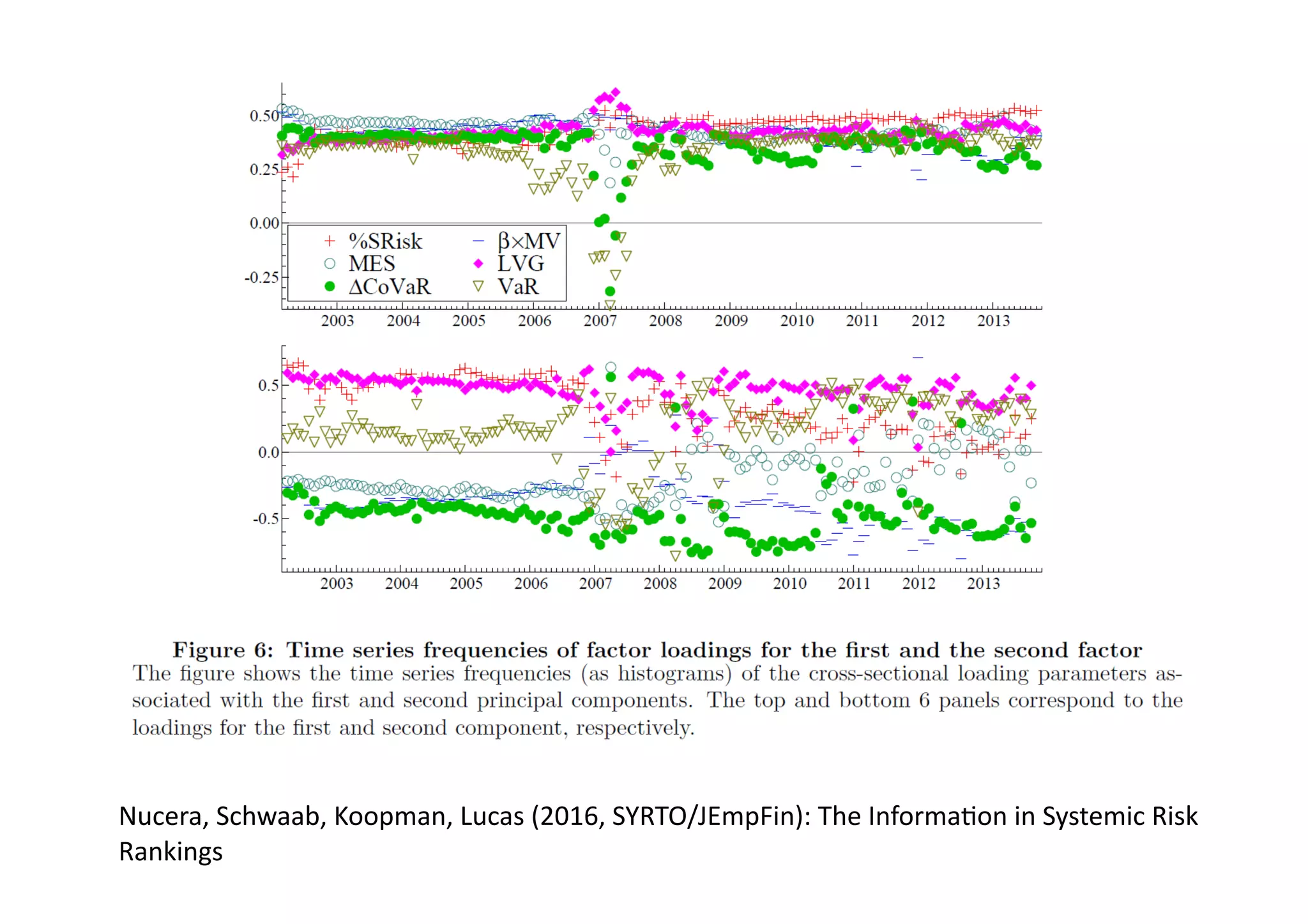

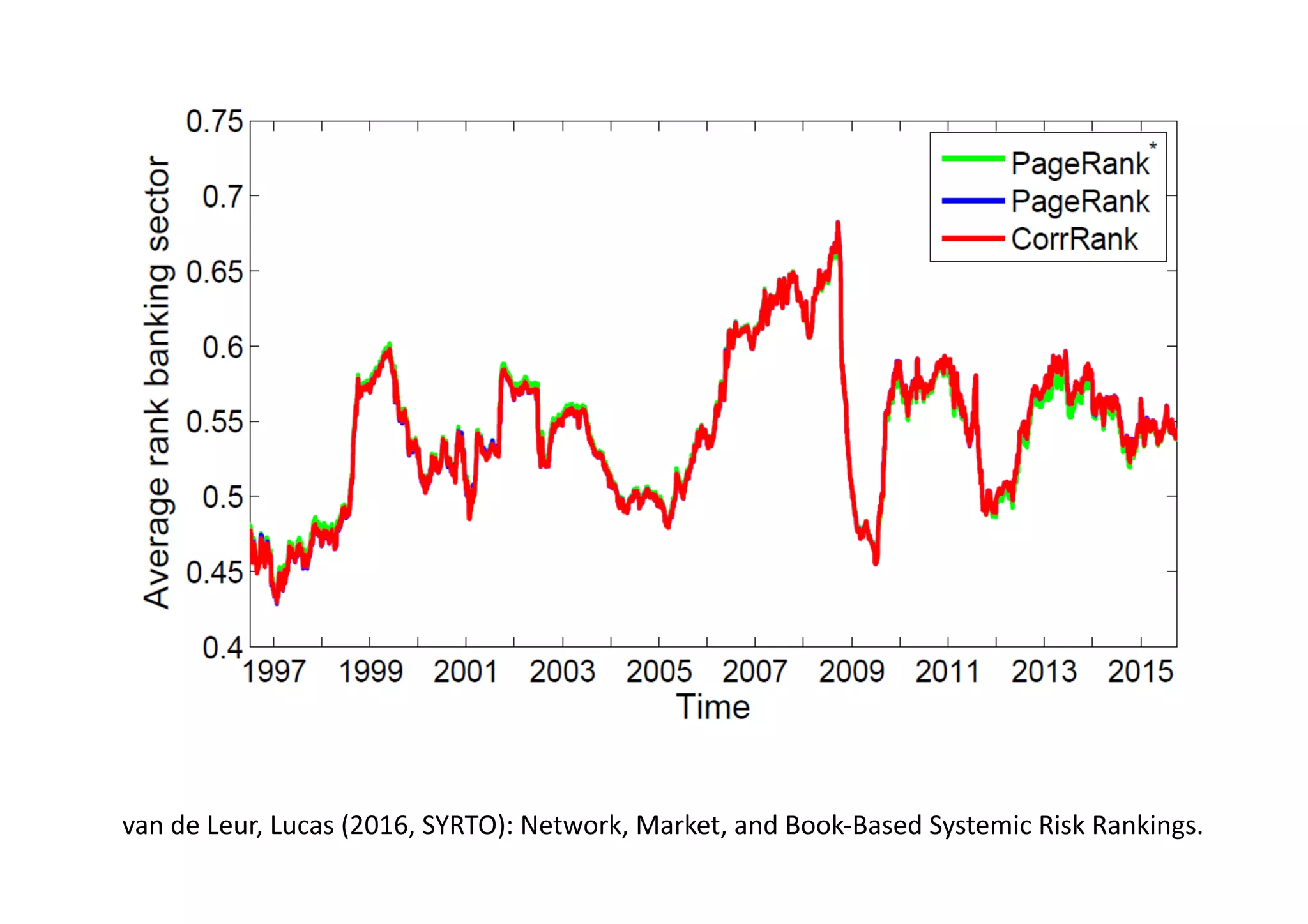

The document discusses systemic risk indicators and the challenges in measuring, monitoring, and managing systemic risk in the financial sector. It highlights the types of systemic risk, various measurement approaches, and ongoing research to improve risk assessment using market prices, network structures, and text parsing. The findings suggest that while current methods are promising, the data demands and complexities involved mean accurate statistical risk monitoring remains a challenge.