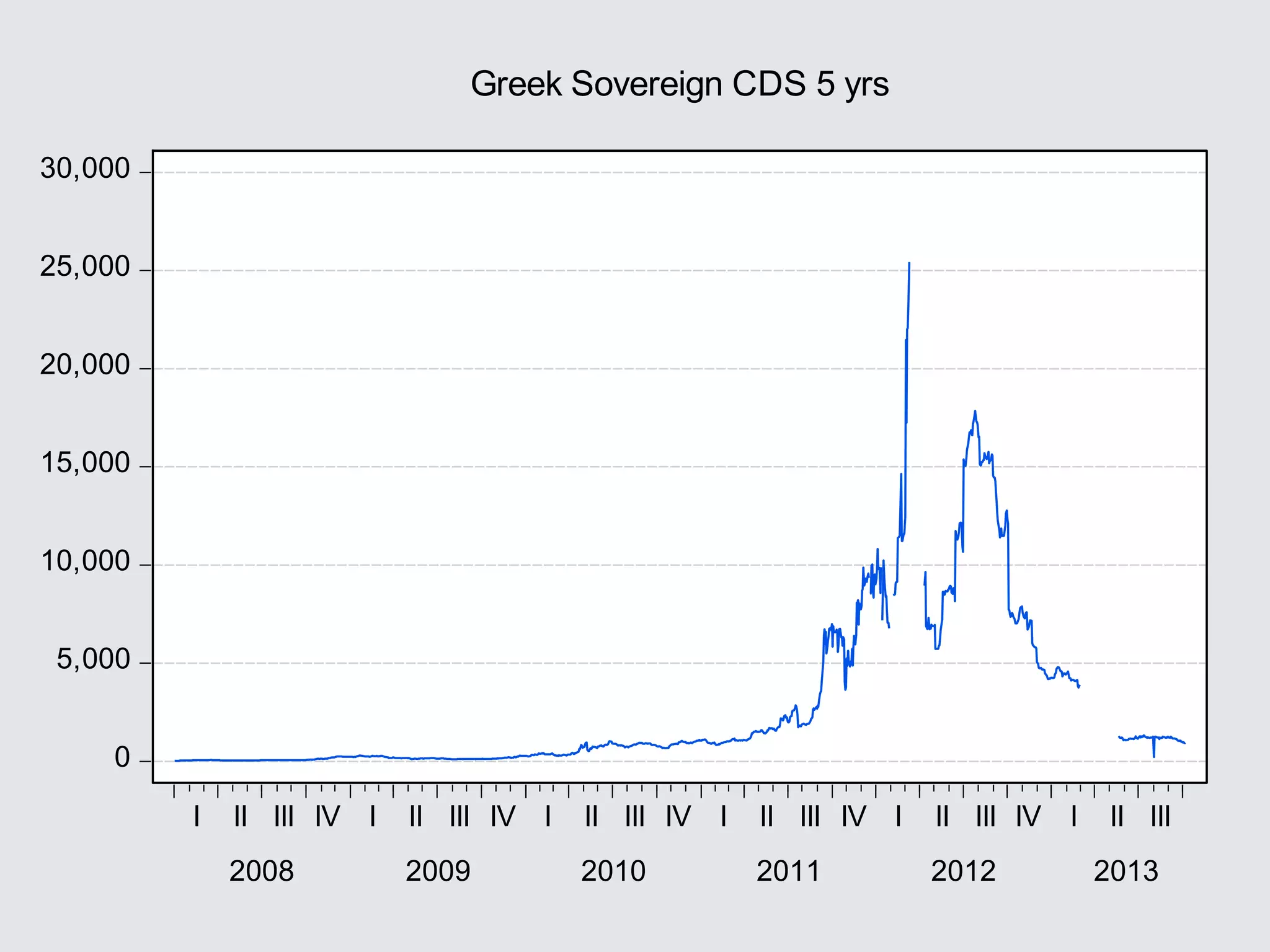

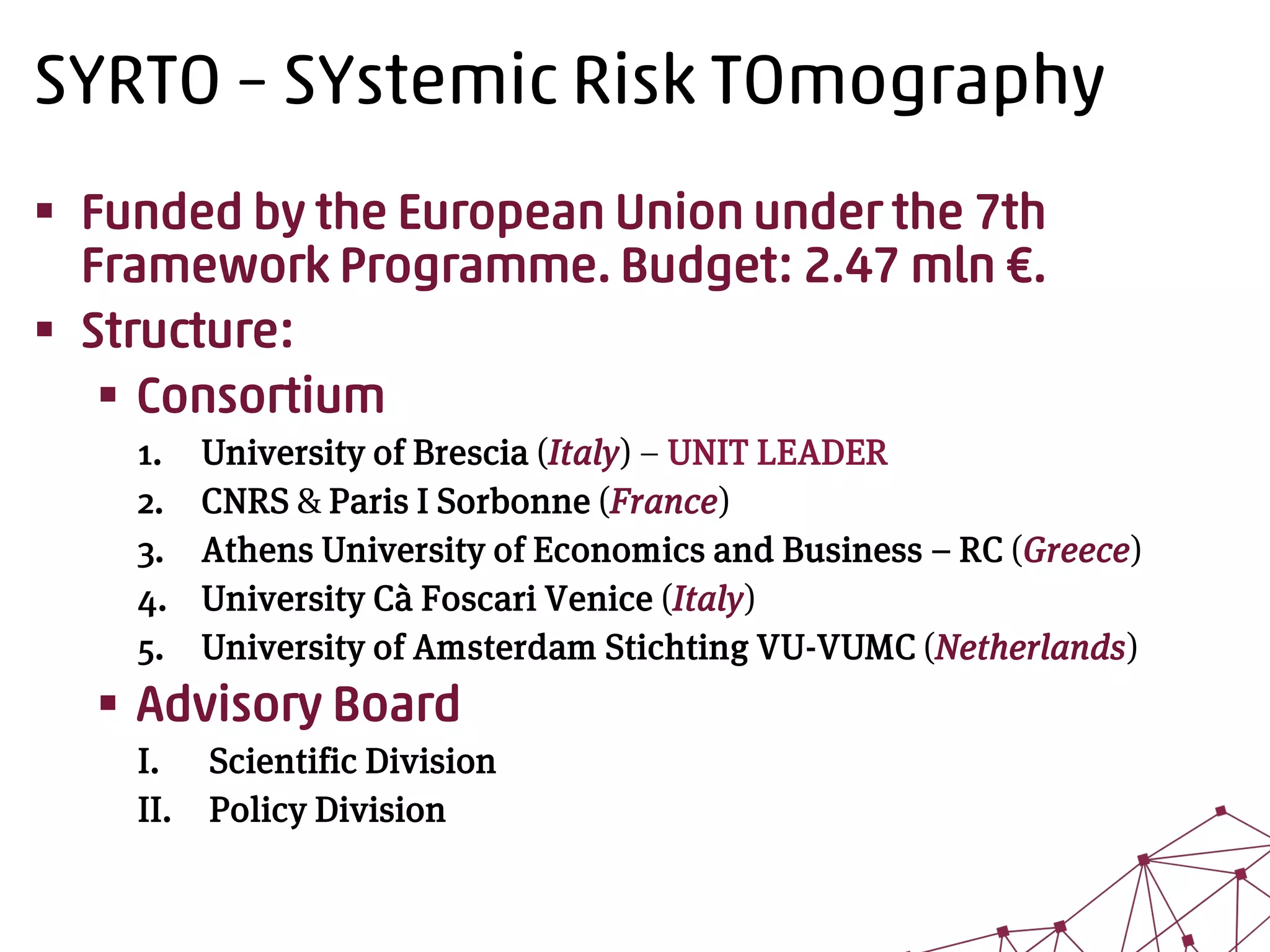

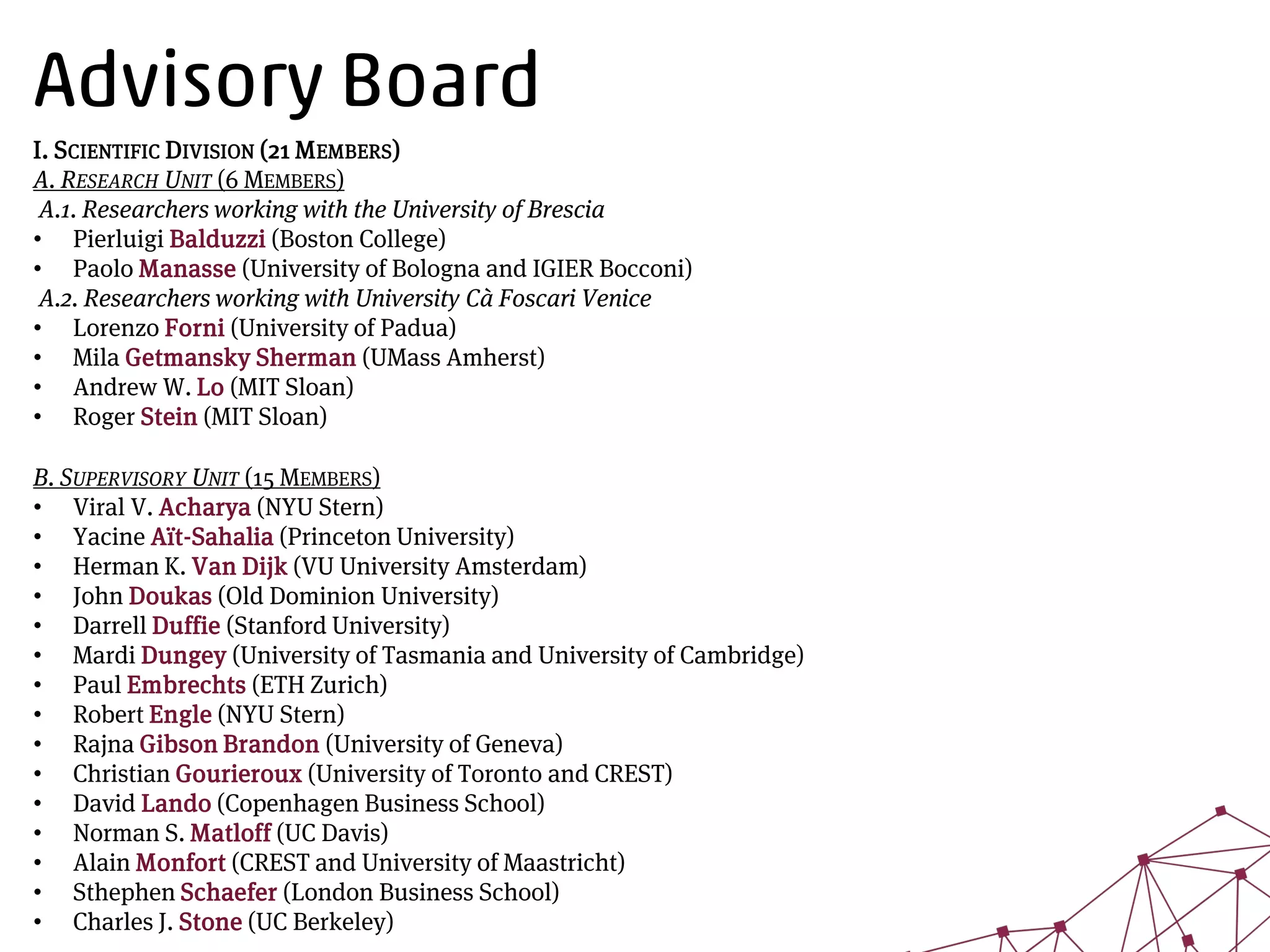

