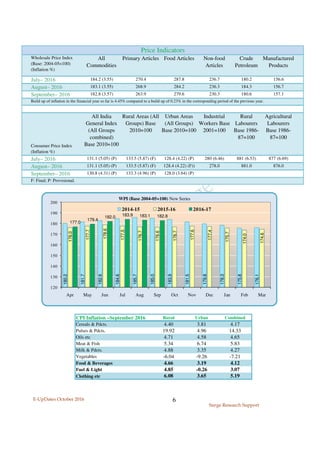

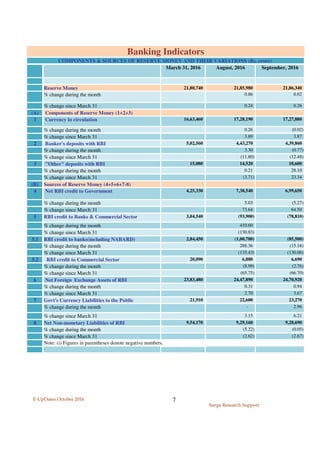

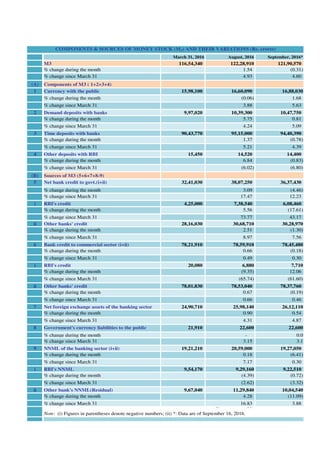

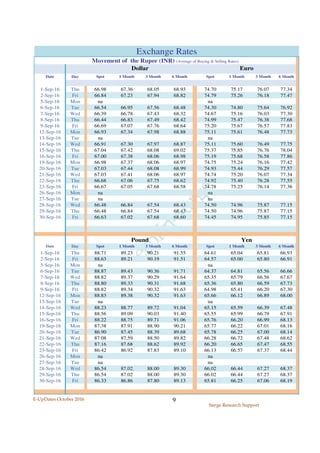

The document is the October 2016 edition of the Ecofin Surge Research Support bulletin, providing statistical updates on the Indian and global economies. It details key economic indicators like GDP growth rates, inflation, and monetary policy, comparing statistics from previous years. Highlights include growth rates, inflation figures, and banking indicators as of September 2016.

![E-UpDates October 2016

Surge Research Support

4

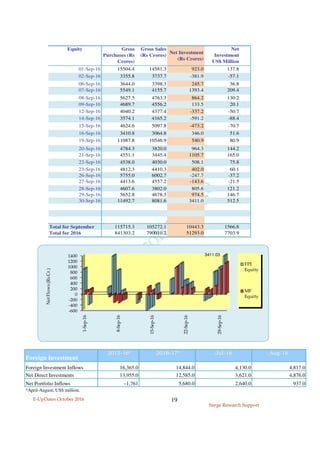

GDP Growth Rates

(at 2011-12 prices)

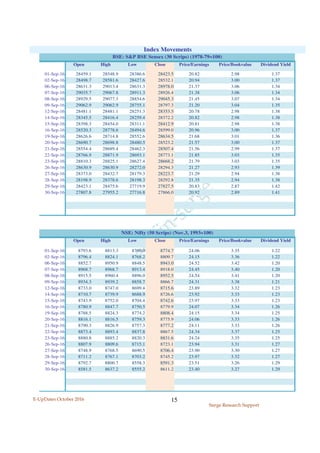

Q1 Q2 Q3 Q4 FY

2016-17 7.1

2015-16 7.5 7.6 7.2 7.9 7.6 (PE)

GVA at Basic Price by

Economic Activity

1 Agriculture, forestry & fishing 3,67,623 2.6 3,74,390 1.8

2 Mining & quarrying 86,444 8.5 86,091 -0.1

3 Manufacturing 4,49,280 7.3 4,90,164 9.1

4 Electricity, gas, water supply &

other utlility services

57,037 4.0 62,378 9.4

5 Construction 2,25,637 5.6 2,29,092 1.5

6 Trade, hotels, transport,

communication and services

related to broadcasting

4,83,238 10.0 5,22,610 8.1

7 Financial, real estate &

professional services

5,81,471 9.3 6,35,963 9.4

8 Public administration, defence

and other services

3,00,705 5.9 3,37,630 12.3

9

GVA at basic prices (1 to 8) 25,51,435 7.2 27,38,318 7.3

Estimates of Final

Expenditures on GDP

10 Private final consumption

expenditure (PFCE)

