This document provides an overview of Medicare options, including:

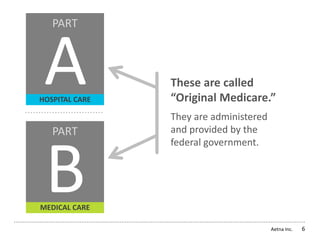

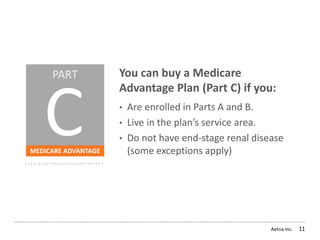

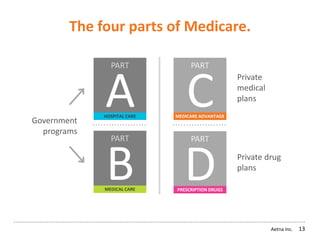

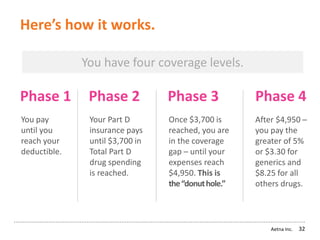

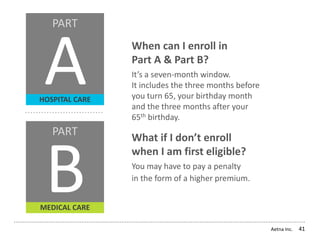

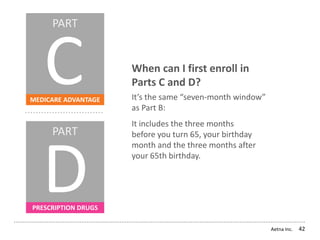

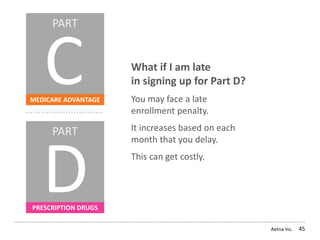

- The four parts of Medicare (A, B, C, D) and what they cover

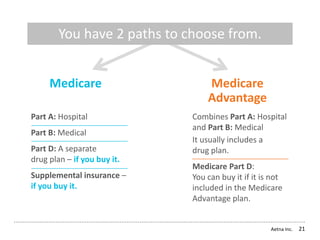

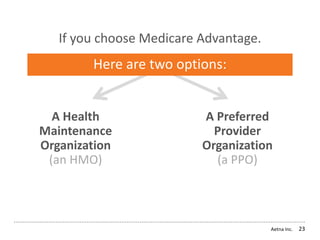

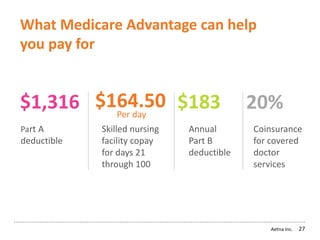

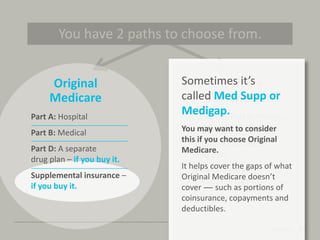

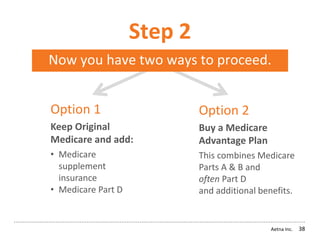

- Choosing between original Medicare or Medicare Advantage plans

- Factors to consider when choosing a plan like costs, doctors, and prescription drug coverage

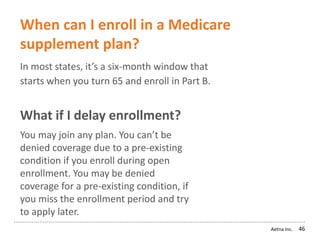

- Enrollment periods for Medicare including an initial 7-month window and annual open enrollment

The document aims to help readers understand their Medicare coverage options and enrollment process.