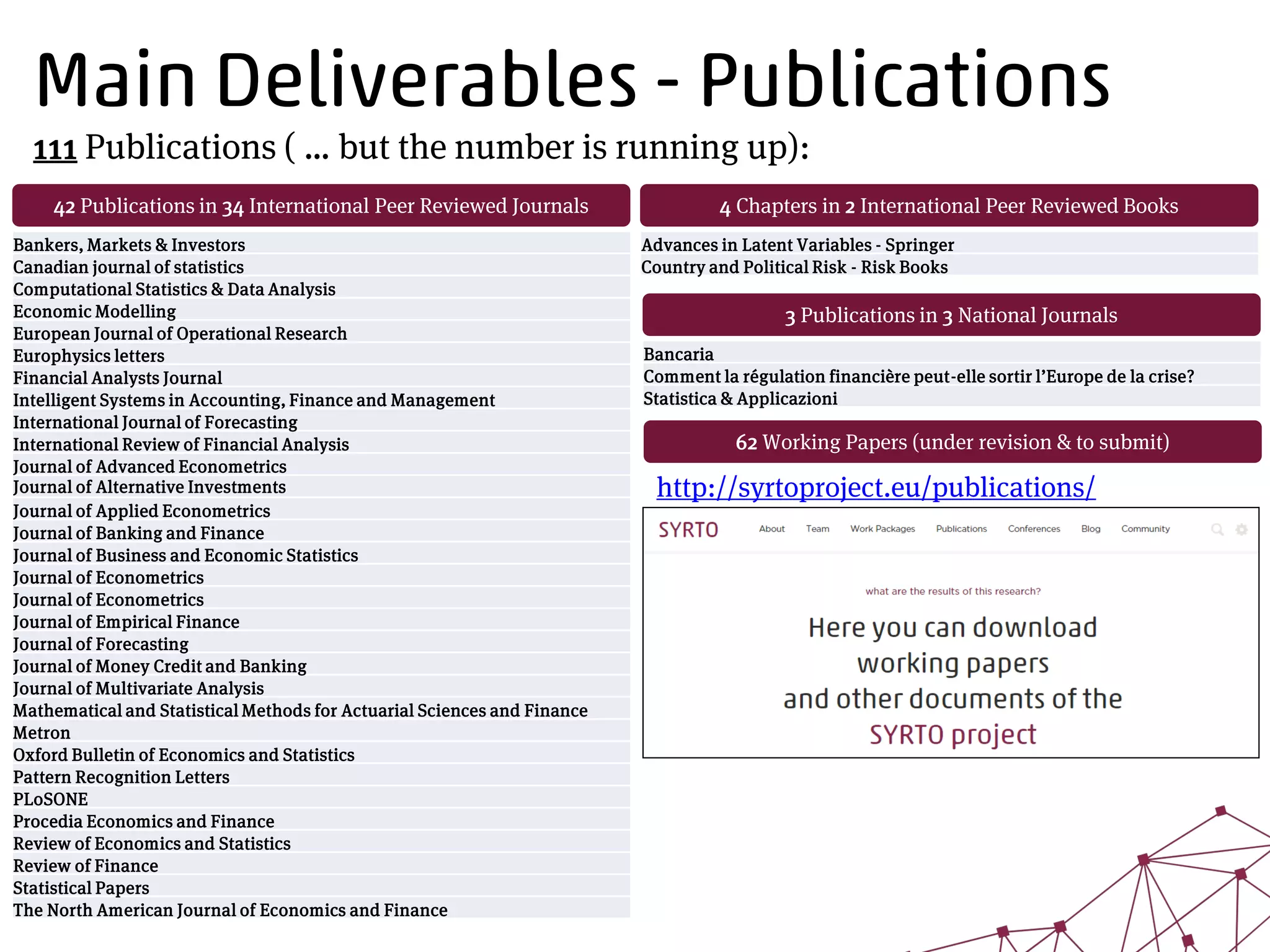

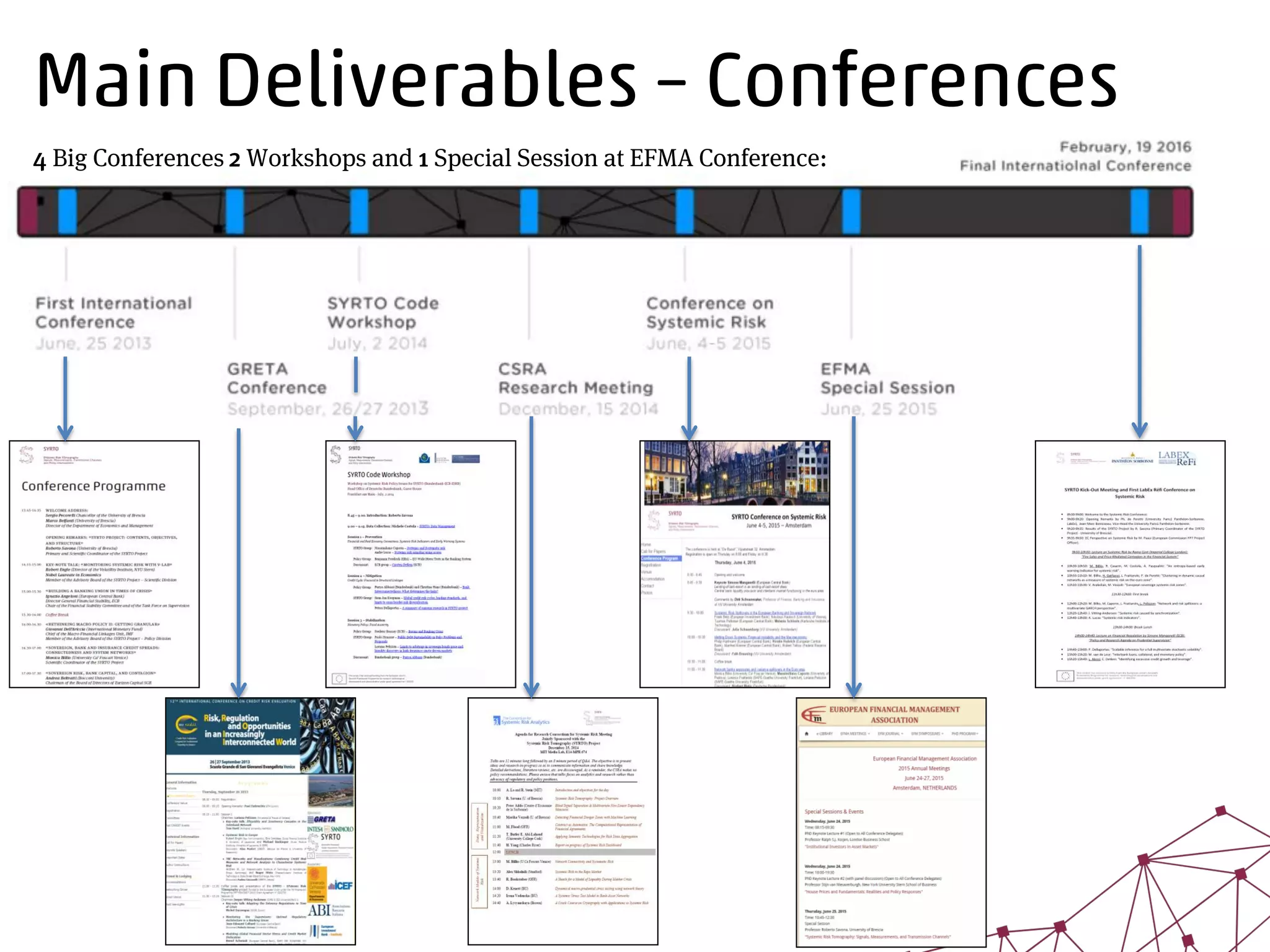