15,04,442 6.9 (55.2) 16,05,527 6.7 (55.0)

11 Government final consumption

expenditure (GFCE)

2,93,720 `-0.2 (10.8) 3,49,059 18.8 (12.0)

12 Gross fixed capital formation

(GFCF)

8,91,627 7.1 (32.7) 8,63,956 `-3.1 (29.6)

13 Changes in stocks (CIS) 50,754 3.6 (1.9) 54,345 7.1 (1.9)

14 Valuables 43,138 `(1.6) 22,129 `(0.8)

15 Exports 5,85,324 `-5.7 (21.5) 6,04,052 3.2 (20.7)

16 Less Imports 6,45,577 `-2.4 (23.7) 6,07,953 `-5.8 (20.8)

17 Discrepancies 761 `(0.0) 26,232 `(0.9)

18

GDP (10 to 17) 27,24,188

7.5

(100.0)

29,17,348 7.1 (100.0)

Growth Indicators

YoY

Growth

(Share in

GDP)

(%)

GDP

[at Constant(2011-12) prices]

2015-16

(Q1)

Rs.Crore YoY

Growth

(Share in

GDP)

(%)

2016-17

(Q1)

Rs.Crore](https://image.slidesharecdn.com/eupdtsoct16-170222033922/85/E-UPDates-A-Monthly-Statistical-Bulletin-Sample-4-320.jpg)

![E-UpDates October 2016

Surge Research Support

5

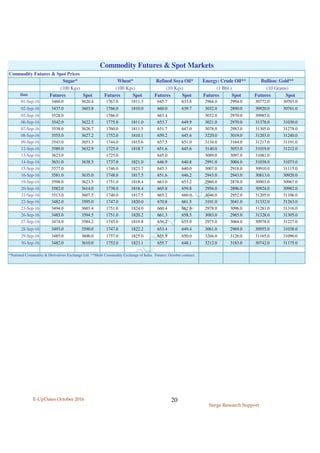

1 GVA at basic prices 104,27,191 7.2 97,27,490 7.1

2 Taxes 11,90,986 7.5 11,08,339 8.0

3 Less Subsidies 2,67,929 -5.6 2,83,679 4.8

4

GDP (1+2-3) 113,50,249 7.6 105,52,151 7.2

5 Net Domestic Product (GDP less

Consumption of Fixed Capital)

100,71,784 7.6 93,59,476 7.1

6 Net factor income from abroad -1,36,921 -1,24,450

7 Gross National Income (4+6) 112,13,328 7.5 104,27,701 7.3

8 Net National Income (GNI less

Consumption of Fixed Capital)

99,34,863 7.6 92,35,026 7.2

9 Population (in million) 1,283 1.3 1,267 1.3

10 Per capita GDP (Rs.) 88,466 6.2 83,285 5.9

11 Per capita GNI (Rs.) 87,399 6.2 82,302 6.0

12 Per capita PFCE (Rs.) 49,112 6.1 46,285 4.9

PE : Provisional Estimates; RE : Revised Estimates.

Index of Industrial Production Aug-16 Aug-15 Aug-16 FY2016-17 FY2015-16

General Index 175.3 176.6 -0.7 -0.3 4.1

1. Mining 113.5 120.2 -5.6 0.6 1.4

2. Manufacturing 184.3 184.8 -0.3 -1.2 4.5

3. Electricity 194.6 194.4 0.1 5.7 3.2

Index 2004-05 =100 Change (YoY, %)

Rs.Crore YoY

Growth (%)

GDP

[at Constant(2011-12) prices]

2015-16

(PE)

Rs.Crore YoY

Growth

2014-15

(1st RE)

126.5

129.3

122.6

186.0

189.8

186.0

178.6

188.6

198.8

176.8

181.1 178.3

100

110

120

130

140

150

160

170

180

190

200

210

2014-15 2015-16 2016-17

IIP-Annual Averages (Base : 2004-05=100) Mining &

Quarrying

(141.75)

Manufacturing

(755.27)

Electricity

(103.16)

General Index

(1000.0)](https://image.slidesharecdn.com/eupdtsoct16-170222033922/85/E-UPDates-A-Monthly-Statistical-Bulletin-Sample-5-320.jpg)