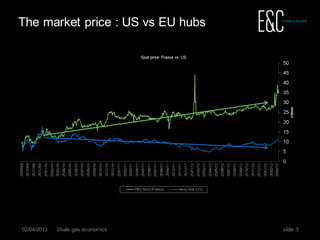

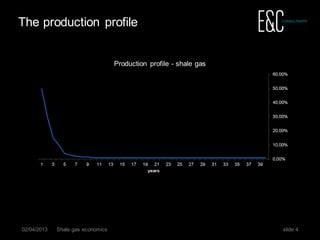

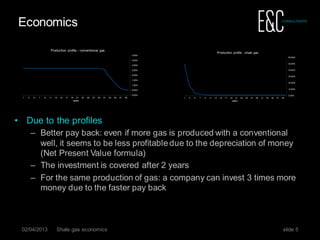

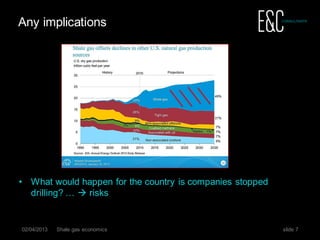

This document discusses the economics of shale gas production in the US. It notes that shale gas wells produce less gas than conventional wells but have similar or higher costs. However, shale gas wells have a faster production decline profile, meaning the investment is recovered more quickly through production. As a result, it is more profitable for companies to continuously invest in new shale gas wells to sustain production levels, despite the ongoing costs. This business model leaves the industry reliant on a high rate of new drilling to offset declines, creating risks if drilling activity decreases.