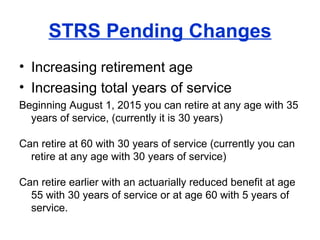

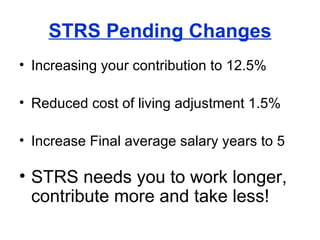

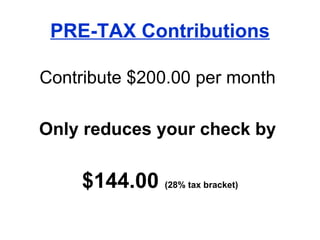

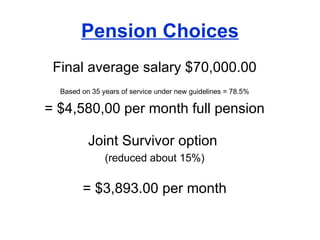

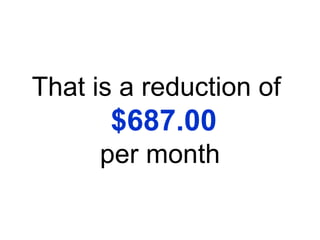

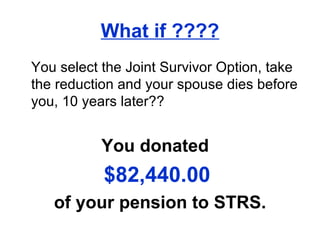

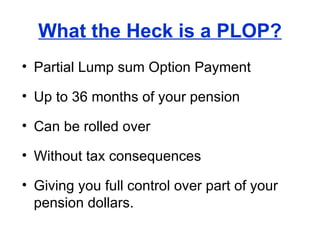

This document discusses retirement planning topics for Ohio STRS pension recipients, including pending changes that will increase retirement ages and contribution amounts while reducing cost of living adjustments. It recommends supplementing a pension with pre-tax contributions to a 403(b) tax-sheltered annuity. Choosing the right investment options like fixed indexed annuities can help maximize gains while avoiding losses. Key decisions like taking the full pension or joint survivor options can significantly impact the amount received. A PLOP allows rolling over a partial lump sum payment without tax consequences.