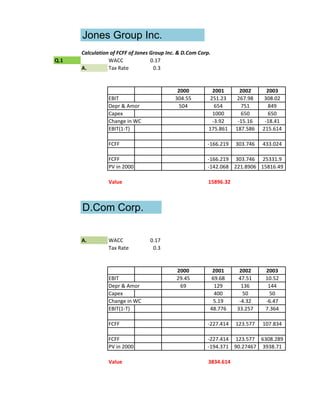

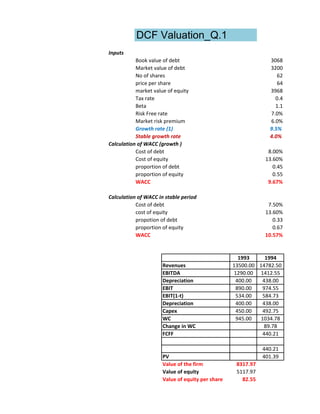

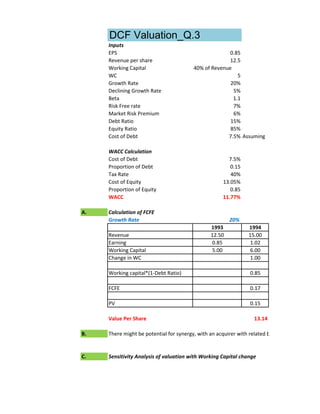

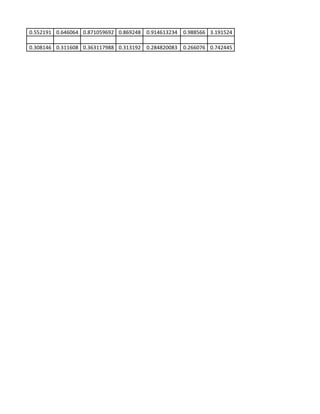

This document contains calculations related to discounted cash flow (DCF) valuation for three different companies or divisions. It includes calculations of weighted average cost of capital (WACC) using given inputs like debt ratio, cost of debt, beta, tax rate. It also includes projections of revenue, earnings, capital expenditures, depreciation, working capital and free cash flows to the firm. These cash flows are discounted using the WACC to calculate the intrinsic value per share or overall valuation of the company/division. Sensitivity analysis is also performed by varying the assumptions for working capital as a percentage of revenue.

![1-T)+NCC-FC-Inc in WC

Return on Equity

idend per share*shares outstanding)]/Net Income

nning of the year equity

end per share*shares outstanding)

Sales Growth 6%

For 2006 2005 2006 variance

Sales 4052173 4295303 243130

Expenses 3735397 3735397

Non cash Charges 56293 60000

Interest on long term Debt 20265 20265

Other interest 5223 5223

Income before income taxes 234995 474418](https://image.slidesharecdn.com/assignmentvos-110314212120-phpapp02/85/Assignment-vos-19-320.jpg)

![80

674

Net Income/Beginning of the year Equity

0.118694

Plowback ratio* Return on equity

b*ROE

[Net Income-(Dividend per share*share outstandind)]/Net Income

0.286

84

b*ROE

0.08305

0.6+0.286 0.886

0.008273

uld be used to increase production capacity

wth rate. The proceeds of issue of bond increases the production

s of growth in share price. But it has no direct relation with sustainable growth rate.

ng shares increases by 2 times whereas the price per share decreases by half.](https://image.slidesharecdn.com/assignmentvos-110314212120-phpapp02/85/Assignment-vos-28-320.jpg)

![Sundanci_Q.25

A. The formula for calculating a price earnings ratio (P/E) for a stable growth firm is the dividend payout ratio

P/E on trailing earnings

P/E = [payout ratio (1 + g)]/(r g)

Growth 13%

Payout 30%

Cost of Equity 14%

P/E Ratio 33.9

P/E on next year's earnings

P/E Ratio 30.0

B.

The P/E Ratio is a decreasing function of riskiness. As risk increases, the P/E ratio decreases. Increases in the riskin](https://image.slidesharecdn.com/assignmentvos-110314212120-phpapp02/85/Assignment-vos-52-320.jpg)