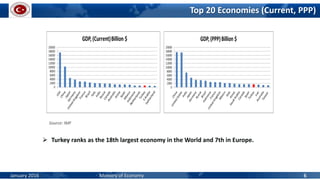

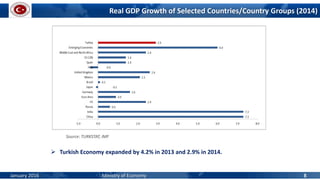

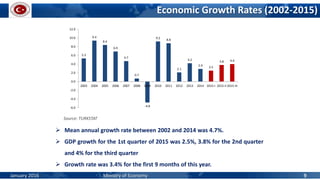

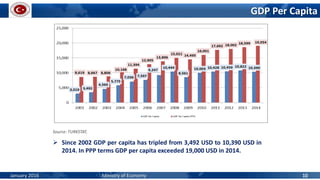

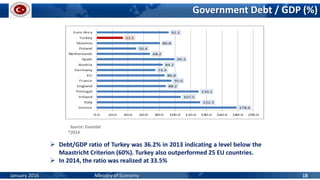

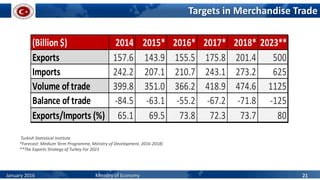

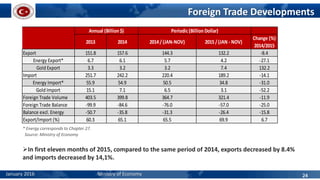

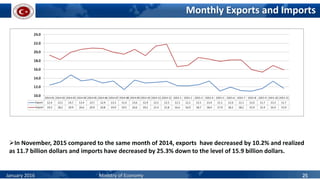

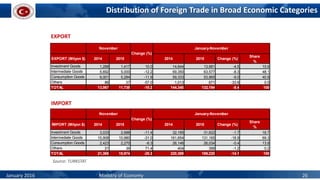

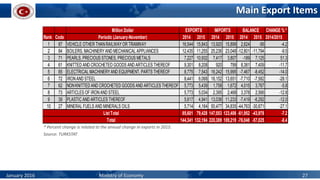

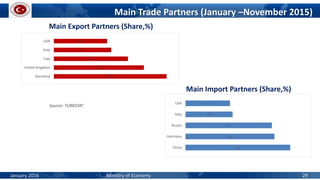

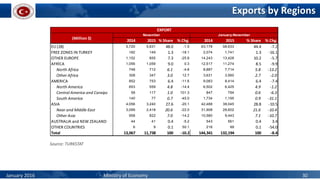

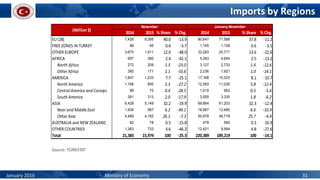

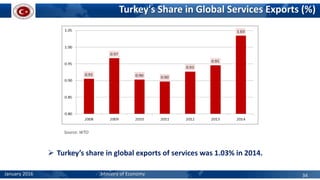

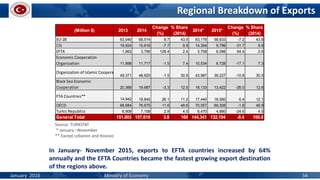

The document provides an economic outlook from the Ministry of Economy of Turkey for January 2016. It includes macroeconomic forecasts from international organizations showing Turkey's GDP growth expected around 3% in 2015-2016. The medium term program targets 4.5% GDP growth in 2016 with a reduced current account deficit. Exports decreased 8.4% in the first 11 months of 2015 while imports decreased 14.1%. Top exports include vehicles, machinery, precious metals and textiles, while machinery, intermediate goods and consumption goods dominate imports.