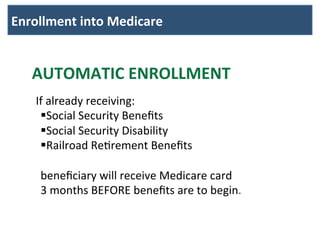

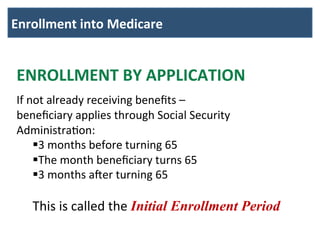

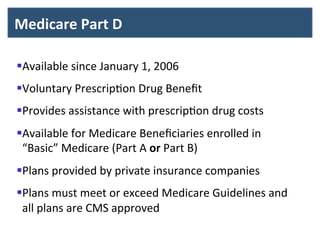

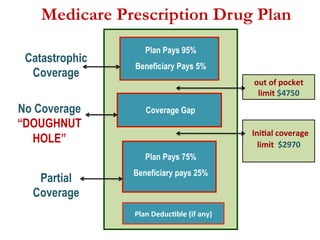

This document provides an overview of Medicare, including what it is, how it works, and enrollment details. Medicare is a federal health insurance program for those aged 65 and older or with disabilities. It has multiple parts that provide coverage for different healthcare areas like hospital stays, doctor visits, and prescription drugs. Individuals are automatically enrolled in Medicare based on other benefits they receive, or they can apply during initial, delayed, or general enrollment periods.