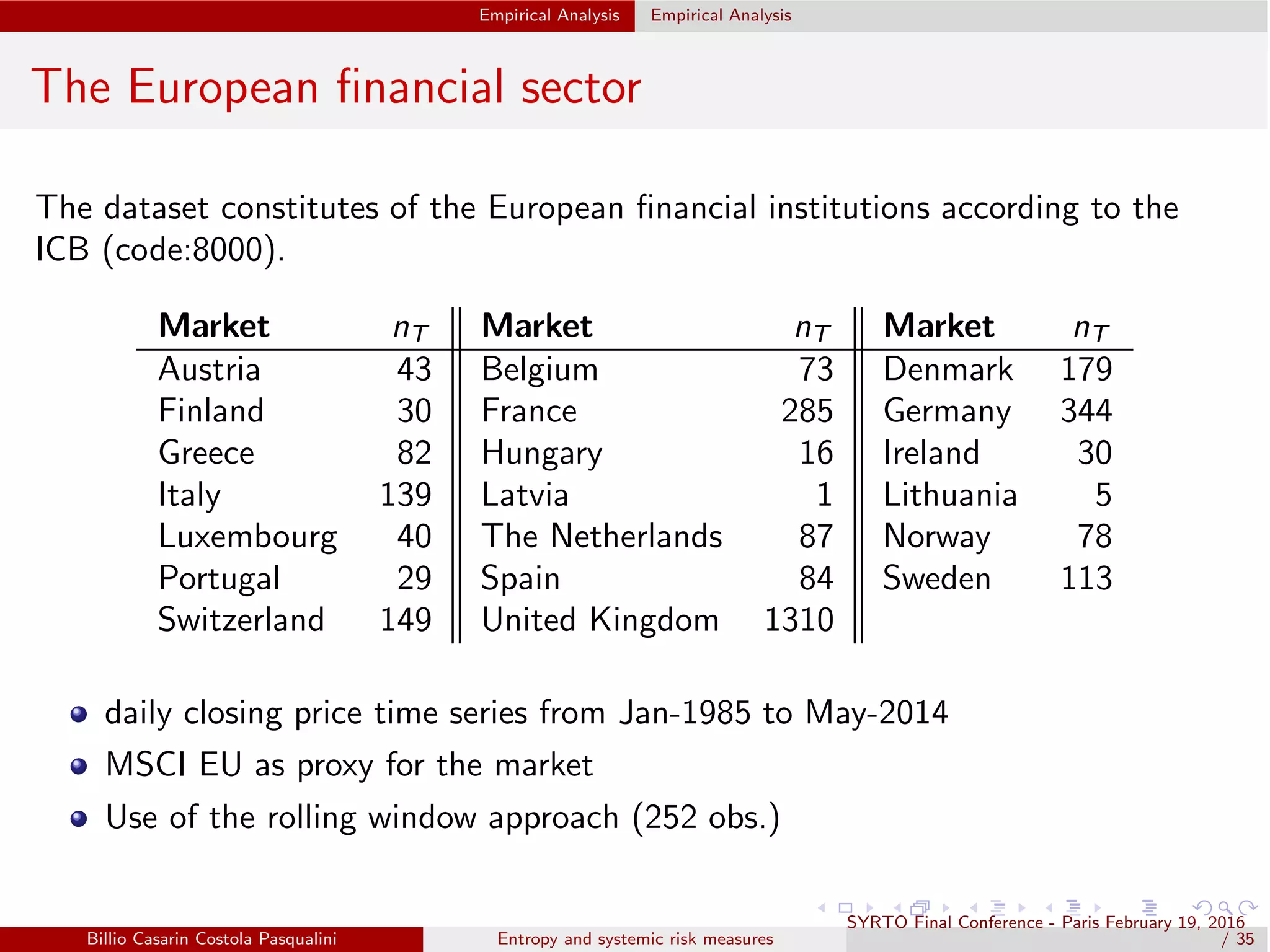

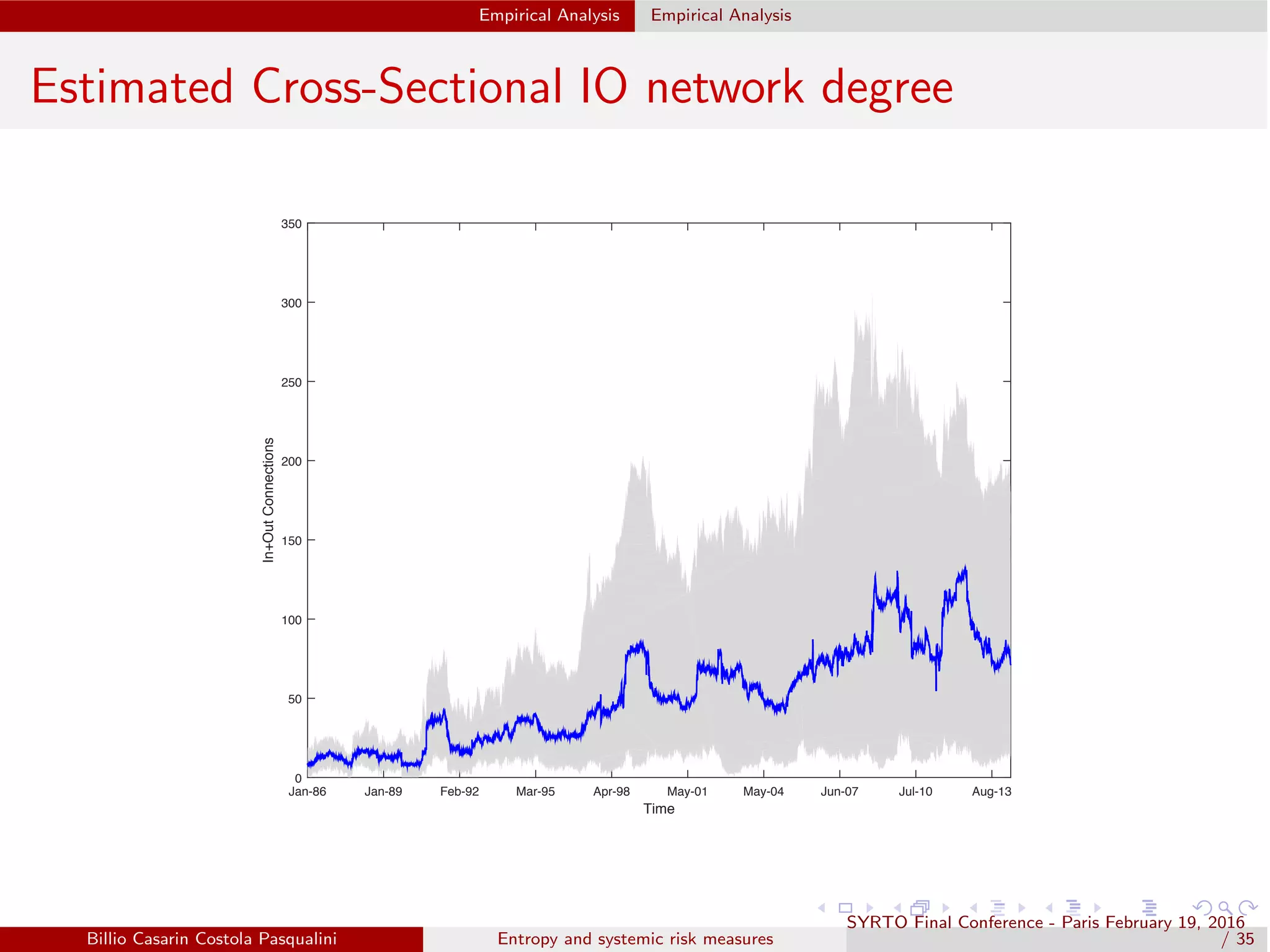

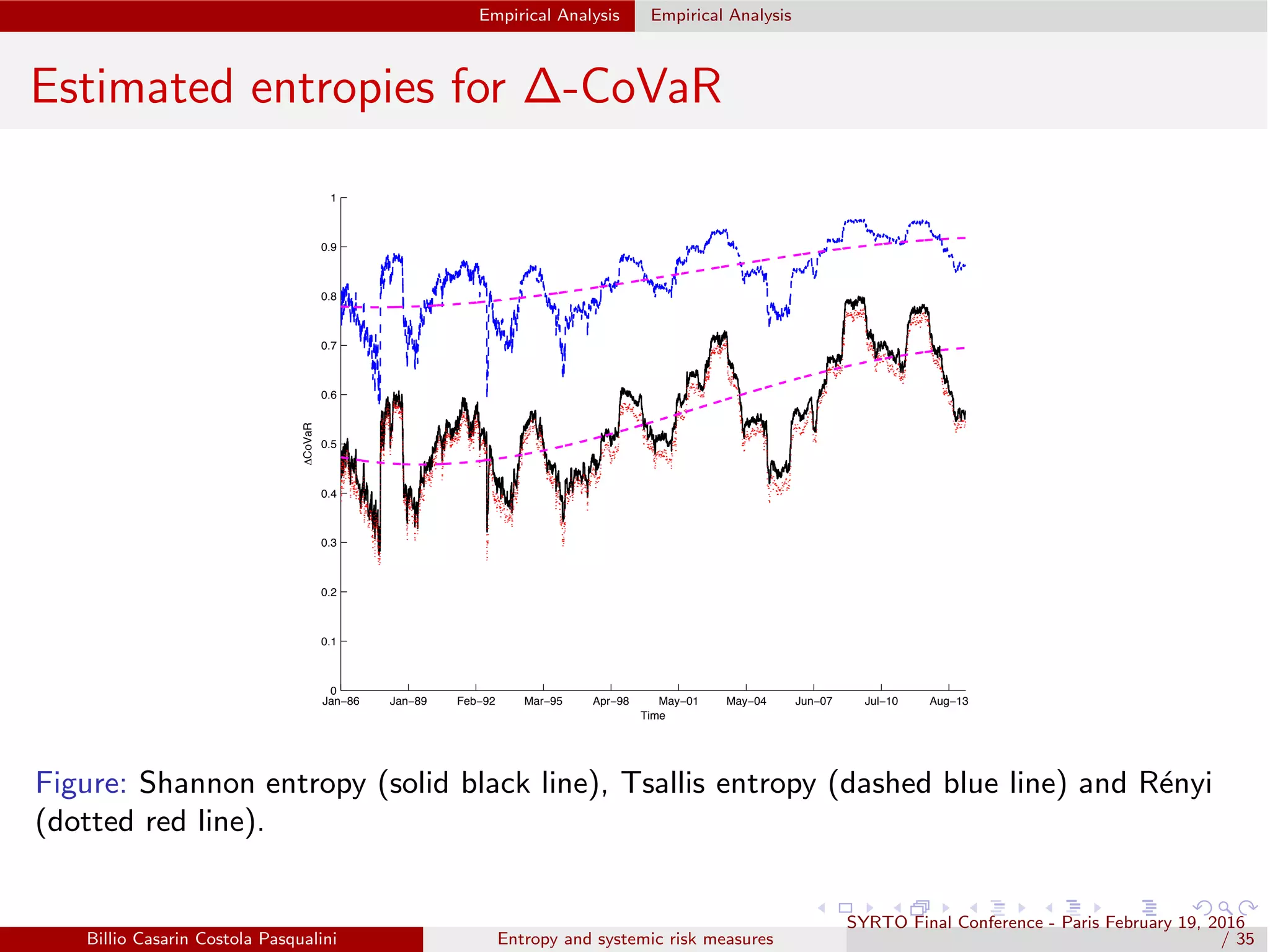