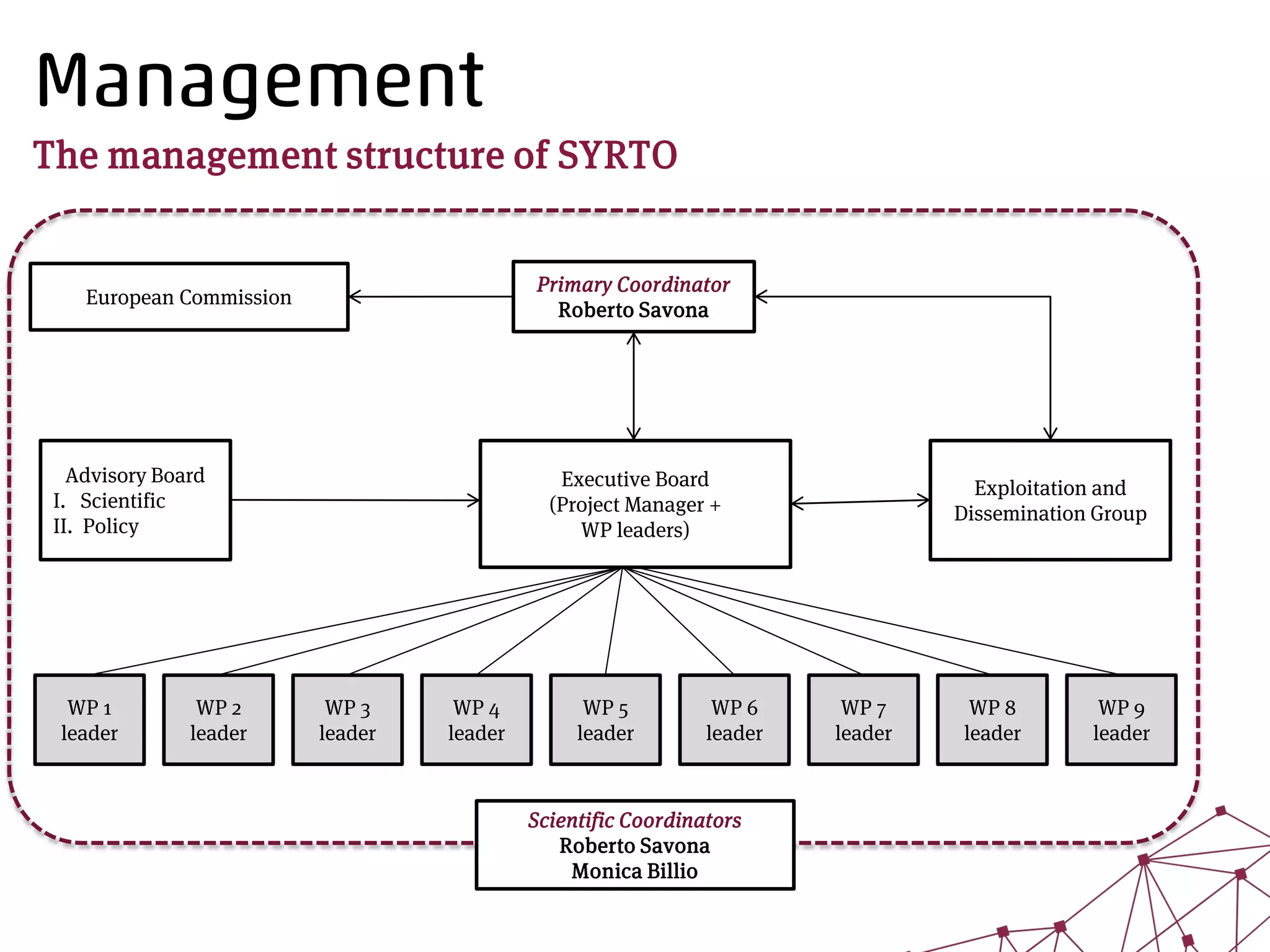

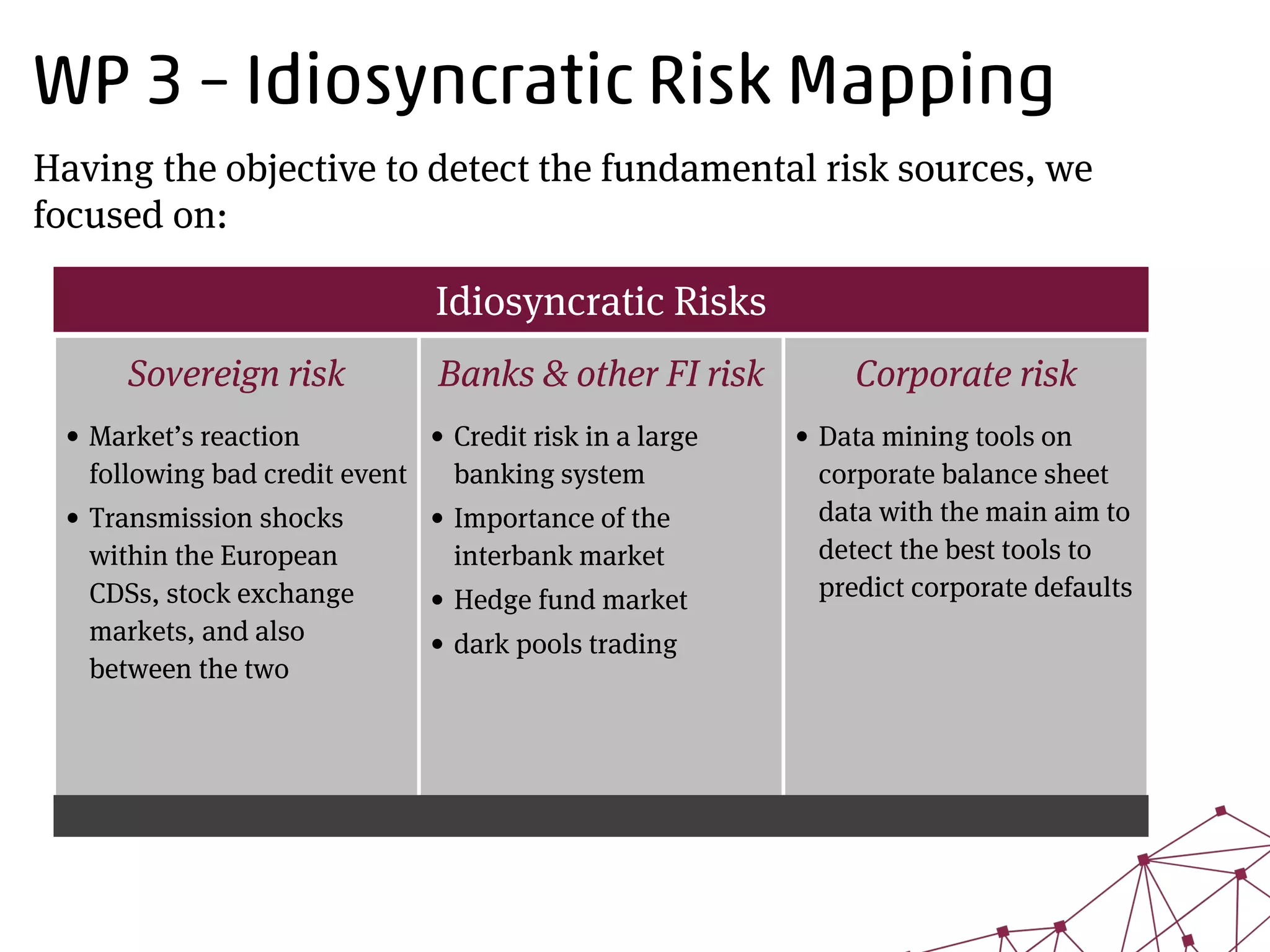

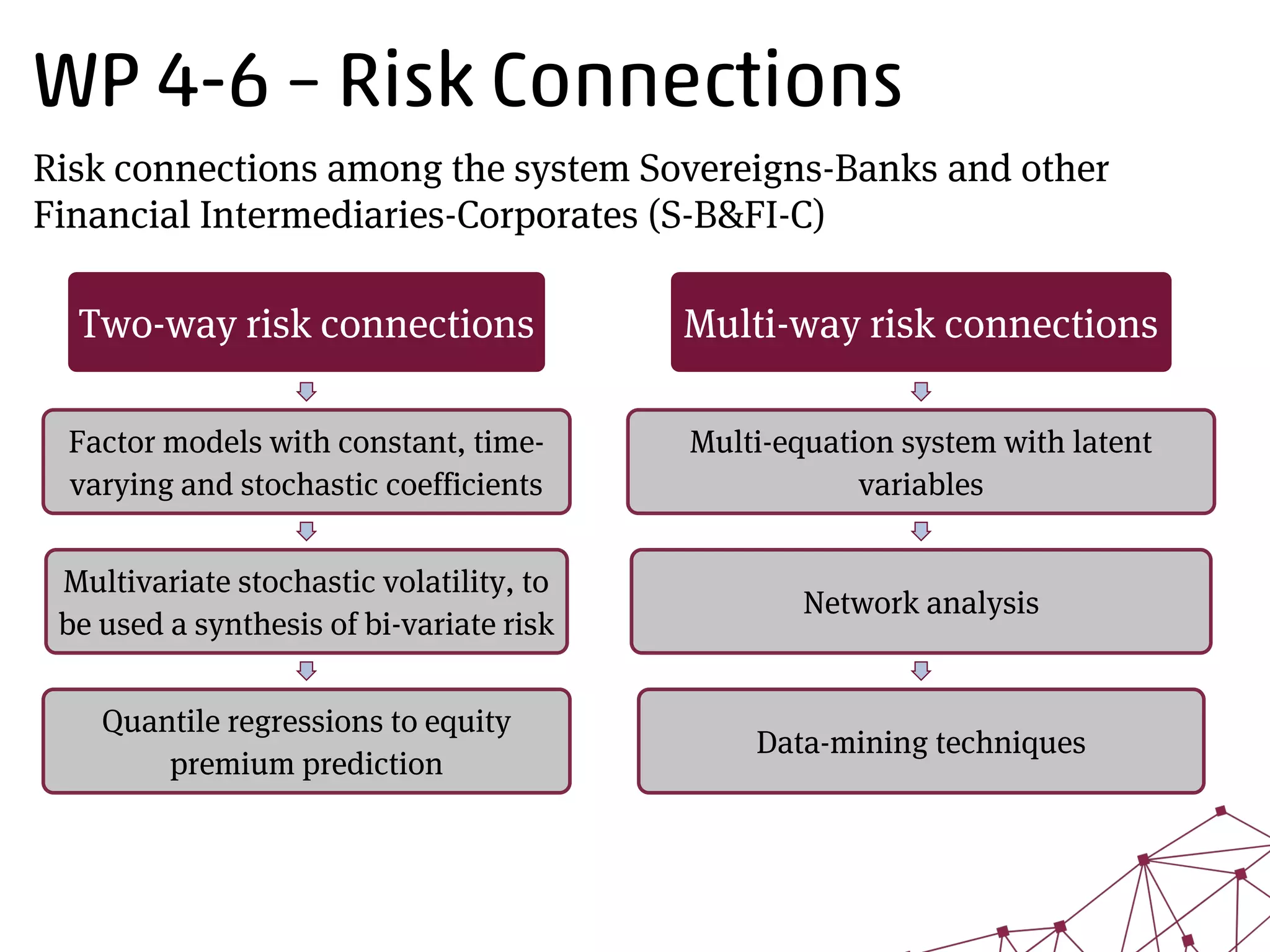

