The document summarizes key aspects of the Minimum Wages Act, 1948 in India such as:

1) It mandates the appropriate government to fix minimum rates of wages for employees and review them every five years.

2) It specifies requirements for normal working hours, overtime rates at double the ordinary rate, and a day of rest in every seven days.

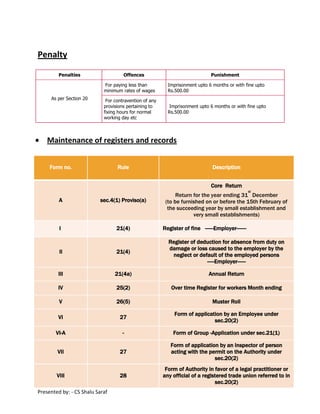

3) It describes the composition of committees to include representation from employers and employees in equal numbers, and penalties for non-compliance including fines and imprisonment.

3) It lists various forms and registers that employers must maintain such as wage registers, muster rolls, and overtime registers.