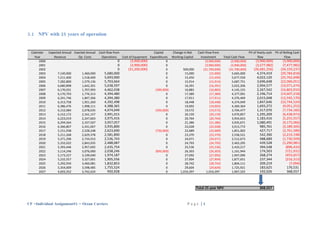

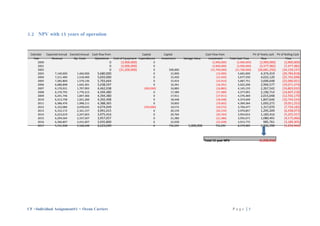

The document analyzes the financial viability of purchasing a $39 million capesize dry bulk carrier that would operate for 25 years. Net present value (NPV) calculations are shown for operating the vessel for both 25 years and 15 years. Operating it for 25 years yields a positive NPV of $368,557. However, operating it for only 15 years pursuant to company policy and then scrapping it yields a negative NPV of -$1,252,916, indicating a loss. Therefore, the recommendation is to reject the proposal due to the company's 15-year vessel operation limit.