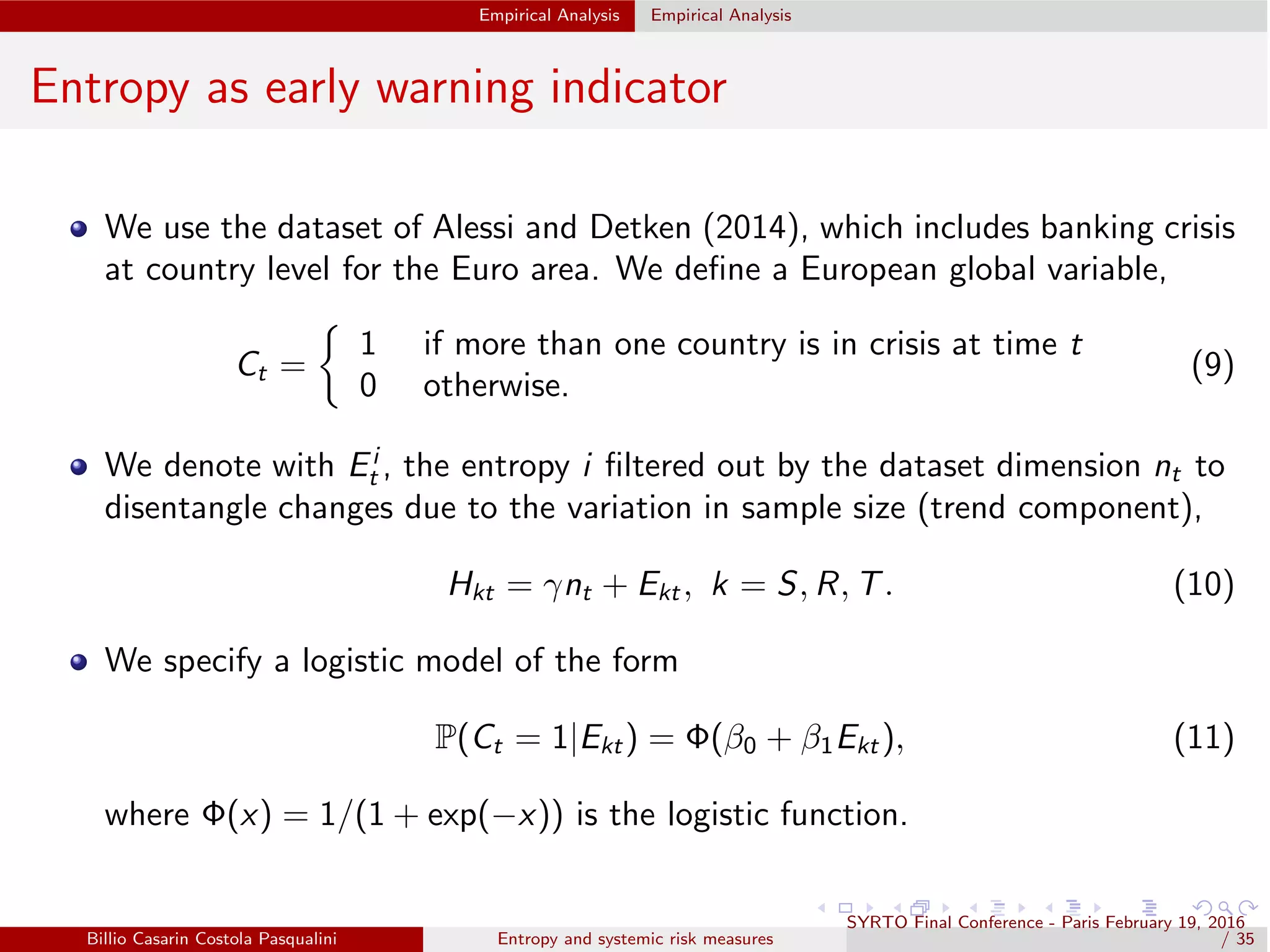

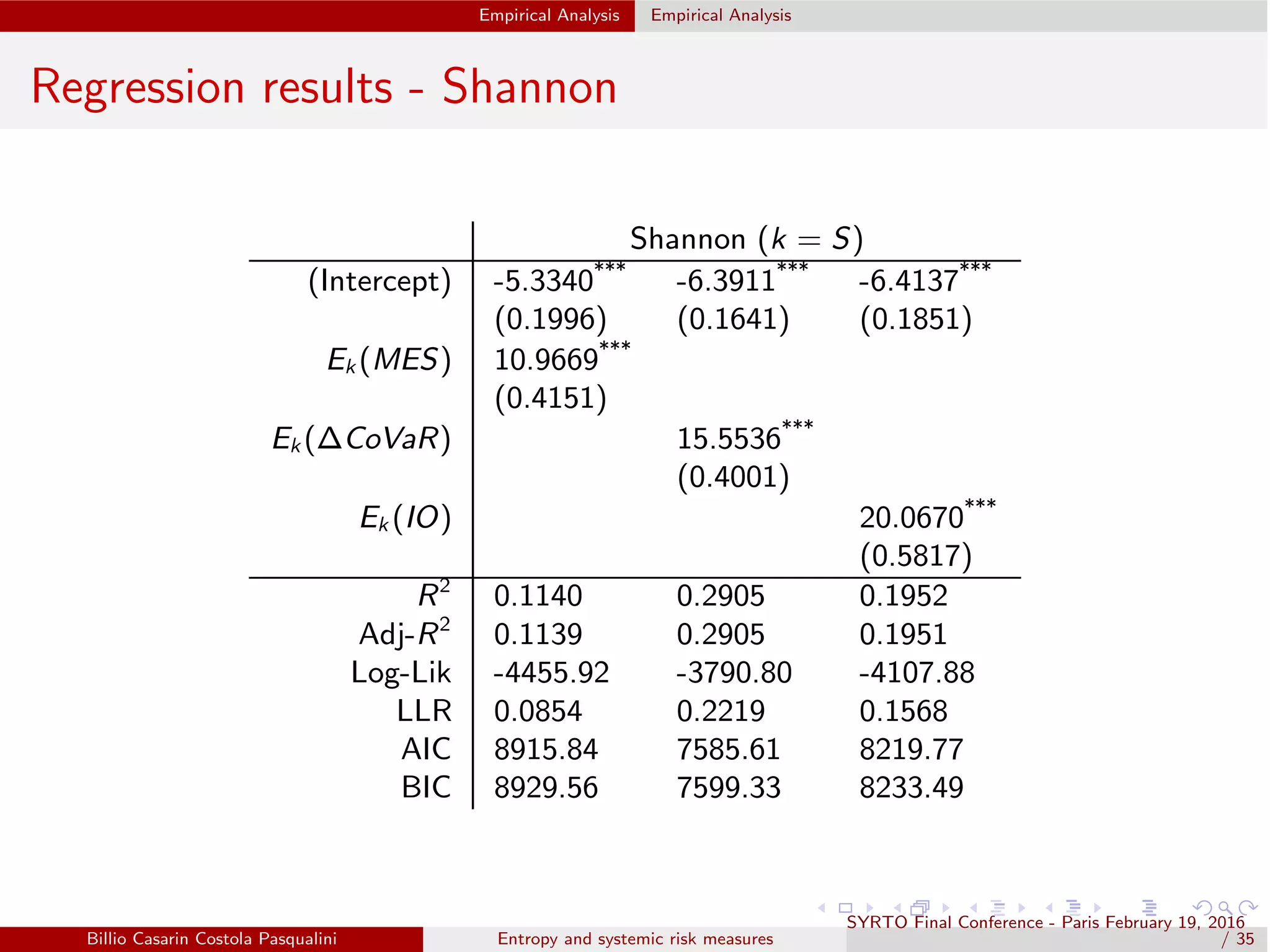

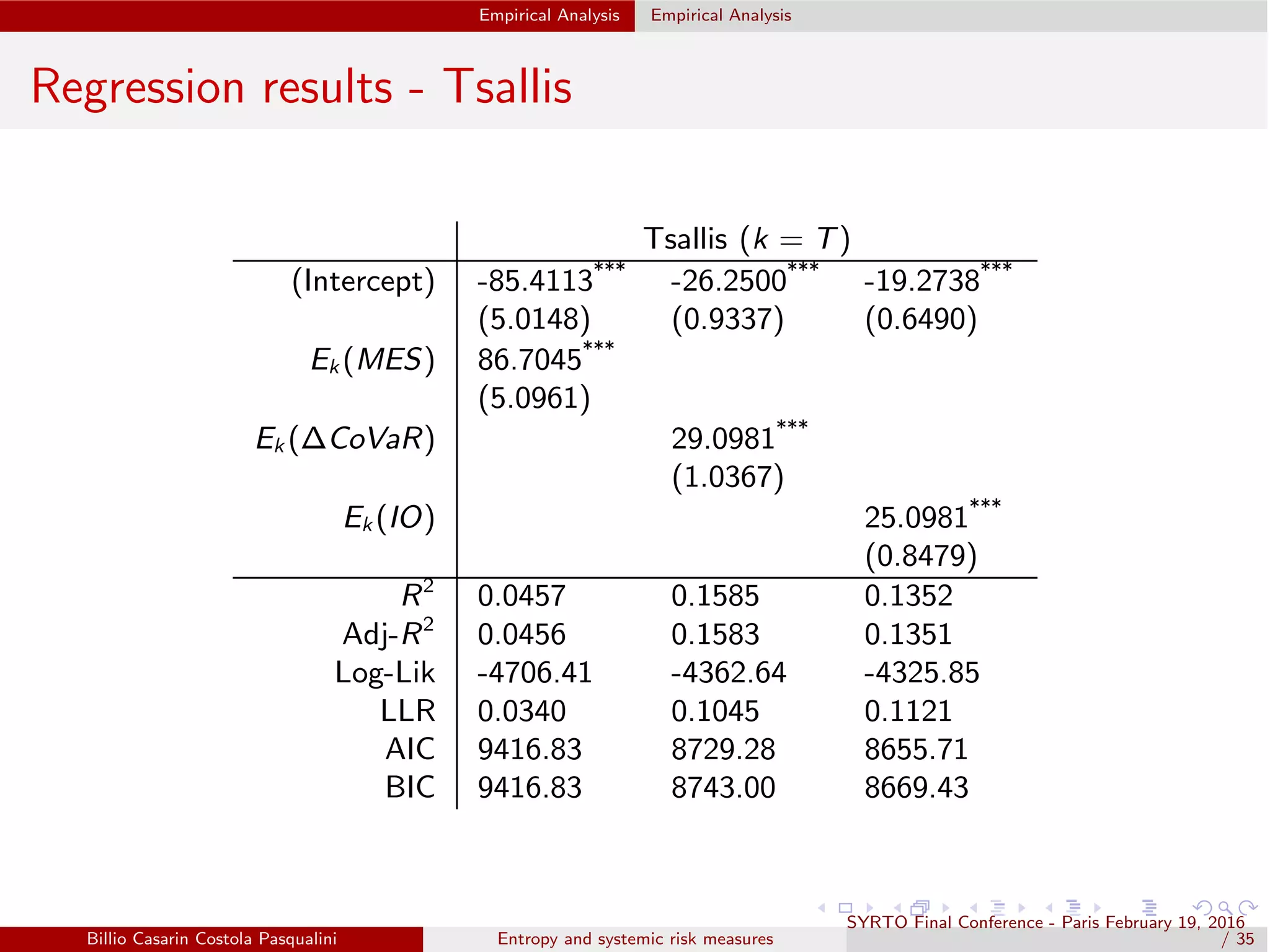

