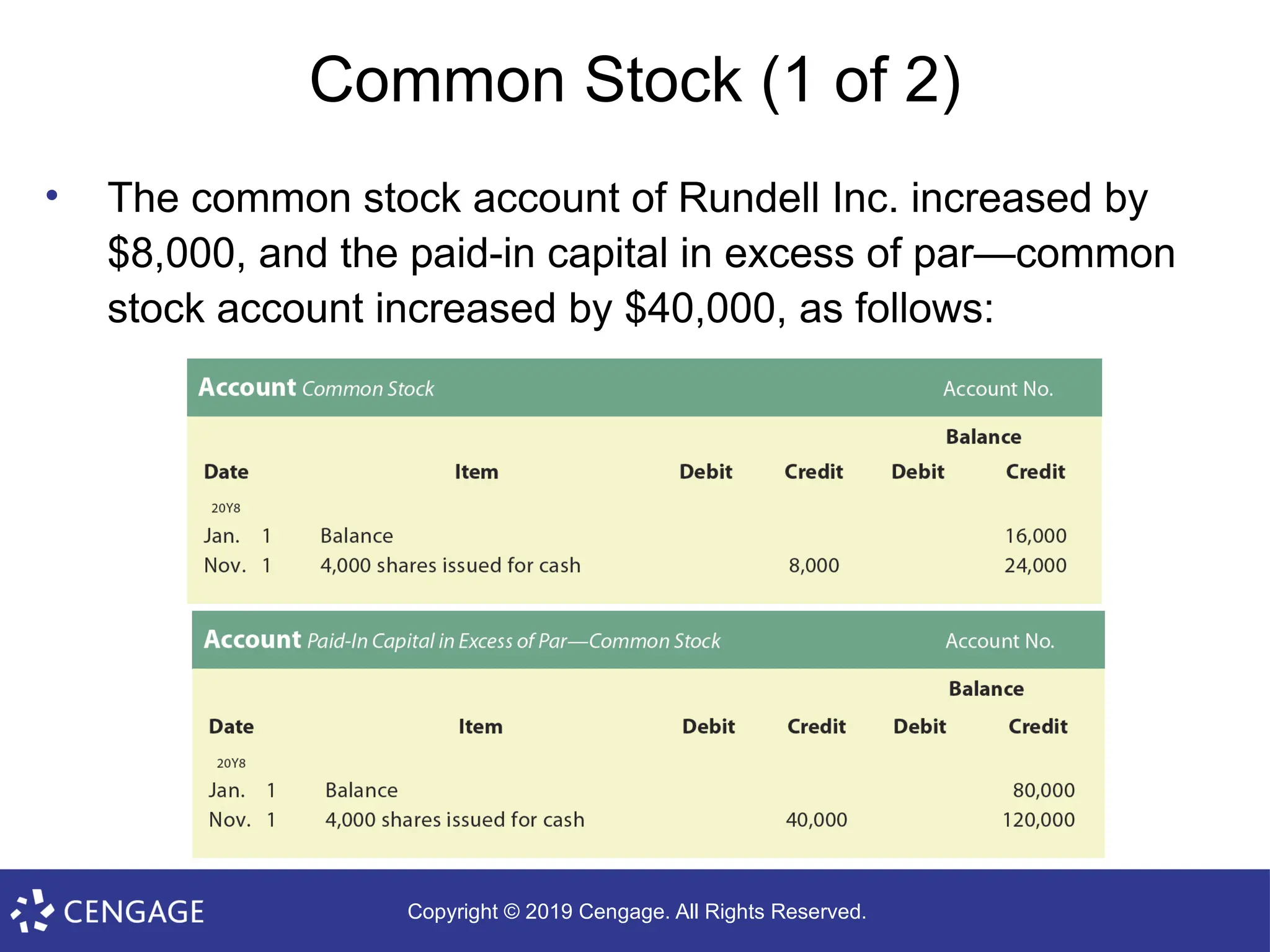

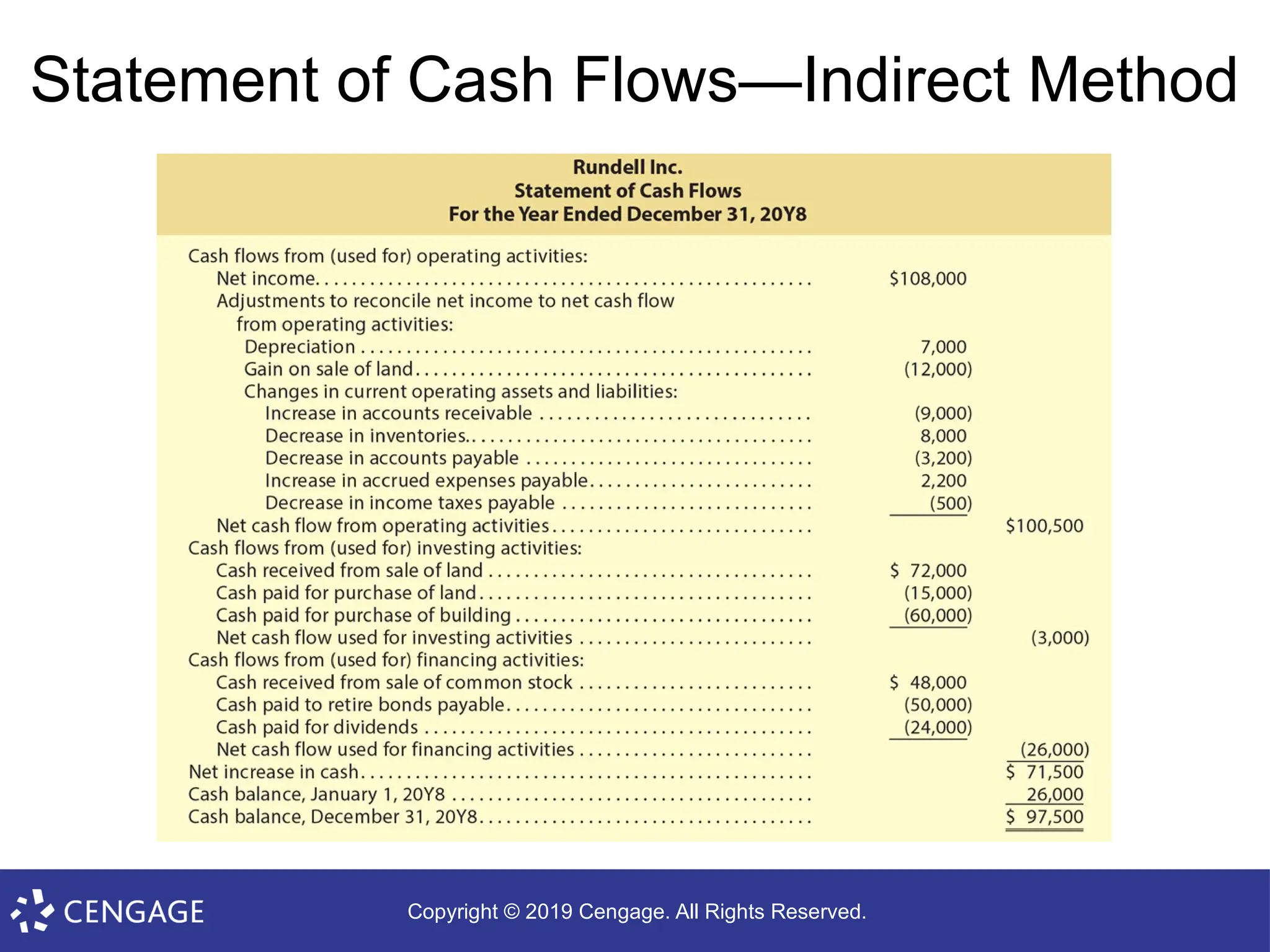

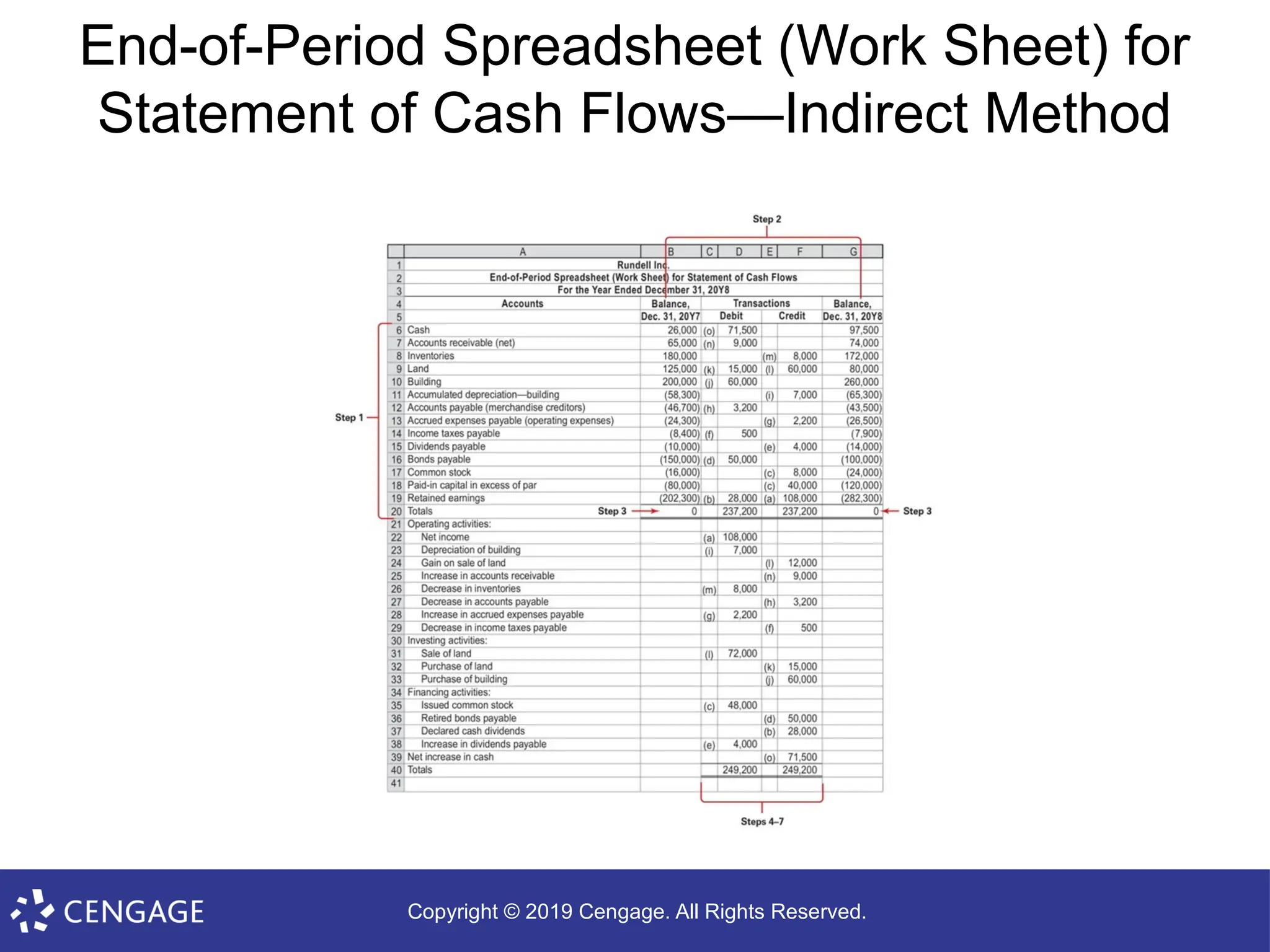