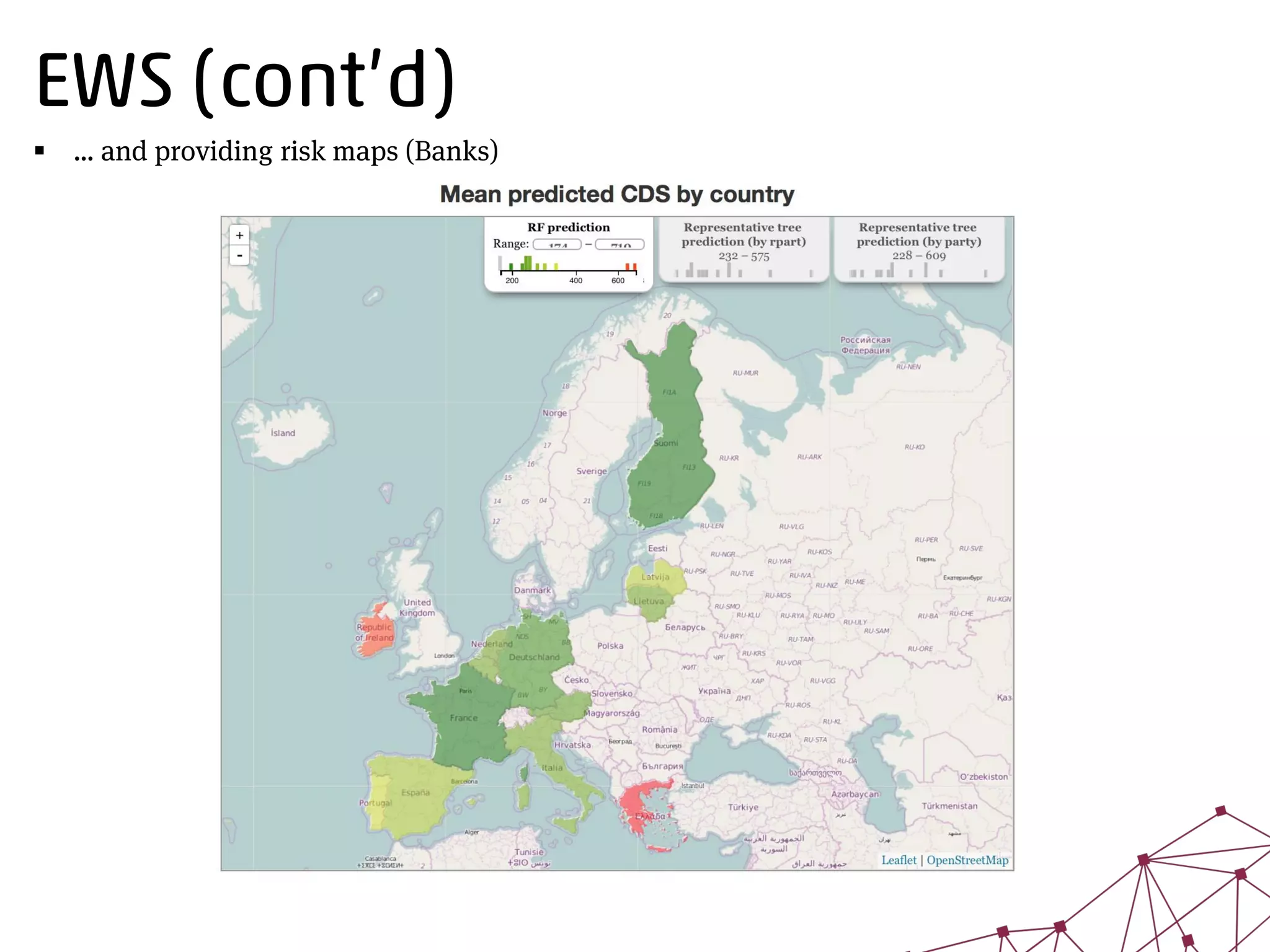

The SYRTO project focuses on understanding systemic risk in financial systems through various measures, indicators, and a structured consortium of European universities. Key objectives include identifying risk signals, measuring their transmission, and proposing policy interventions for better financial stability. The project has produced numerous publications, developed an early warning system, and aims to enhance awareness and preventative strategies against systemic risks.