Embed presentation

Download to read offline

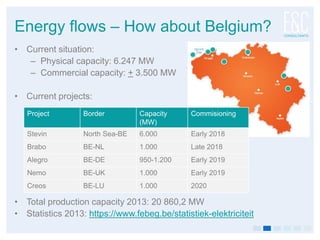

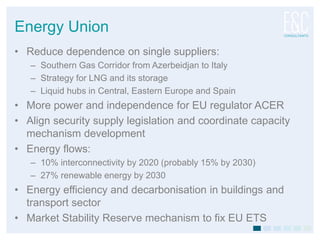

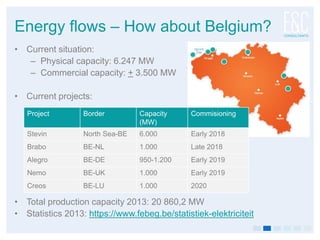

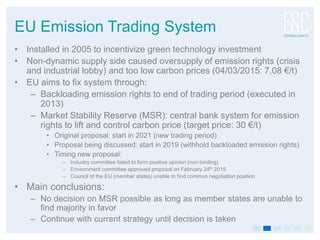

The document discusses the European Union's Energy Union strategy aimed at reducing energy dependence and enhancing energy security through projects like the Southern Gas Corridor and increased interconnectivity. It highlights the EU's goals for renewable energy and the development of a market stability reserve to regulate carbon prices under the EU emissions trading system. Additionally, the document outlines ongoing projects and the challenges faced in achieving consensus among member states regarding emission rights management.