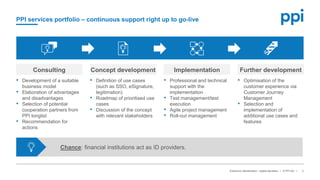

The document outlines the importance of electronic identification (eid) for secure virtual identities in digital workflows, emphasizing the need for transformation from physical to digital identities for user authentication. It describes the services offered by id providers, including single sign-on and online contract execution, while highlighting the role of financial institutions in leveraging AML-compliant customer data. The consulting approach of ppi consulting includes comprehensive support from concept development to implementation and further development of digital services.