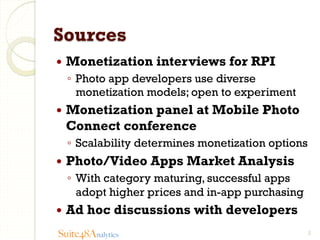

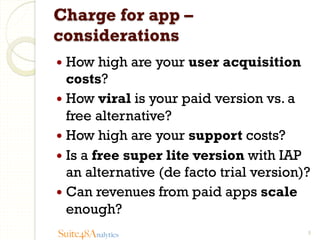

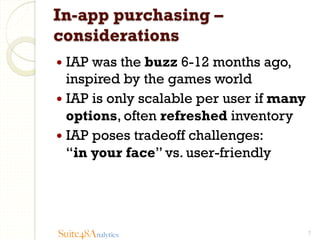

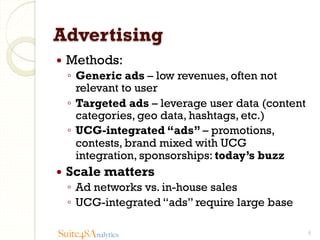

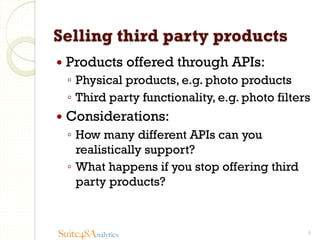

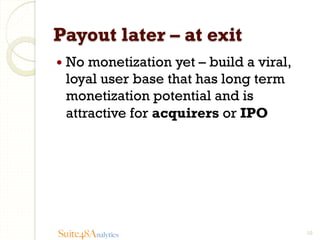

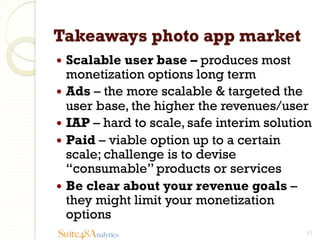

The document discusses monetization strategies used by photo app developers, highlighting diverse models such as charging for apps, in-app purchasing, and advertisements. Key trends indicate a shift towards higher pricing and the growing importance of in-app purchases, while the document also emphasizes the significance of a scalable user base for long-term revenue. Additionally, it suggests that while paid apps can be viable, developers should evaluate their revenue goals to avoid limiting monetization options.