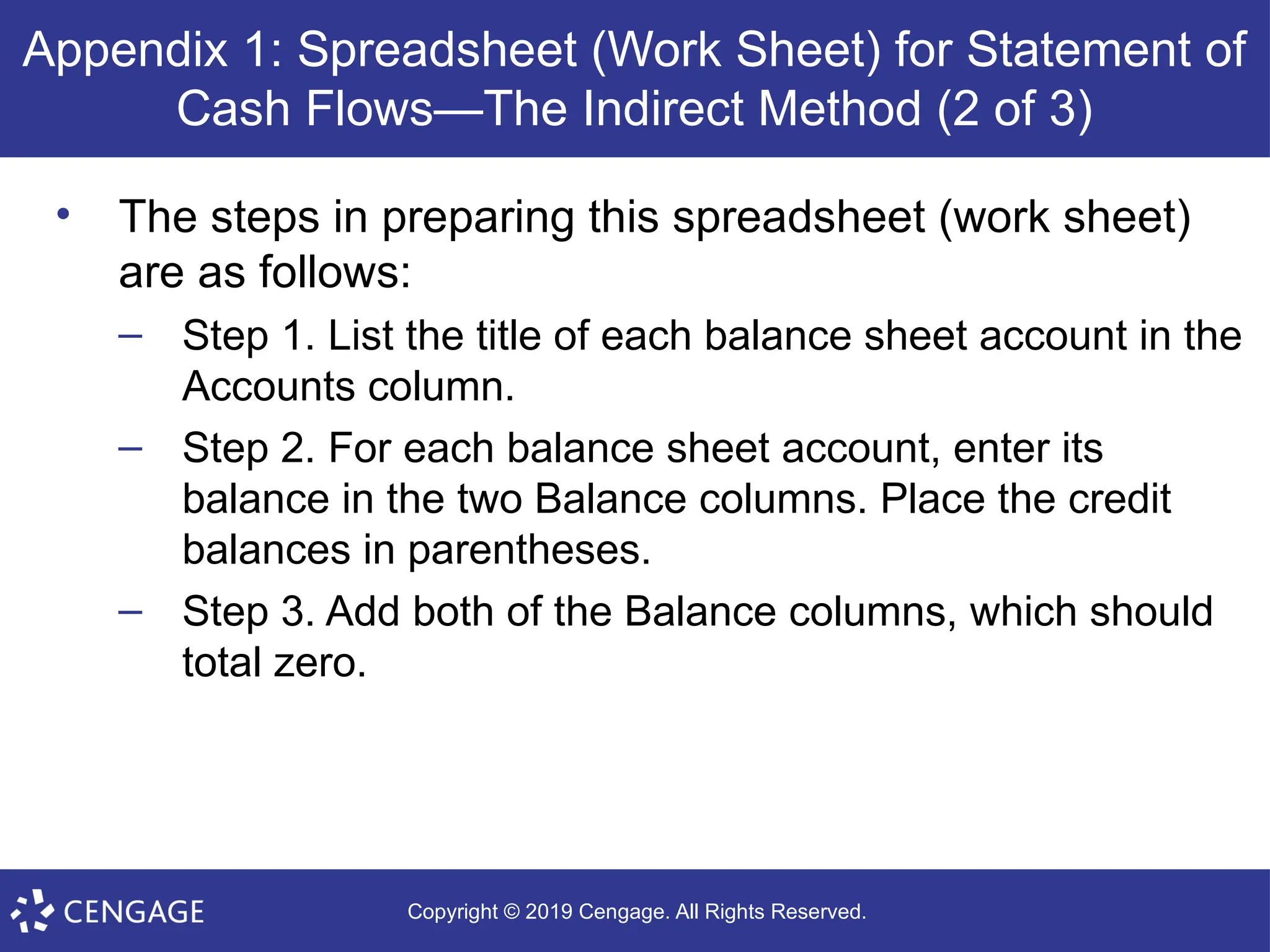

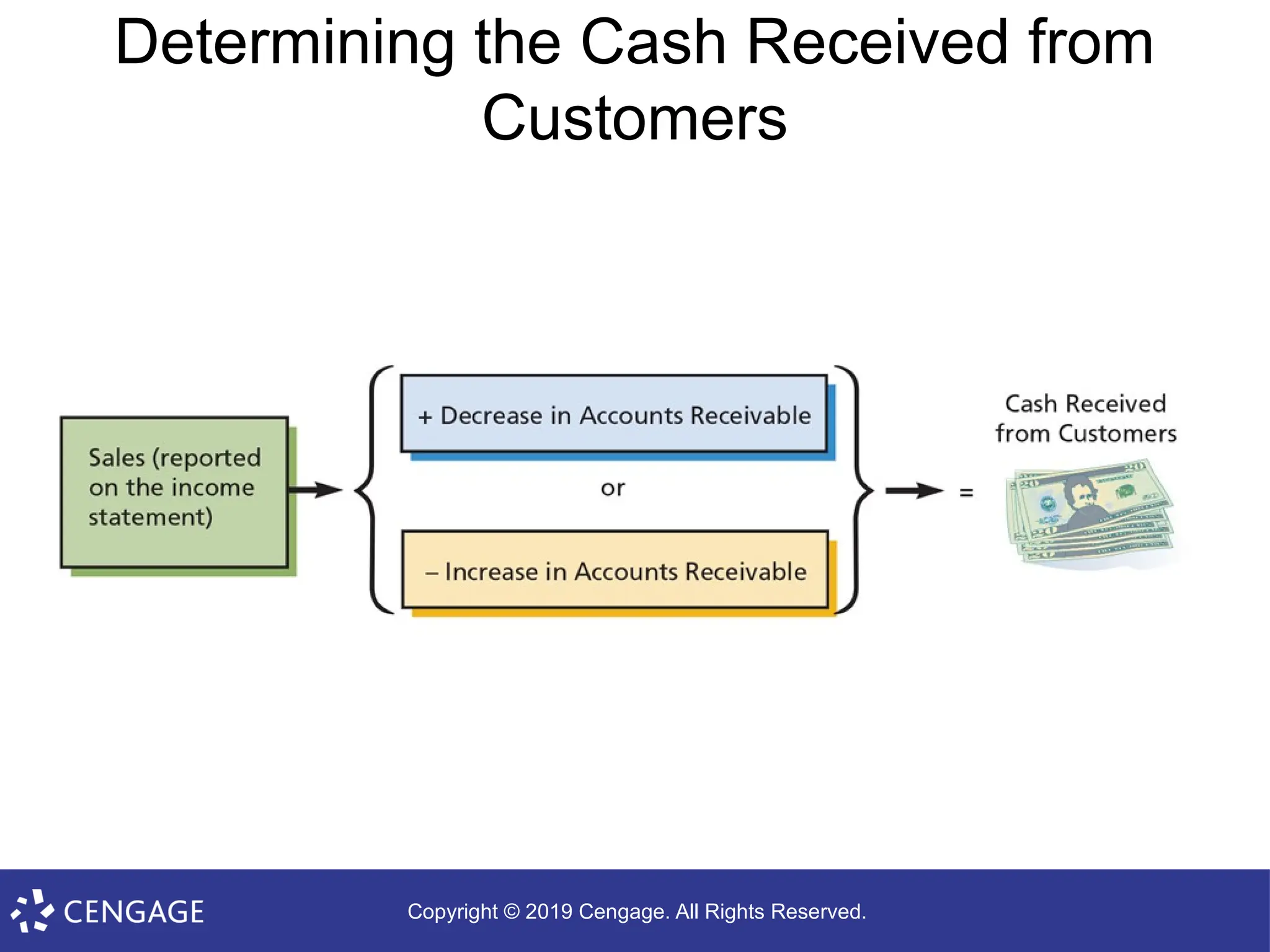

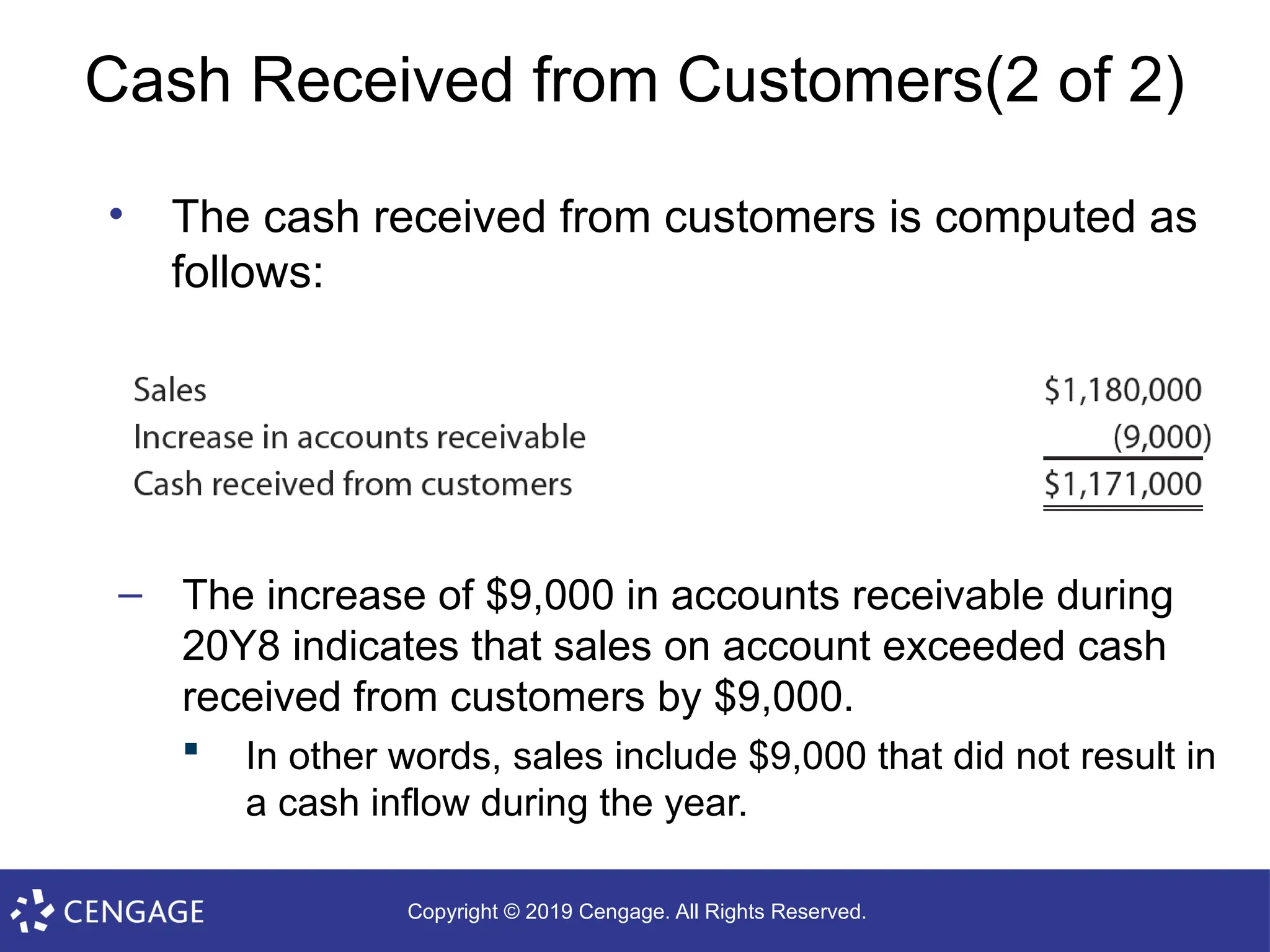

