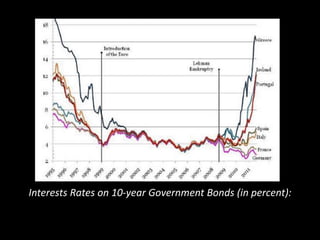

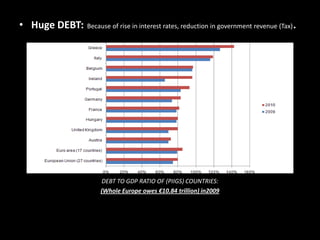

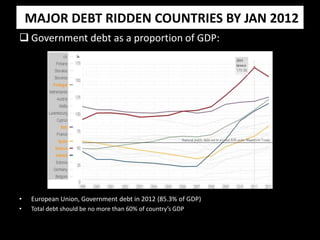

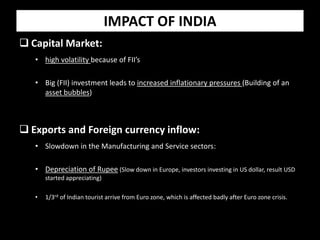

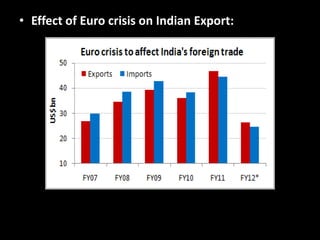

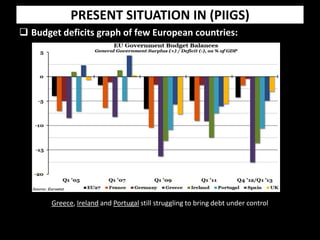

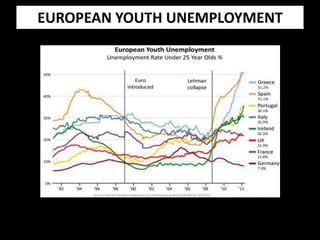

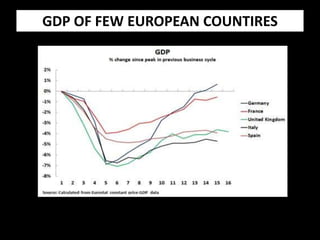

This document summarizes the Euro zone crisis. It establishes that the Euro zone is an economic and monetary union of 17 European countries that have adopted the euro as their currency. Problems arose as many governments ran budget deficits and lacked central fiscal control. The 2008 global financial crisis severely impacted smaller Euro zone countries like Greece, Portugal, Italy and Spain, known as the PIIGS, giving them too much debt to repay. Key factors that led to the crisis included violations of EU rules, banking sector problems, rising interest rates and huge debt levels. The crisis impacted investors, economies, unemployment and global growth. Present situations still see struggles in the most affected PIIGS countries to reduce debt and unemployment.

![WHAT IS EURO ZONE?

• Established: 1st January 1999

• It is an economic and monetary union(EMU)of 17 European

Union countries

[1-Germany, 2-Italy, 3-France, 4 -Finland, 5-Netherlands, 6-Ireland, 7-Greece, 8-Austria, 9-Spain, 10-

Portugal, 11-Belgium, 12-Luxembourg, 13-Slovakia, 14-Slovenia, 15-Malta, 16-Cyprus, 17-Estonia]

• They have fully adopted the euro as their national currency.

• The main objective behind forming Euro zone:

-Reduce trading cost

-Boost tourism

-Smooth the economy](https://image.slidesharecdn.com/eurozonecrisis-140323074715-phpapp02/85/Euro-zone-crisis-2-320.jpg)