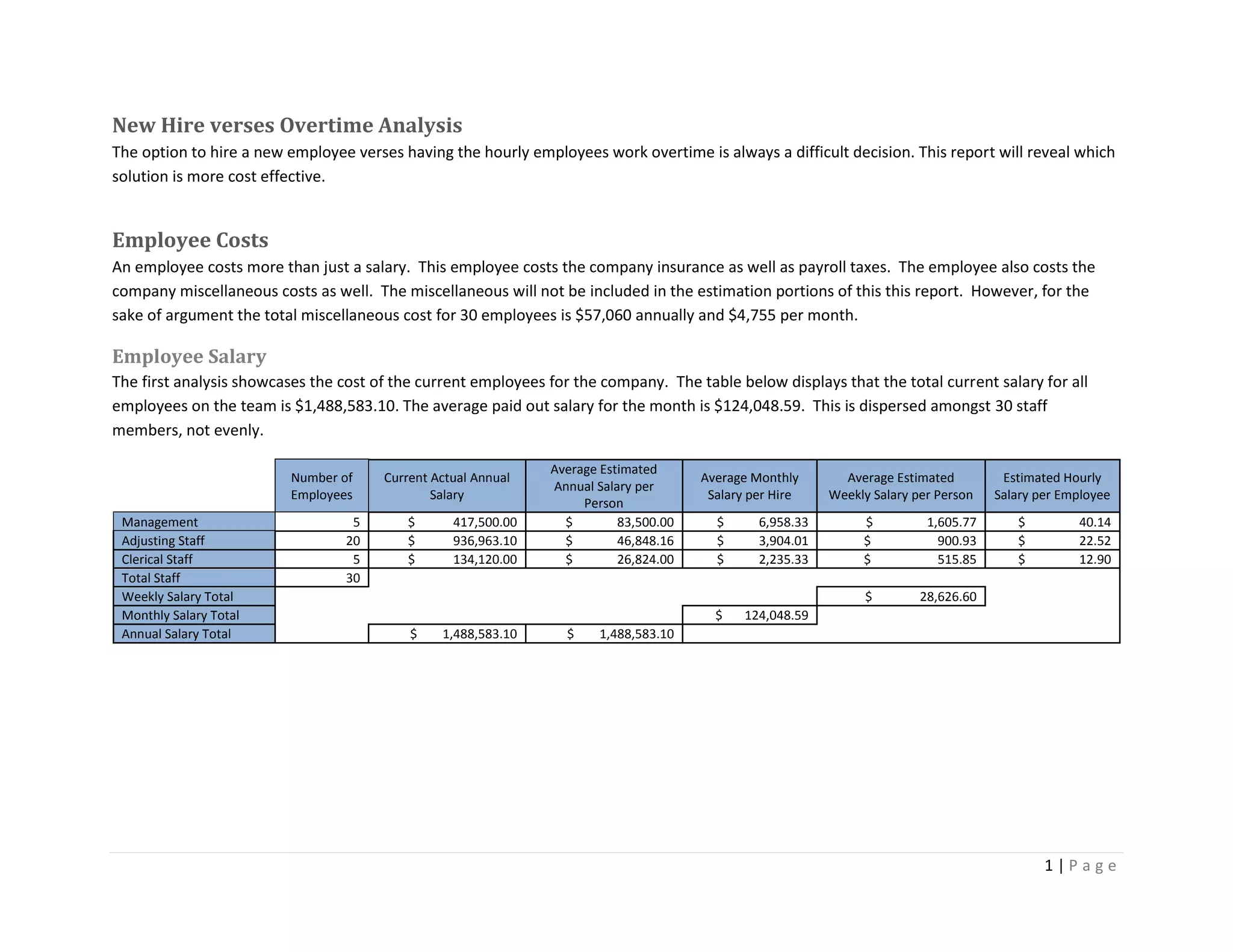

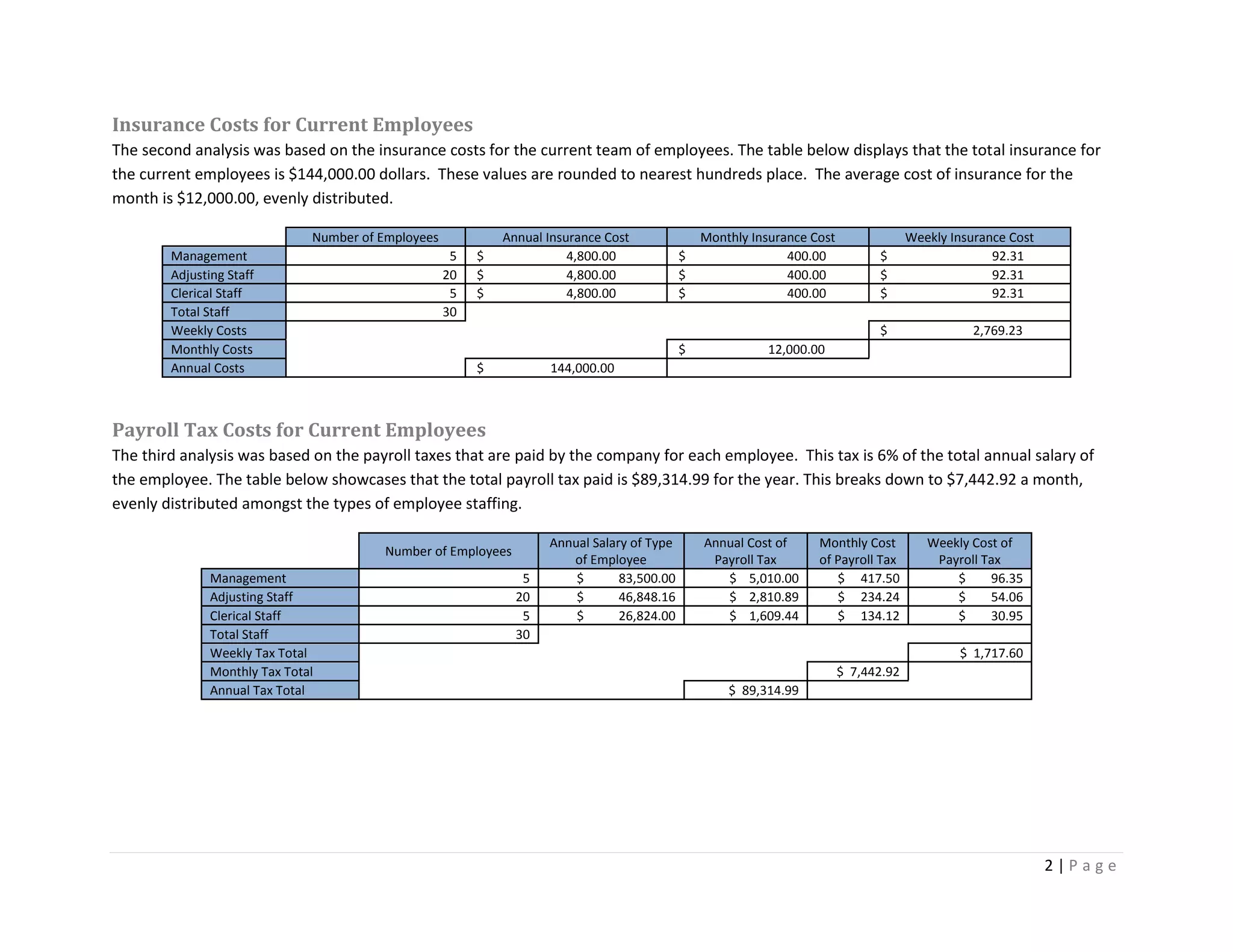

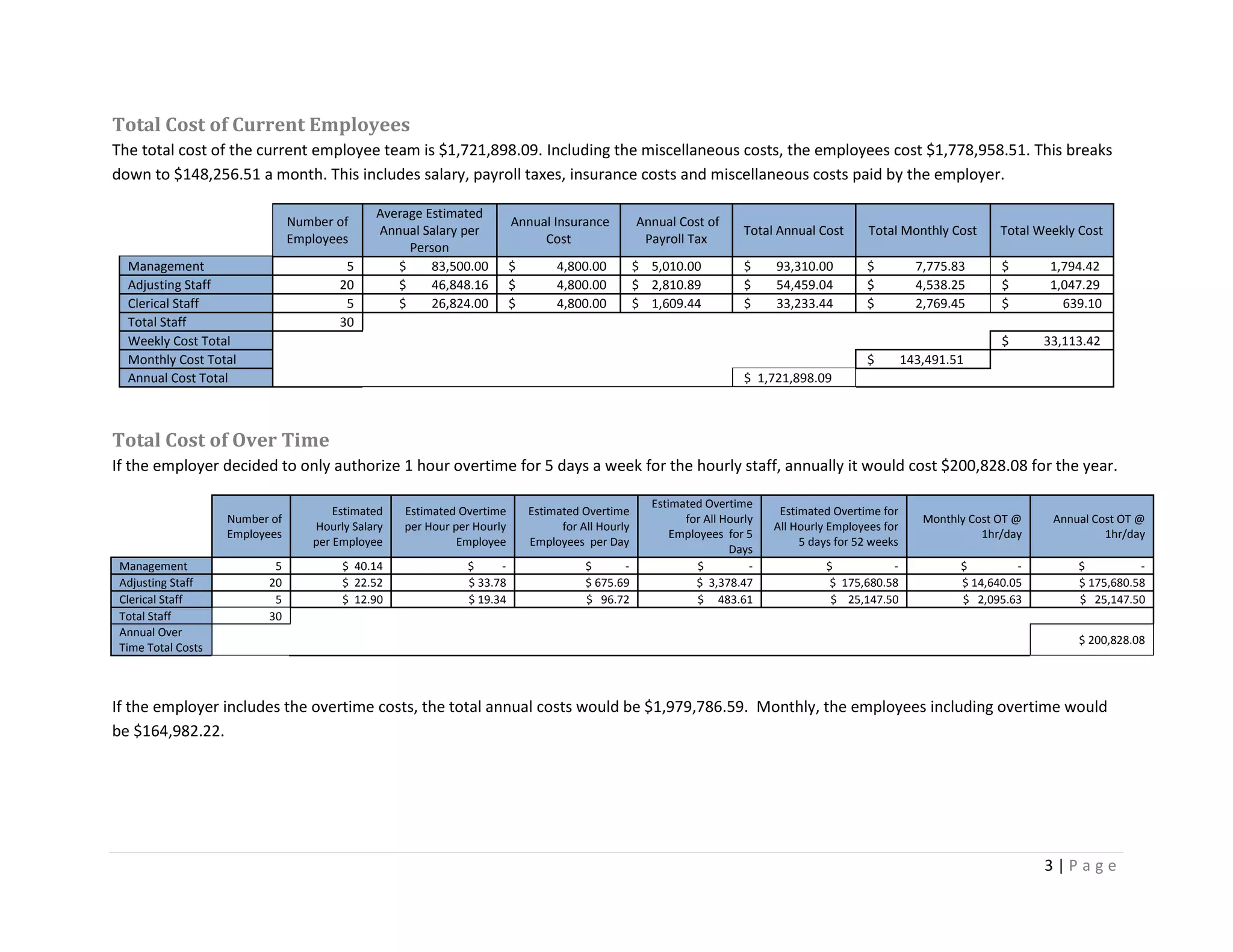

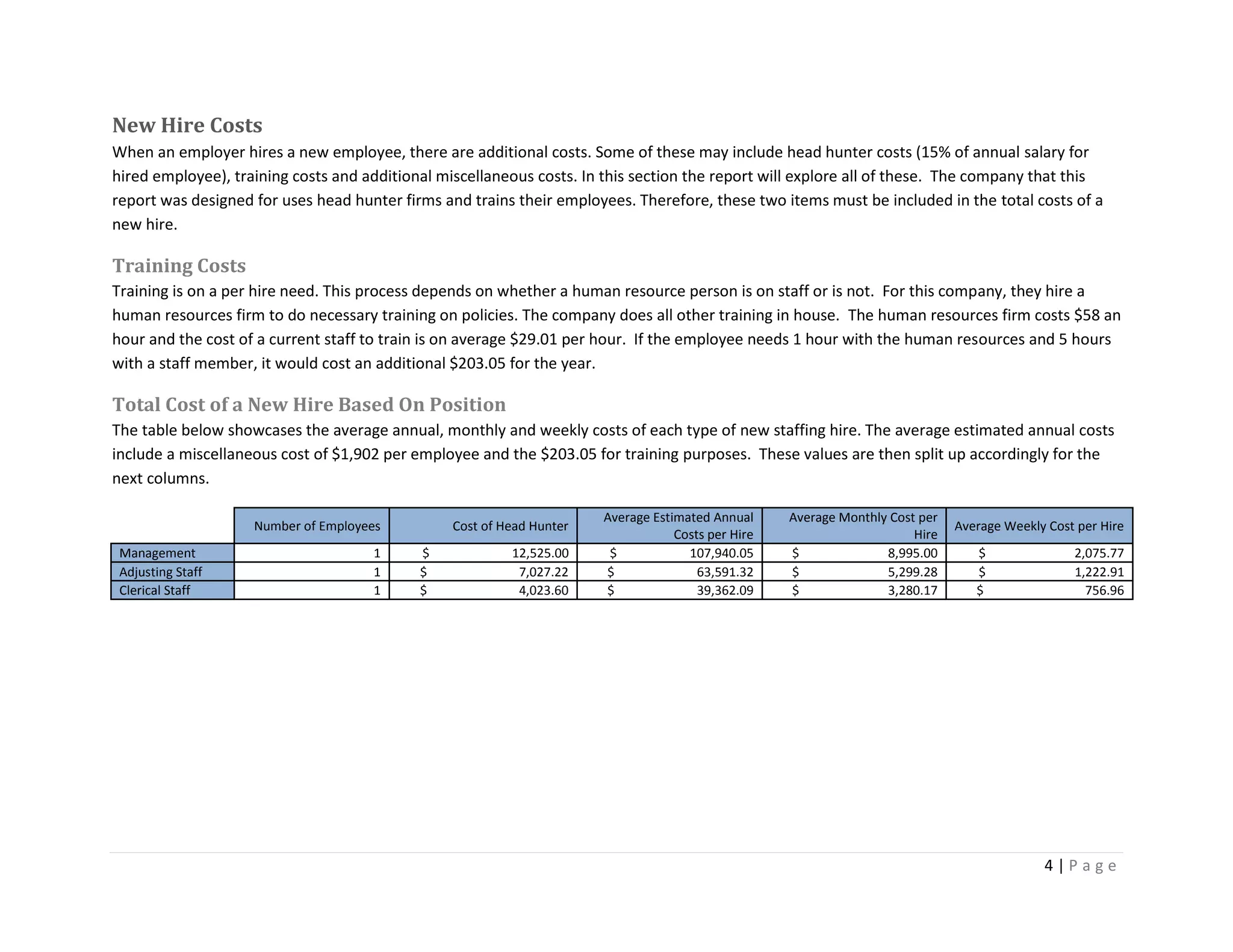