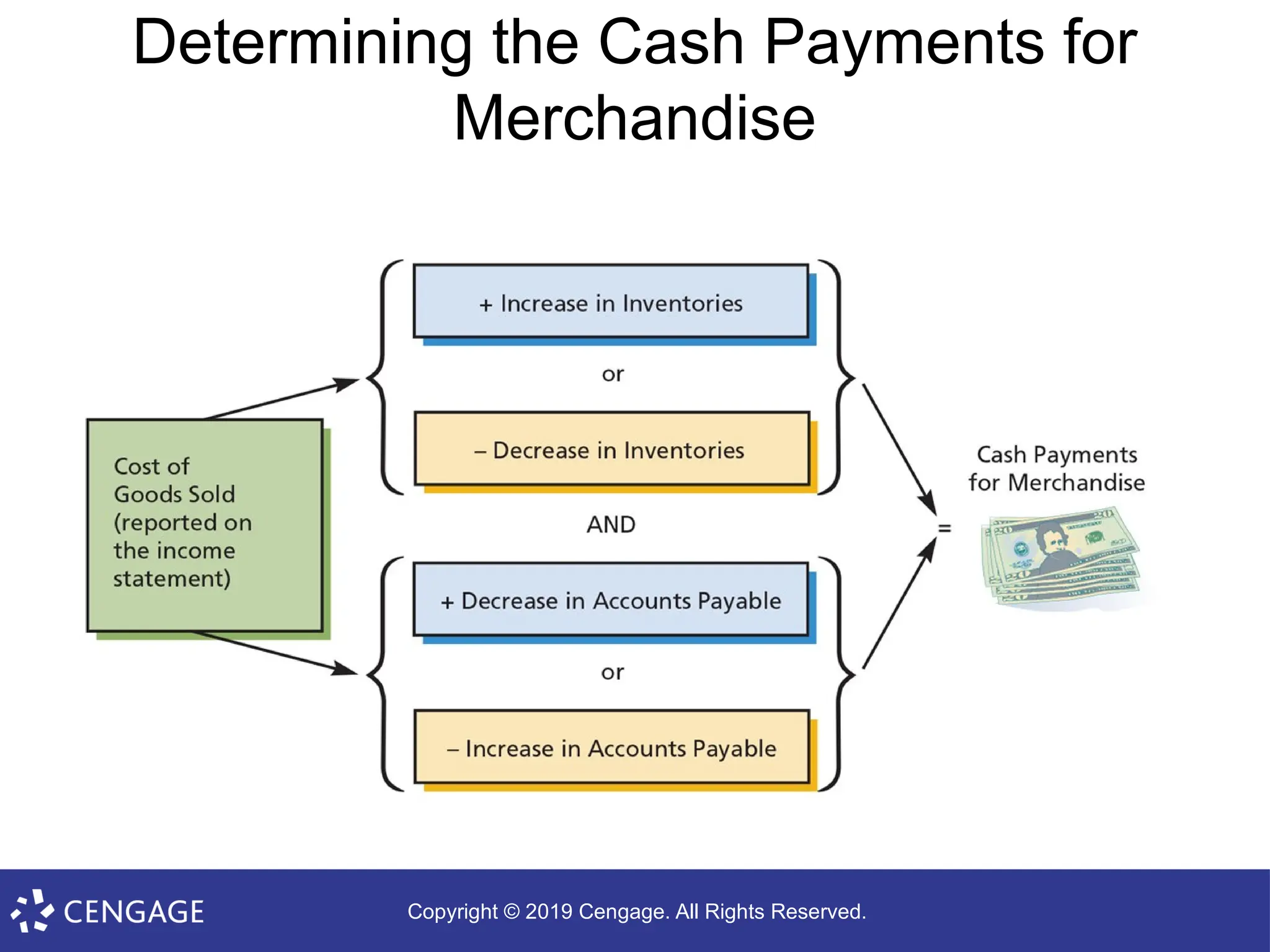

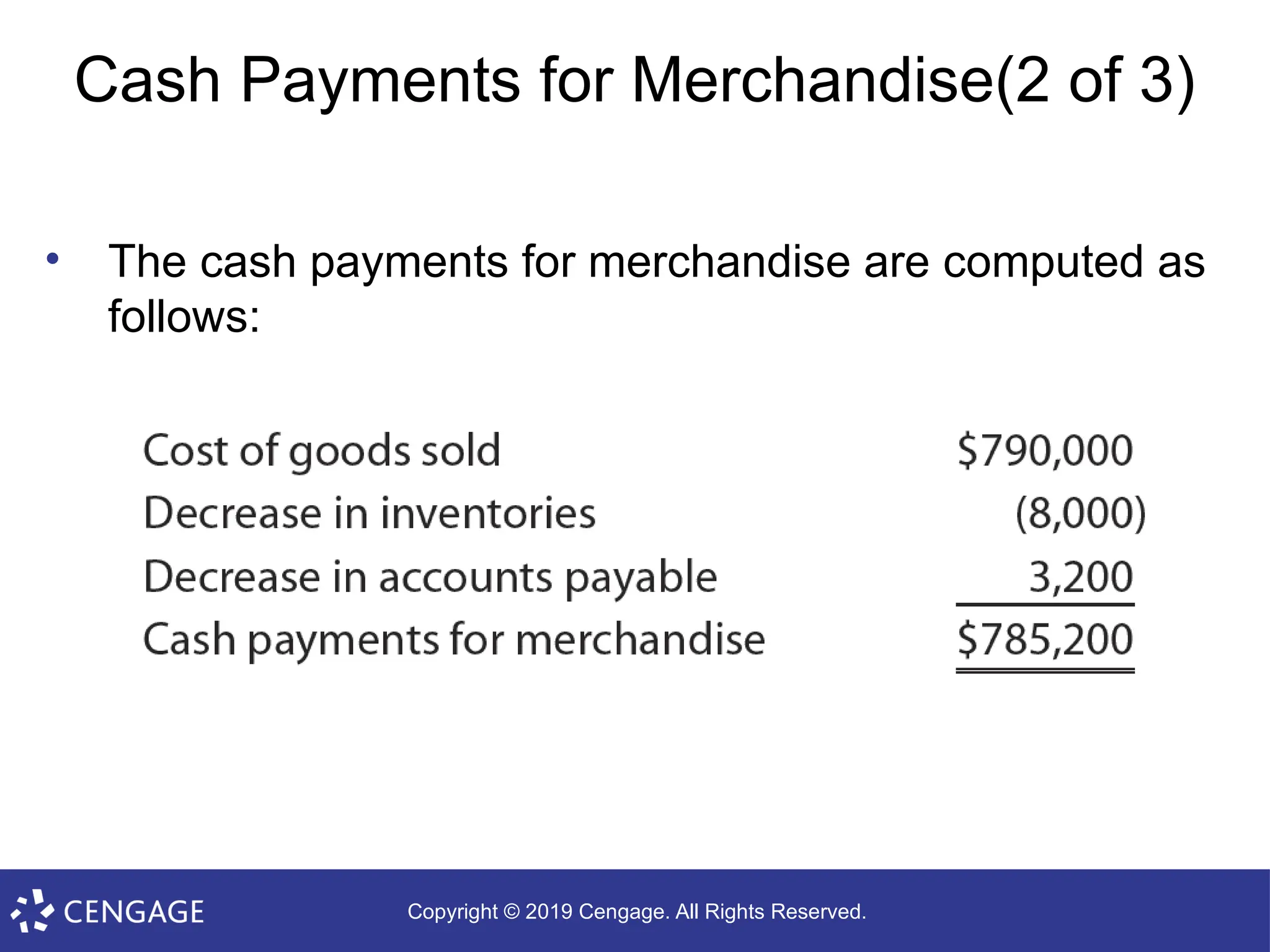

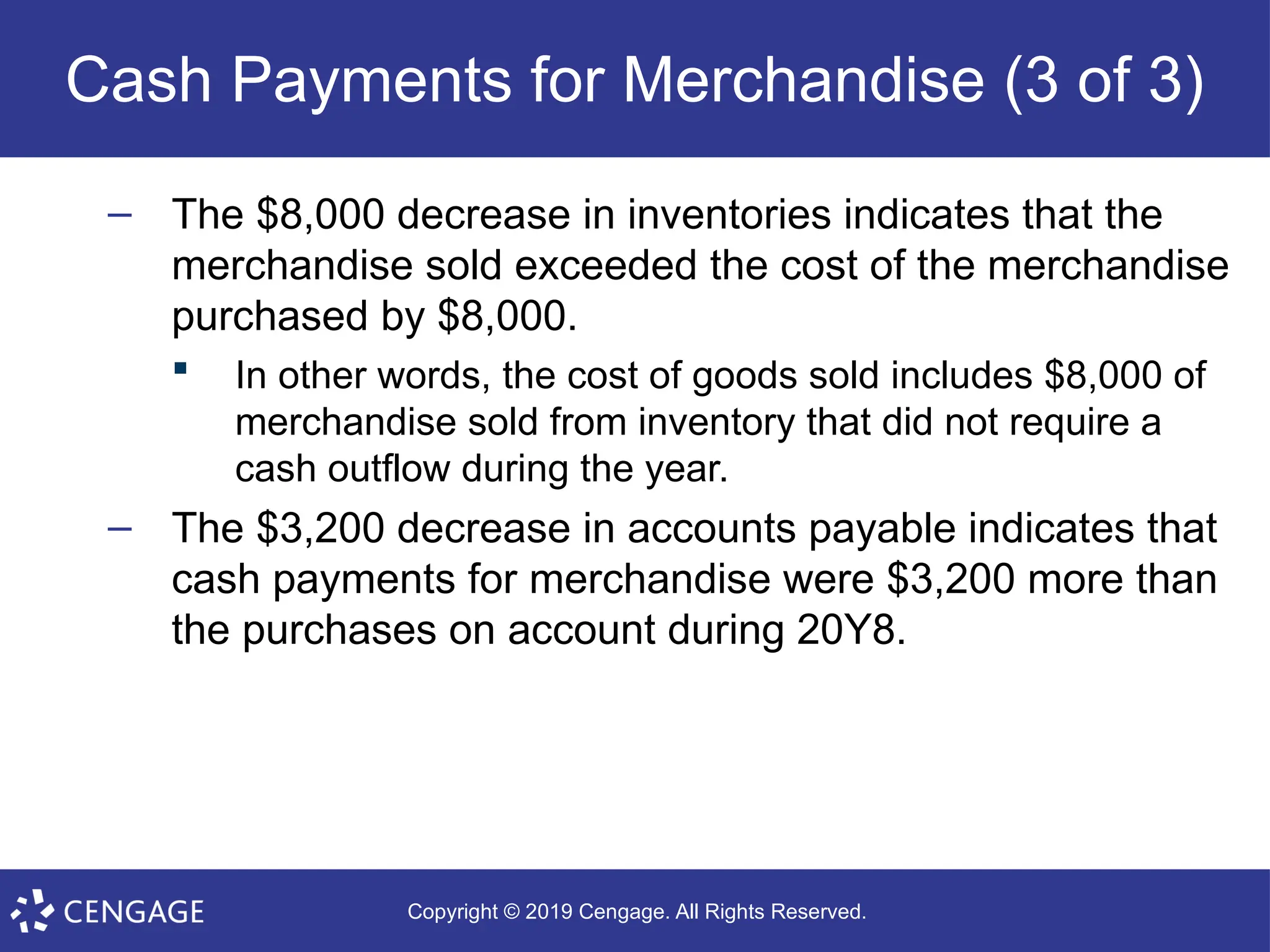