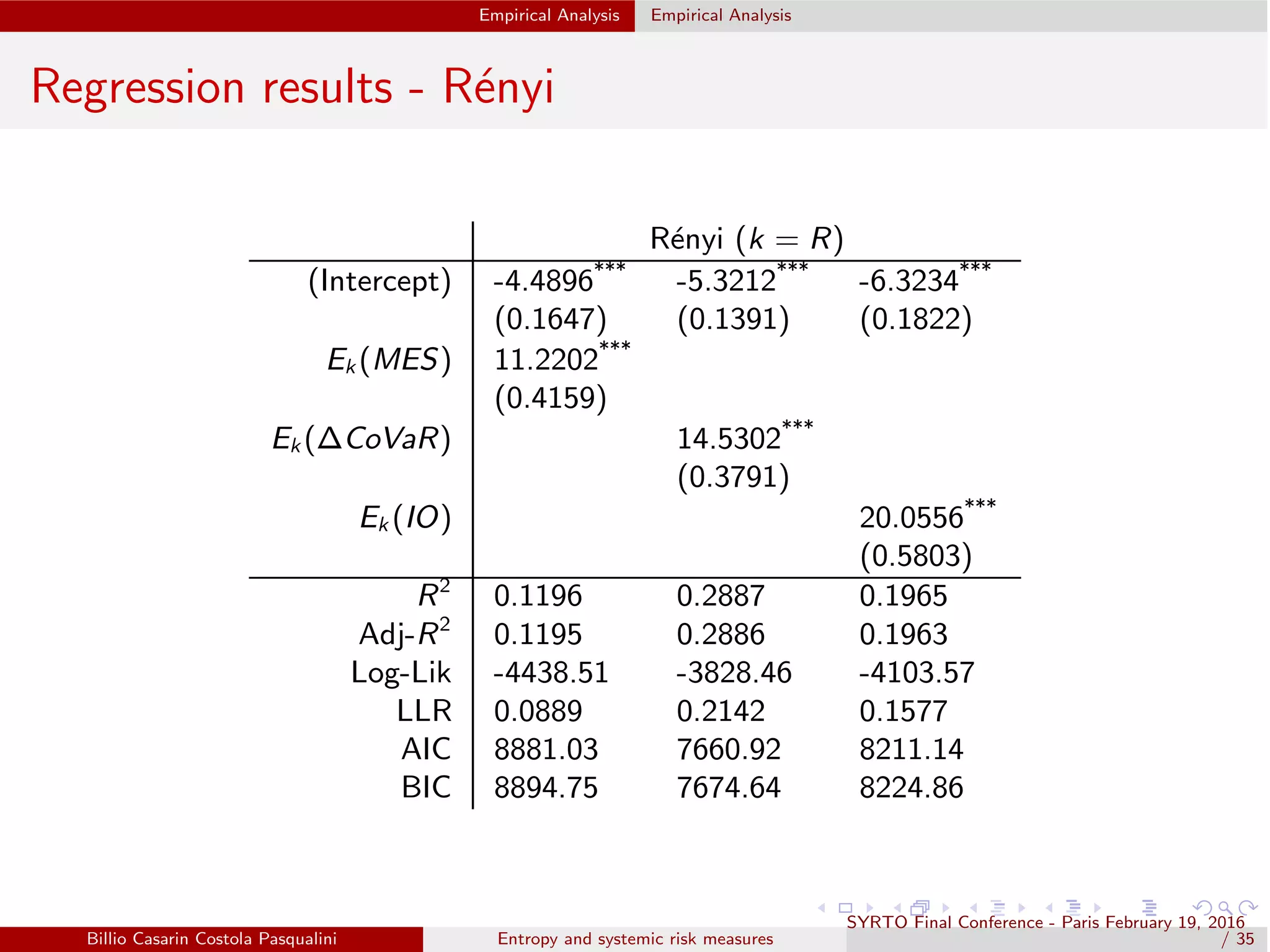

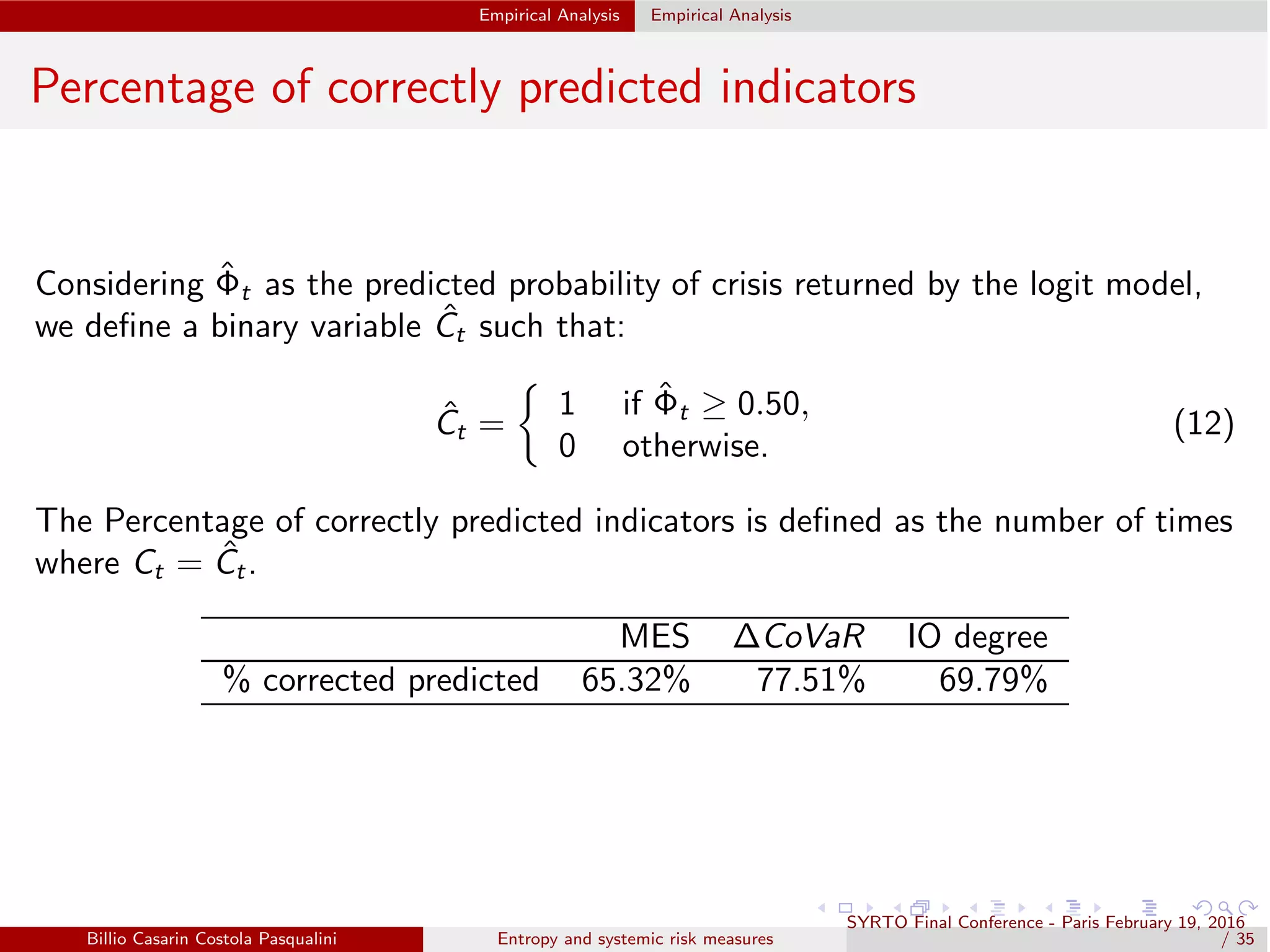

