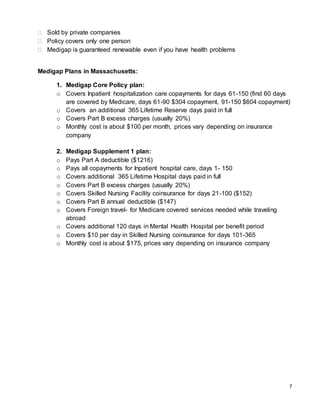

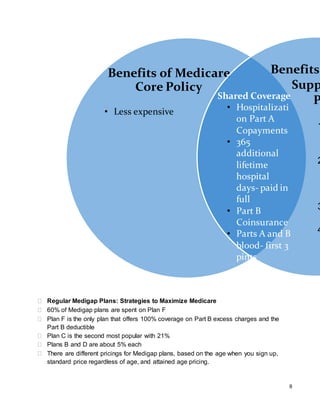

Medicare is federal health insurance for people aged 65 or older. It has different parts that cover various medical costs. Part A covers inpatient hospital stays and skilled nursing facilities. Part B covers outpatient services and has a monthly premium. Part D provides prescription drug coverage. Medicare Advantage plans are an alternative that bundle Parts A, B, and usually D. Supplemental Medigap plans help cover costs like copays and deductibles. Choosing the right Medicare plan requires understanding eligibility, costs, and coverage details for original Medicare versus Medicare Advantage and Medigap options.