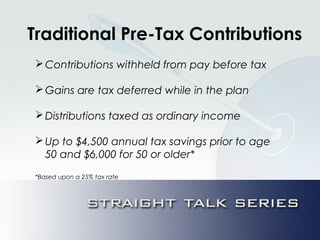

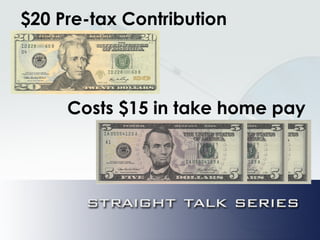

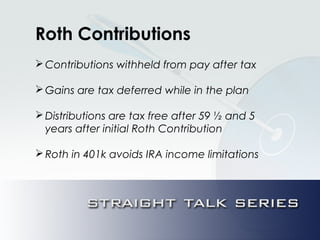

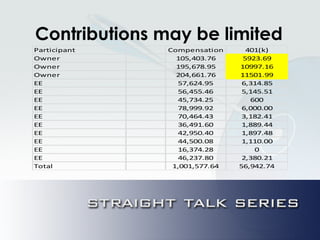

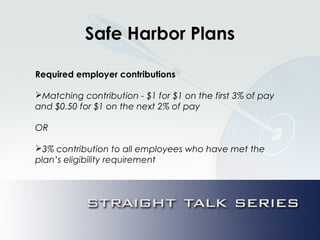

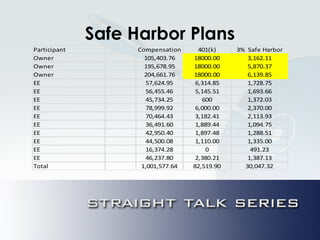

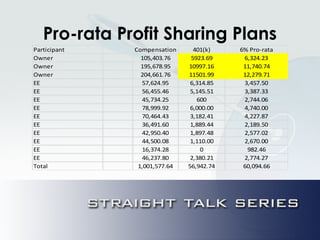

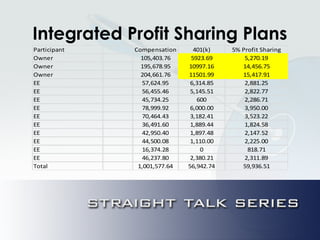

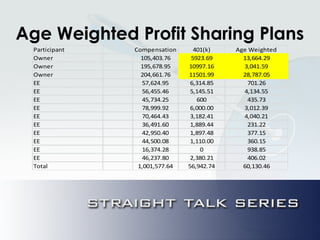

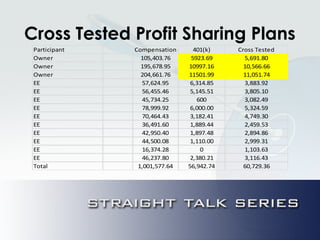

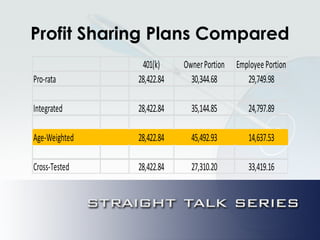

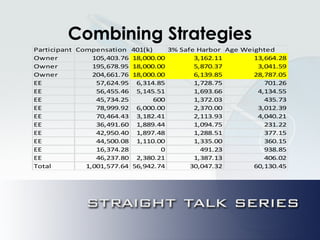

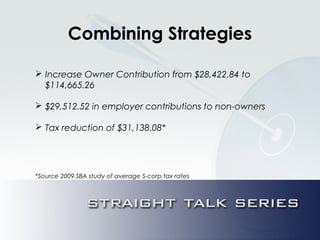

The document outlines strategies for minimizing tax obligations through 401(k) plans, detailing contribution limits and tax benefits for both traditional and Roth contributions. It discusses various profit-sharing plans, including pro-rata, integrated, age-weighted, and cross-tested approaches, emphasizing potential tax savings and employer contributions. The overall conclusion highlights the value of 401(k) plans as effective tax planning tools, allowing business owners to enhance their accounts while benefiting employees.