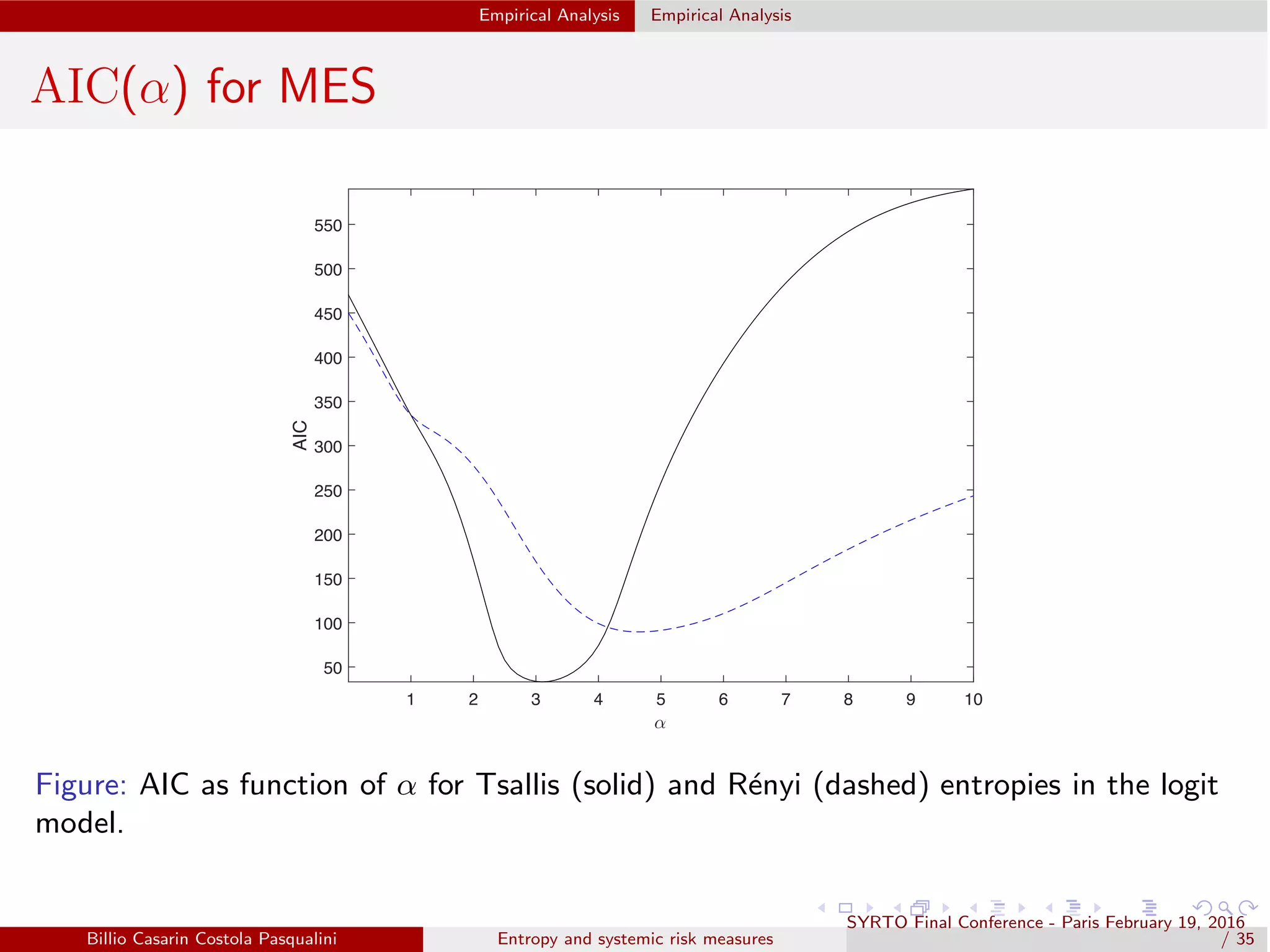

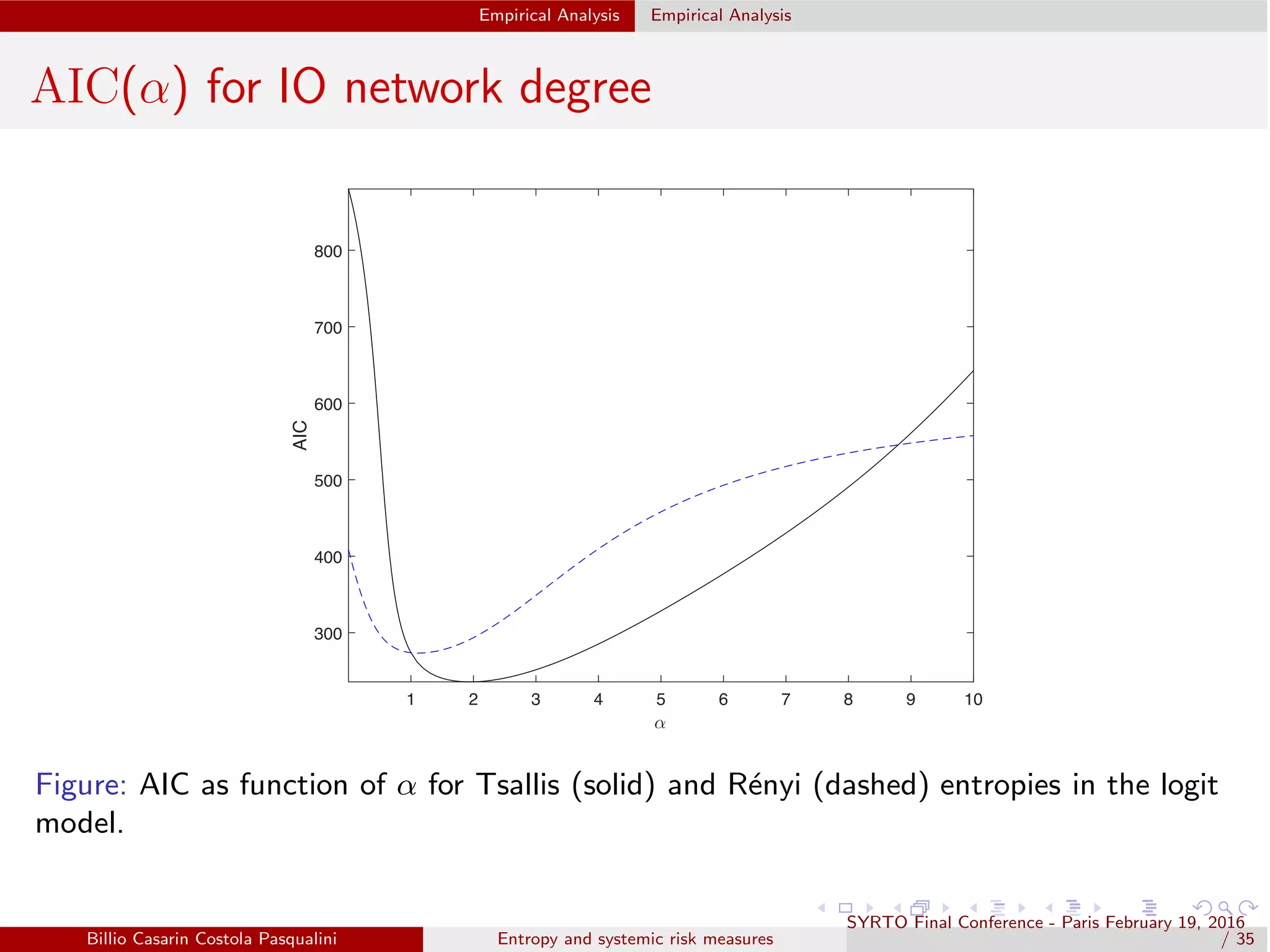

The document discusses the measurement of systemic risk through entropy measures, aiming to construct an early warning indicator for banking crises in Europe. It evaluates various models that assess the interconnectedness among financial institutions and analyzes the role of entropy in capturing the complexities and fluctuations within the financial system. The findings suggest that higher entropy levels could indicate increased systemic risk, helping policymakers to monitor and mitigate potential crises.