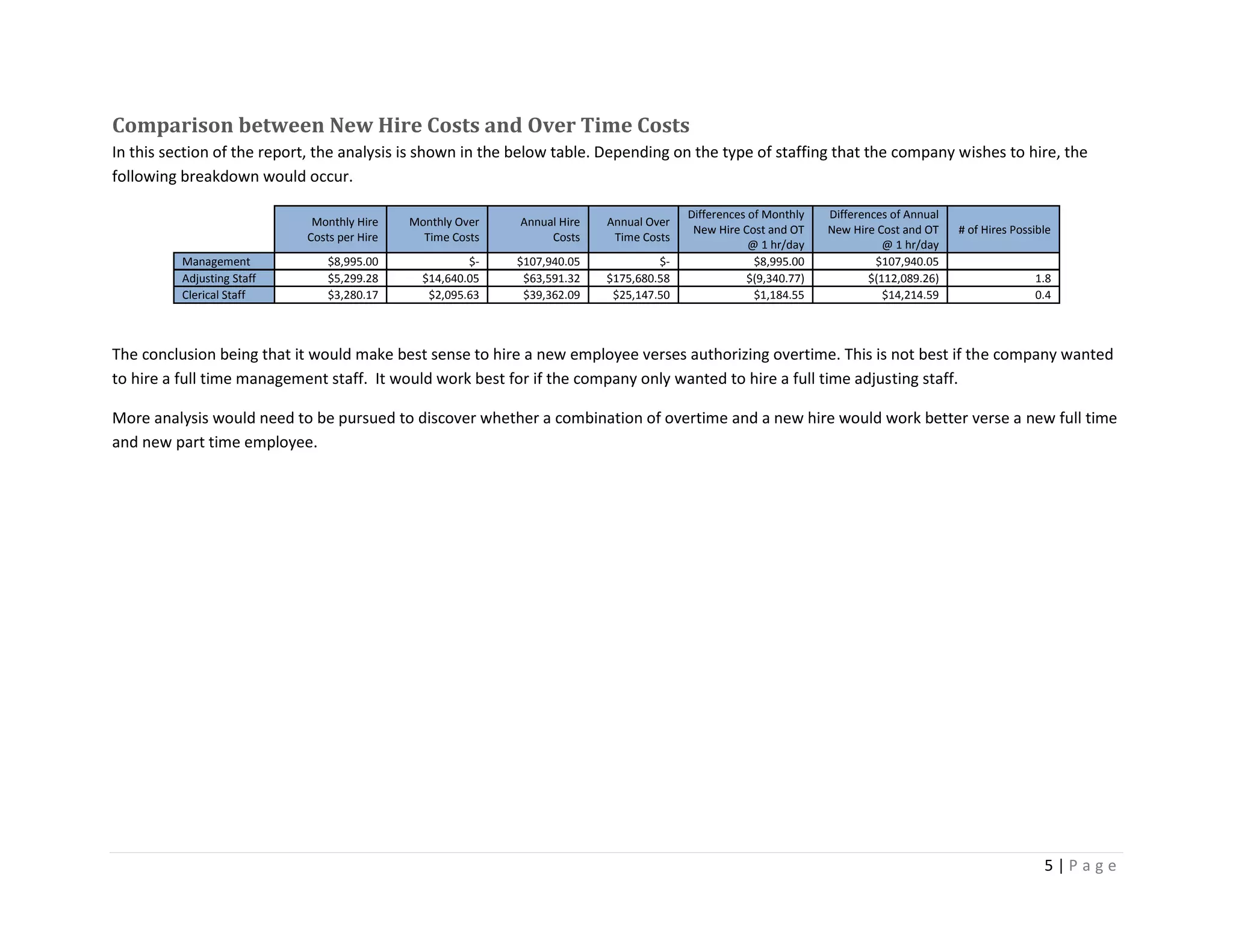

This report analyzes whether it is more cost effective for a company to hire new employees or authorize overtime for current employees over a one-year period. It finds that the total annual cost of current employees through salary, insurance, taxes and other expenses is $1.7 million. Authorizing 1 hour of overtime per day would cost $200,000 annually. Hiring a new employee involves additional headhunter, training and miscellaneous costs. For adjusting staff, hiring 1.8 new employees would be cheaper than authorizing overtime, but hiring management would not be as cost effective as overtime.