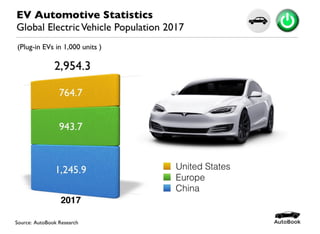

In 2018, electric vehicles (EVs) and autonomous driving technologies are prominent in the automotive industry, with Tesla leading with over 400,000 reservations for the Model 3 and significant advancements in production capacity. The document highlights the historical ebb and flow of EV popularity, noting a past resurgence influenced by environmental concerns and regulatory mandates, contrasting with earlier declines due to technological shifts and production methods. Additionally, the EV/AV autobook serves as a business resource, providing market insights and industry connections for stakeholders in the electric vehicle sector.