Embed presentation

Download to read offline

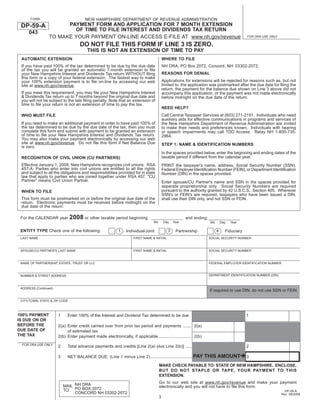

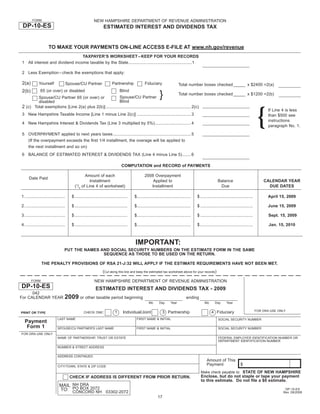

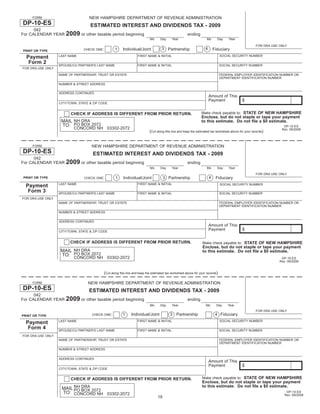

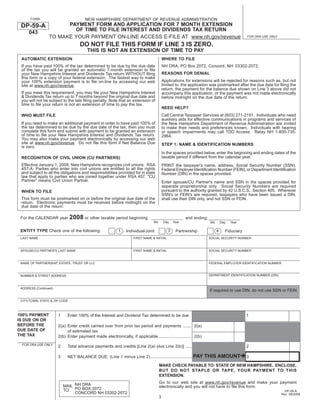

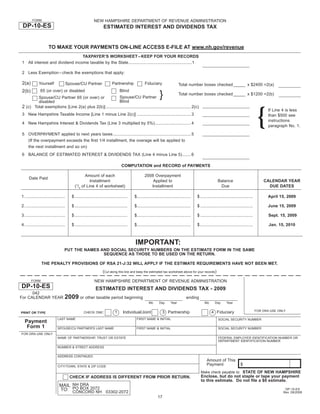

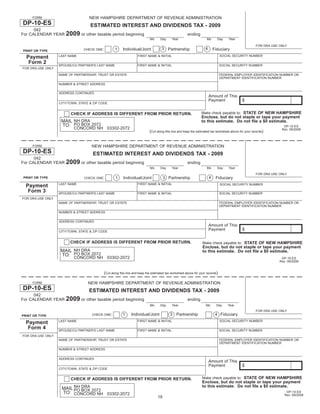

This document contains information about New Hampshire's Interest and Dividends Tax for tax year 2008, including details about: - Filing requirements and deadlines - Payment options including online payments and extensions - A tax rate of 5% on interest and dividend income - Interest rates on late or unpaid taxes - Where to find forms and get assistance It provides the forms and instructions needed to file the Interest and Dividends Tax return, including extensions, estimates, and payments.