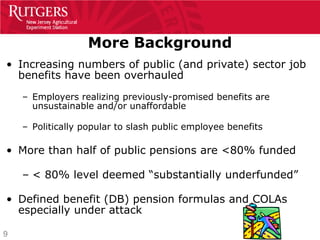

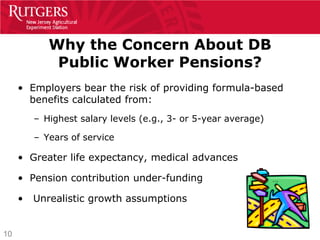

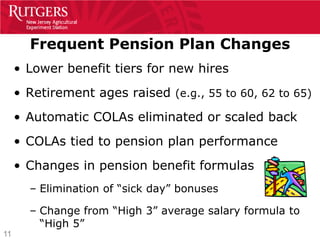

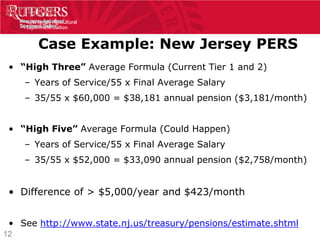

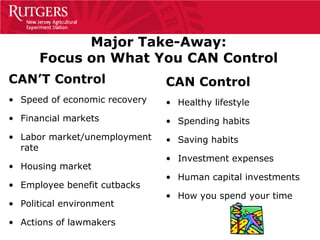

This document discusses how workers can no longer rely on promised income and benefits from their employers. It outlines how many employers have cut or restructured pensions, health benefits, salaries, and other compensation. This represents a shift to a "new normal" with more insecurity. The real cause of anger is that both public and private sector workers have lost pillars of financial support they once took for granted. The document provides advice on ways for workers to cope with these changes, such as saving more, investing more aggressively, spending less, working longer, considering new careers, and focusing on elements of their financial situation they can control.