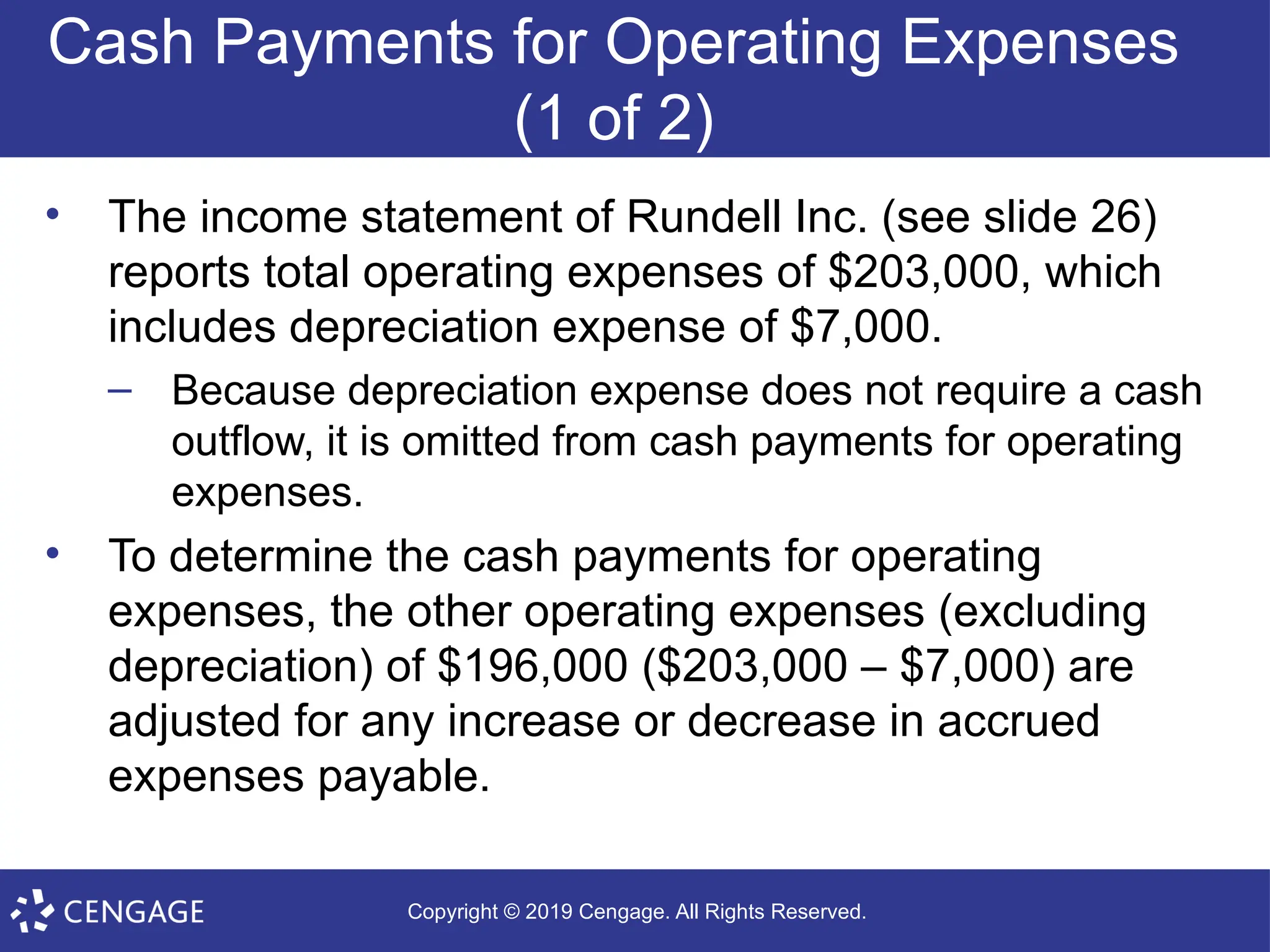

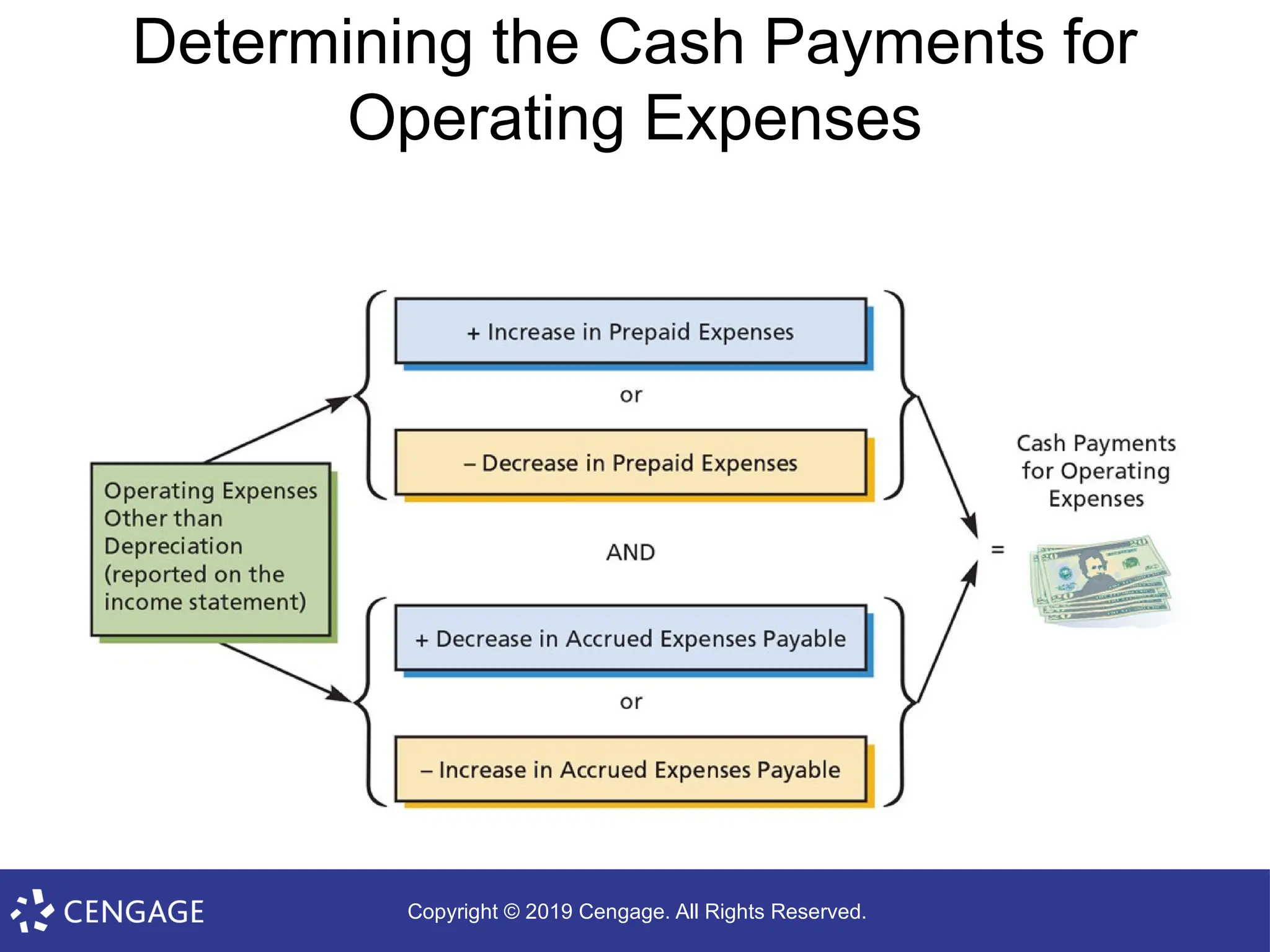

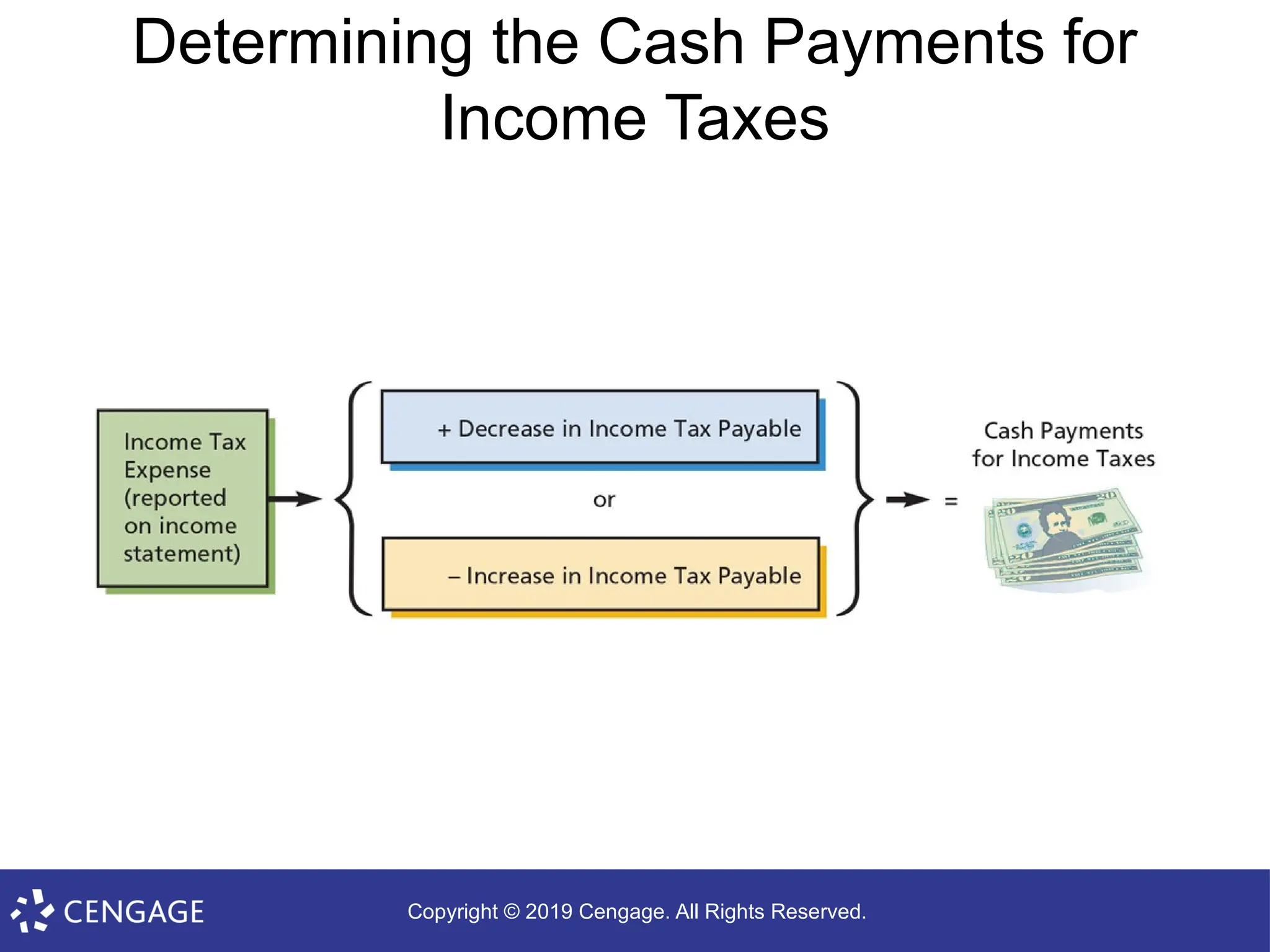

Chapter 15 of the Managerial Accounting textbook focuses on the statement of cash flows, outlining how cash inflows and outflows are categorized into operating, investing, and financing activities. It provides methodologies for preparing this statement using both the direct and indirect methods, highlighting key reporting practices and adjustments needed to reconcile net income to cash flows. Additionally, the chapter discusses the relevance of cash flow for managerial decision-making and provides examples of practical applications.