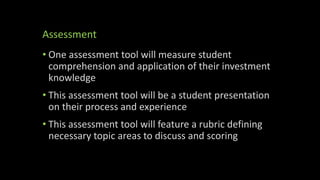

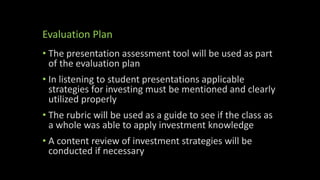

This PowerPoint presentation outlines a curriculum unit on investments for a high school personal finance course. The unit utilizes an investment simulation tool called Wall Street Survivor to have students apply concepts over 10 class periods. Goals and objectives were developed based on Bloom's and Krathwohl's taxonomies to focus on cognitive and affective learning. Instructional strategies involve students participating in the simulation and adjusting strategies based on results. Student learning will be assessed through a presentation rubric evaluating their simulation process, strategies, and experience. The evaluation plan uses this rubric to ensure students properly applied investment knowledge.

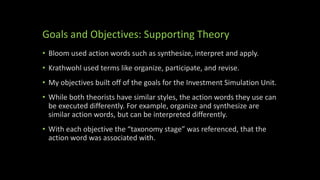

![Goals and Objectives: Objectives

Objectives for 1st Goal

Objective 1: Apply investment and

savings knowledge to make money

within investment simulation.

[Application]

Objective 2: Interpret daily

results/earnings to adjust daily

investment strategy as needed.

[Comprehension]

Objectives for 2nd Goal

Objective 1: Participate in an

individual simulation, problem solving

activity. [Responding Stage]

Objective 2: Revise judgments and

behaviors within the simulation tool

based on previous results when using

simulation tool. [Characterization Stage]](https://image.slidesharecdn.com/edf8289marinoppt-221103201817-e70b76c3/85/EDF-8289-Marino-PPT-pptx-8-320.jpg)

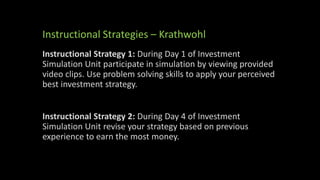

![Instructional Strategies – Bloom

Instructional Strategy 1: During Day 1 of Investment

Simulation Unit apply investment strategy comprehension by

completing the following tasks: short sell a stock, hold a stock,

and purchase a less volatile investiture [bond, CD, etc.].

Instructional Strategy 2: During Day 4 of Investment

Simulation Unit interpret three previous days’ results and

adjust to one strategy you think will earn the most money.](https://image.slidesharecdn.com/edf8289marinoppt-221103201817-e70b76c3/85/EDF-8289-Marino-PPT-pptx-10-320.jpg)

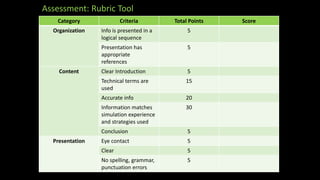

![Evaluation Plan: Continued

• The simulation practice and presentation

assessment allowed for achievement of all learning

goals, objectives, and instructional strategies.

• Assessments allowed them [students] to articulate

their investment knowledge and how they applied

it during the unit.

• The rubric may need to be more clearly defined in

the future.](https://image.slidesharecdn.com/edf8289marinoppt-221103201817-e70b76c3/85/EDF-8289-Marino-PPT-pptx-15-320.jpg)