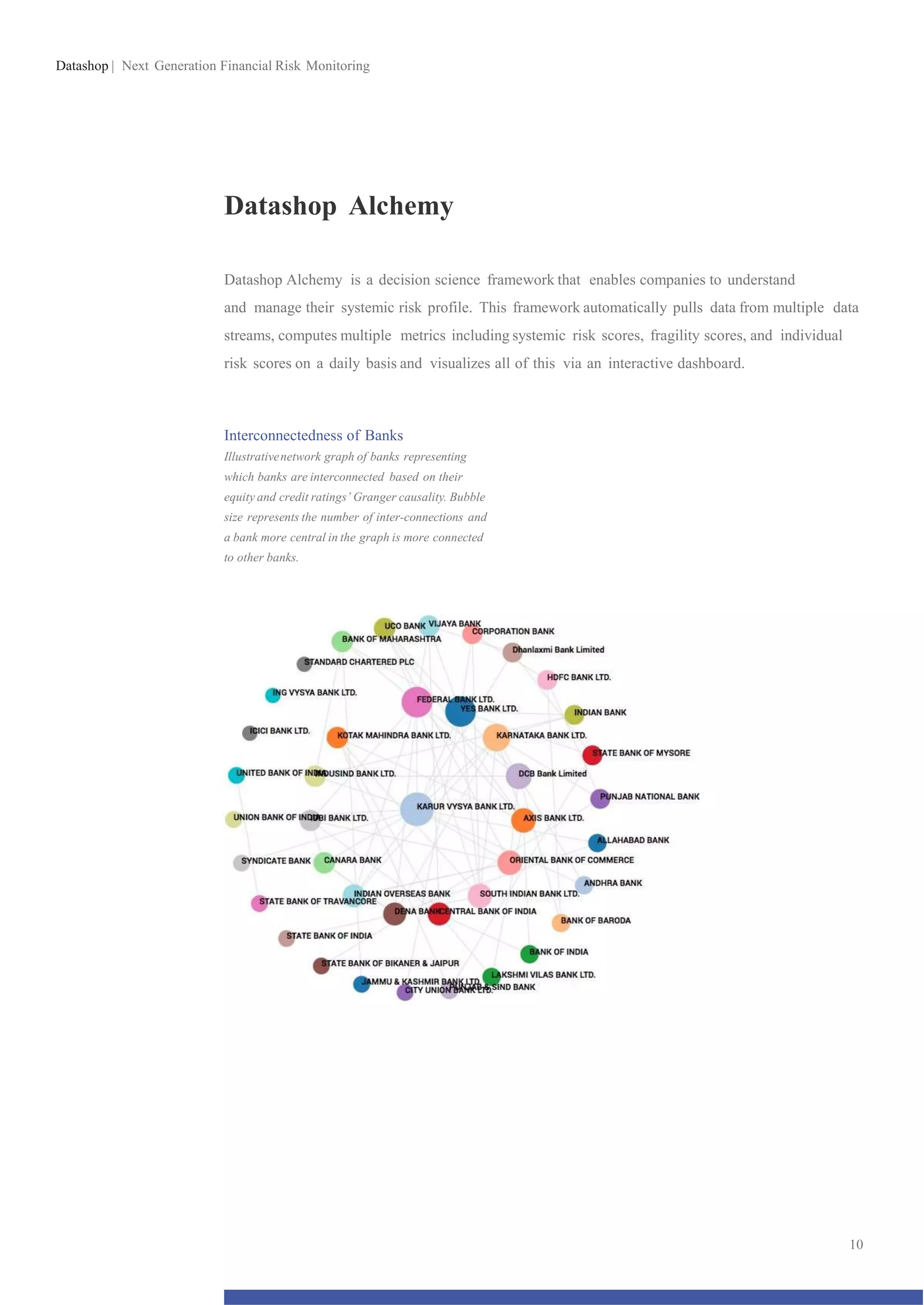

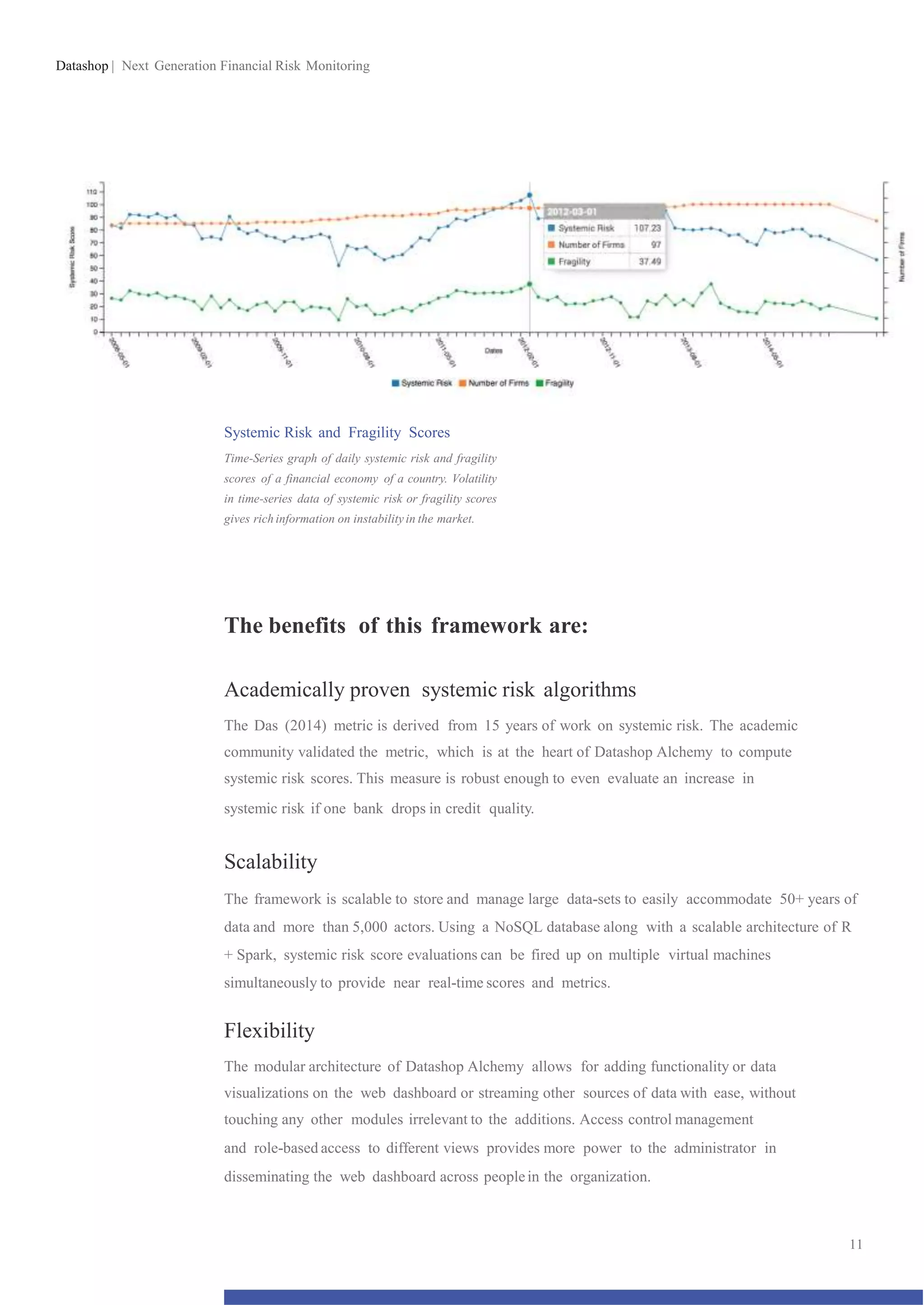

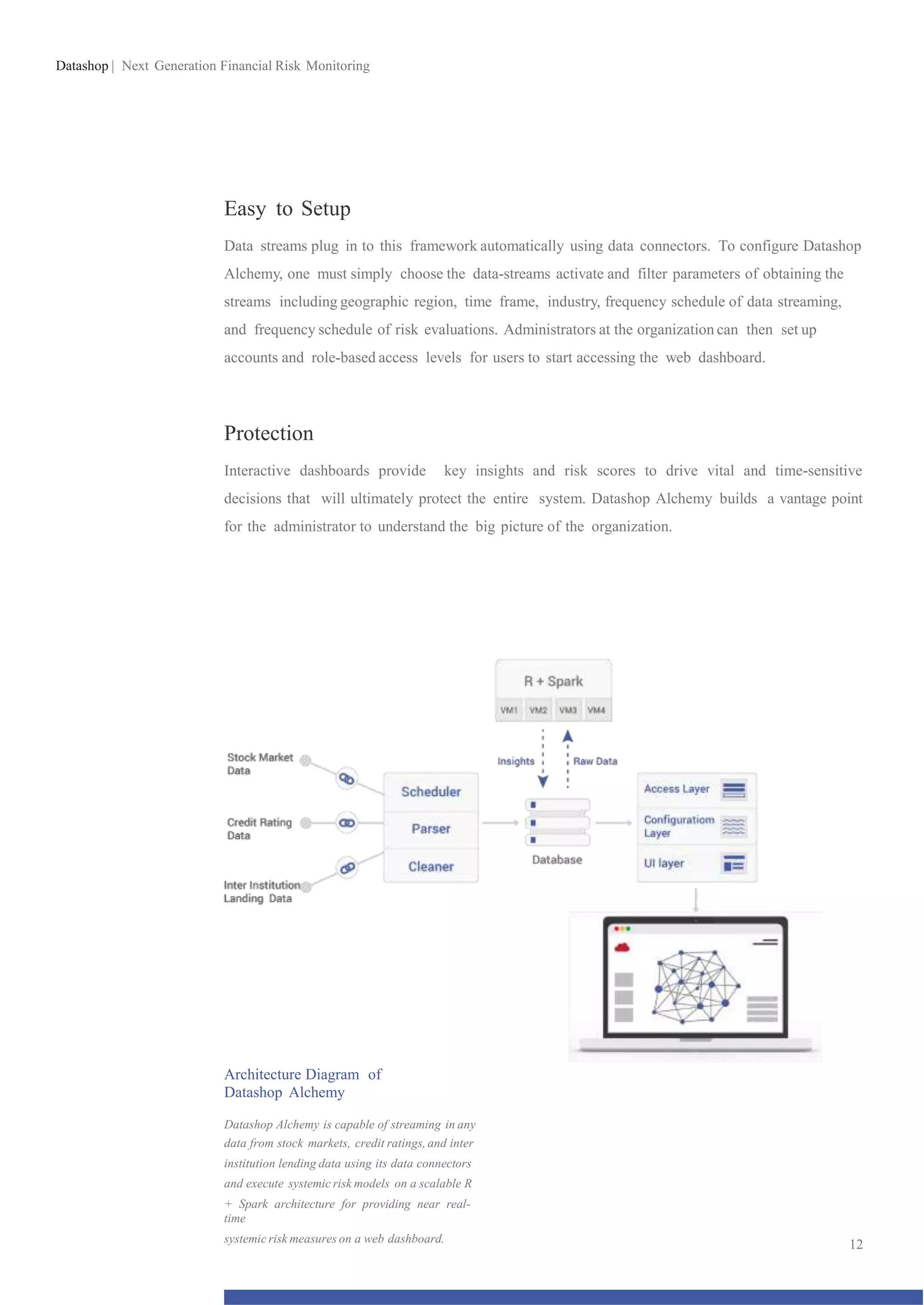

This whitepaper discusses next generation financial risk monitoring using a framework called Datashop Alchemy. It summarizes an approach to measuring systemic risk using interconnectedness between financial institutions and their credit ratings. The framework evaluates daily systemic risk scores using this methodology and visualizes the results. It is intended to help central banks, financial institutions, and other industries monitor systemic risk in their networks to identify risks and support decision making.