The document discusses a case study of converting a defined benefit pension plan to a hybrid defined contribution plan. Key points:

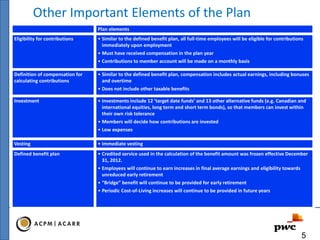

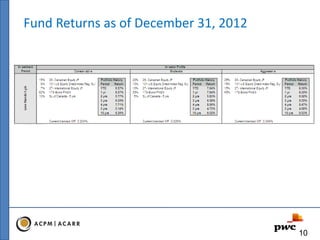

- The hybrid plan design aims to replicate future benefits under a defined contribution plan while preserving early retirement subsidies, bridging benefits, and cost-of-living adjustments from the defined benefit plan.

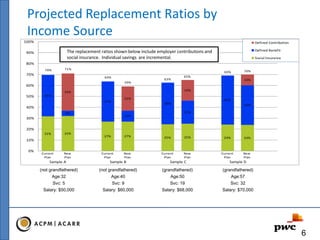

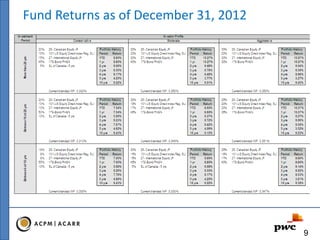

- Employees receive replacement income from three sources: employer contributions to the hybrid plan, individual savings, and social insurance. Target replacement ratios range from 75-85% of pre-retirement income.

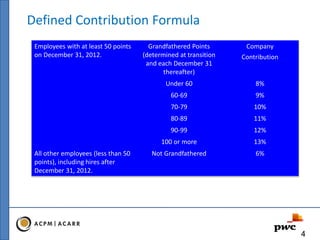

- The hybrid plan provides higher contribution rates for older, longer-serving "grandfathered" employees to make up for less time to accumulate savings compared to younger employees.

- Projected replacement