Embed presentation

Download to read offline

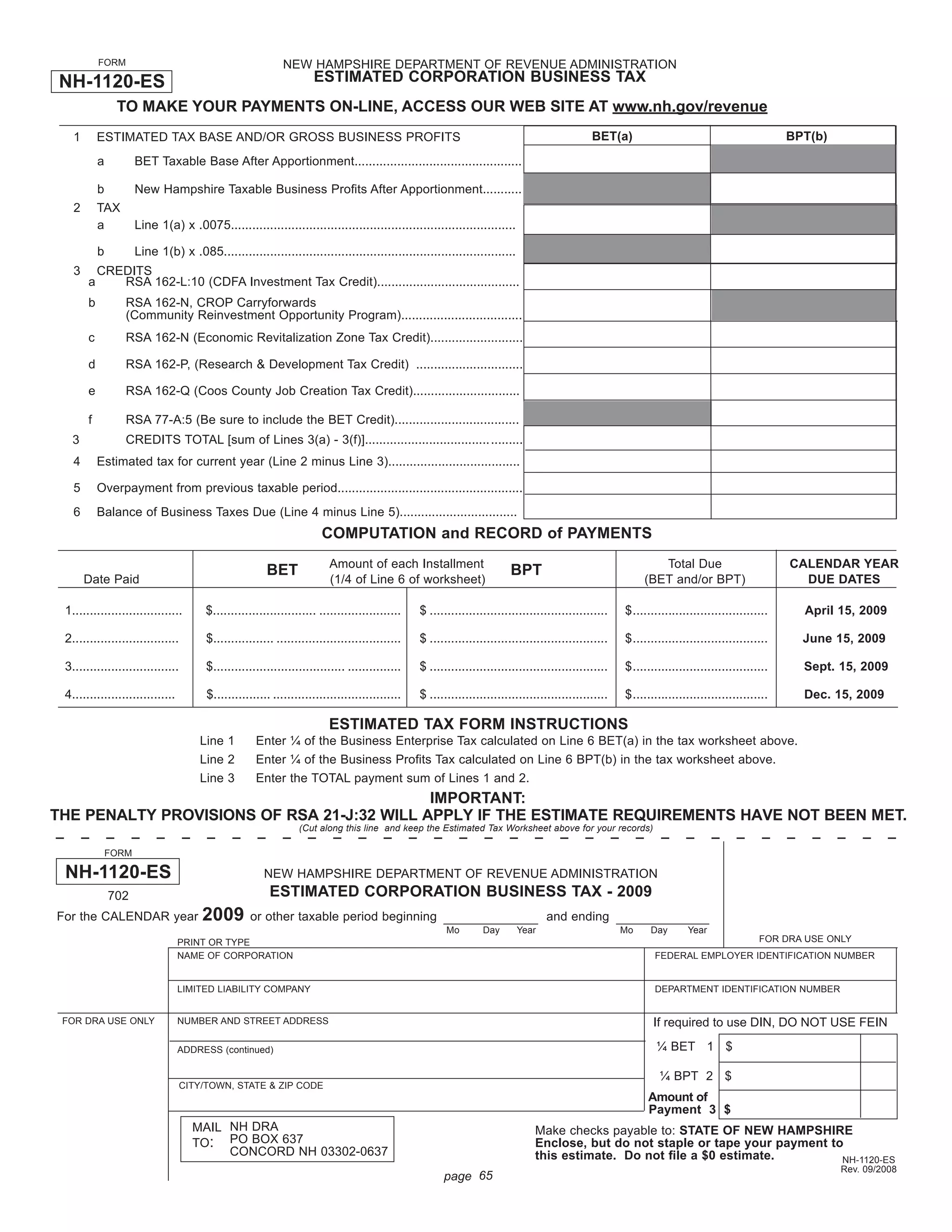

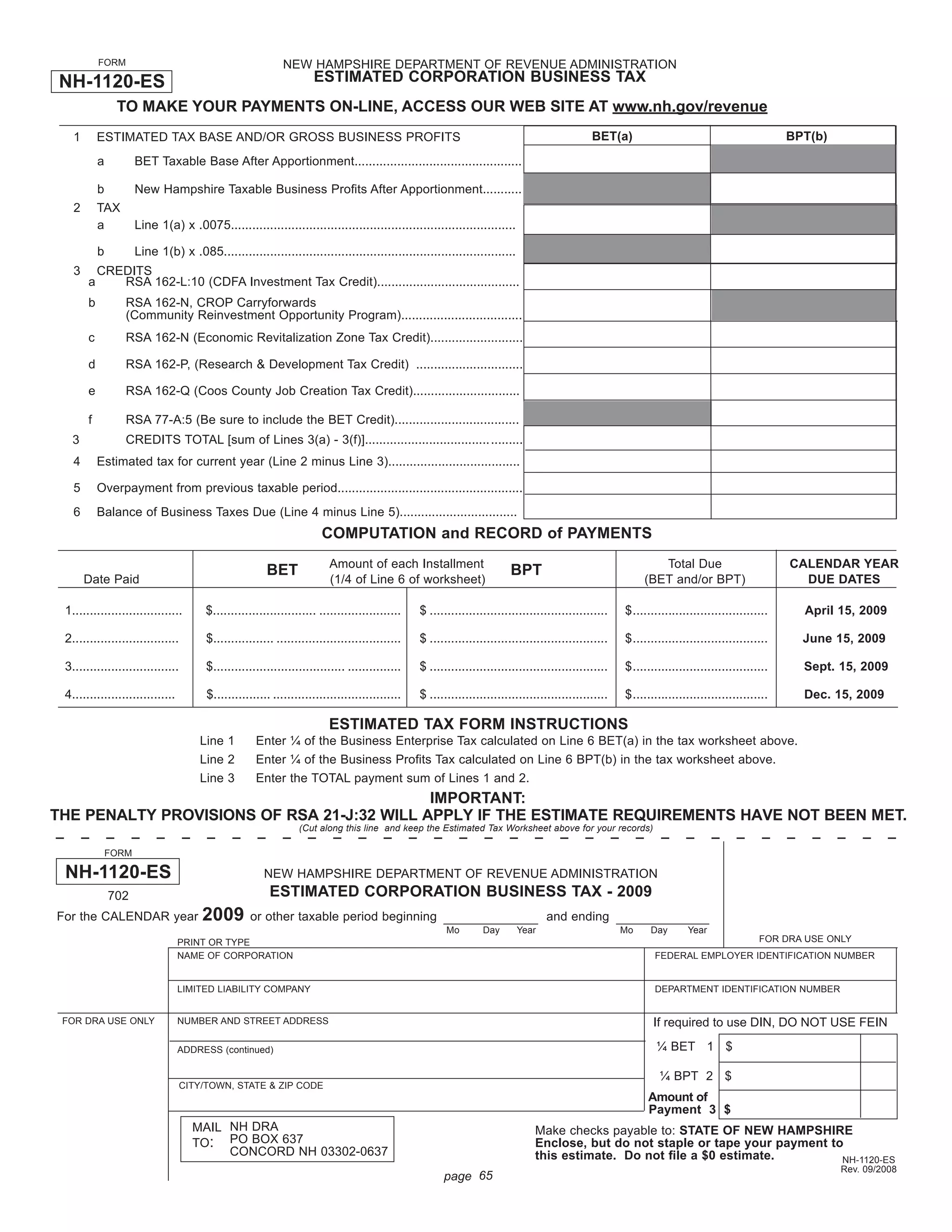

This document provides instructions for filing estimated corporation business tax payments in New Hampshire. It outlines that: 1) Estimated tax payments are due quarterly for any business with an estimated annual tax of $200 or more. 2) Payments can be made online or mailed to the New Hampshire Department of Revenue Administration. 3) The due dates for calendar year filers are April 15, June 15, September 15, and December 15. Fiscal year filers' dates are tied to their tax periods.