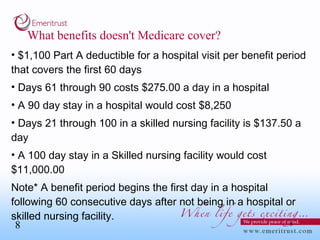

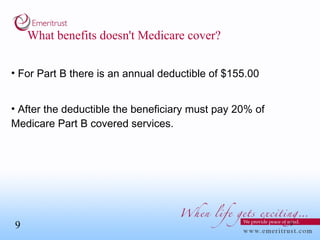

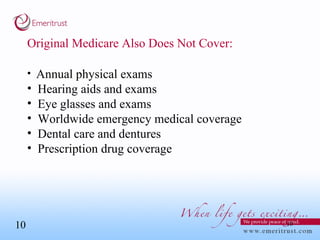

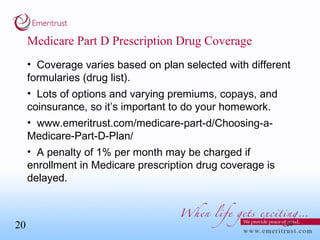

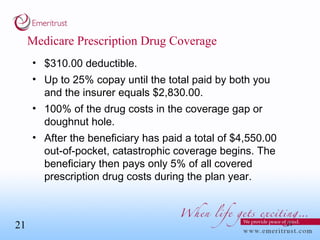

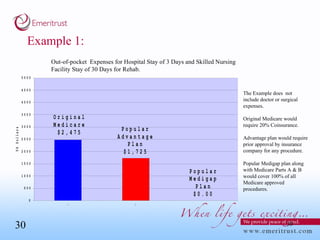

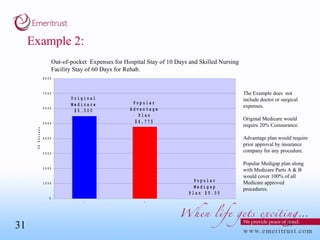

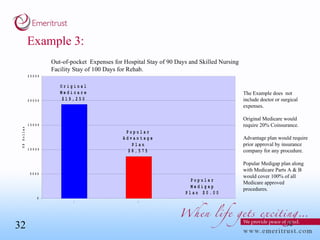

This document summarizes information about Medicare coverage options. It discusses who is eligible for Medicare and what Parts A and B cover. It also describes supplemental plans like Medigap and Medicare Advantage plans, noting their benefits and costs. Examples are provided to illustrate out-of-pocket expenses under different coverage options. The summary concludes that having original Medicare with a Medigap plan and Part D prescription drug coverage provides the most comprehensive coverage at the lowest cost, but a Medicare Advantage plan may also be suitable depending on individual needs and circumstances.