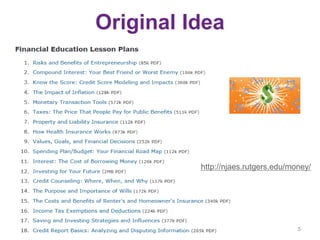

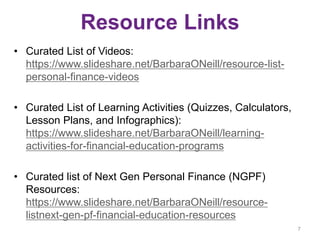

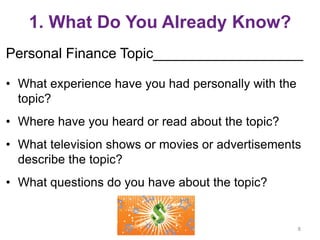

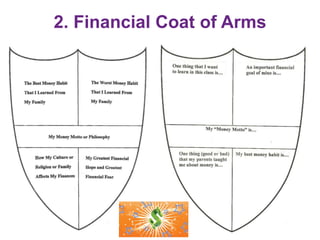

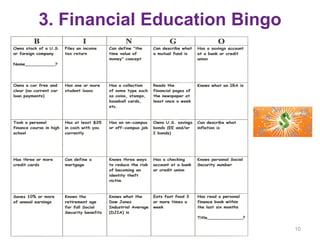

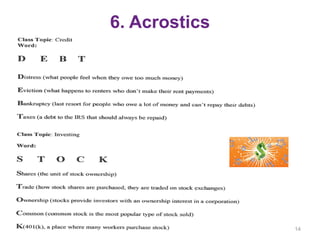

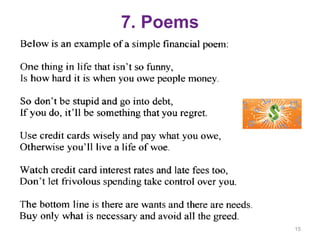

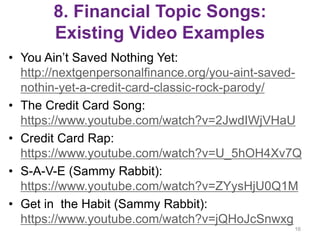

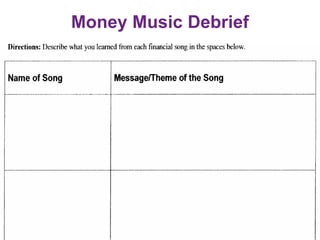

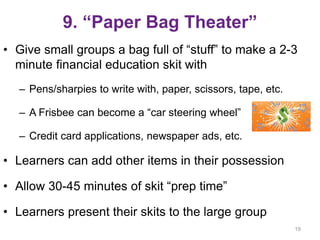

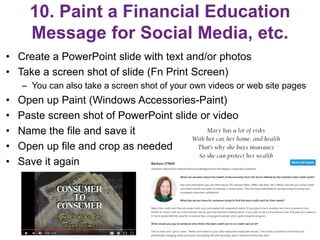

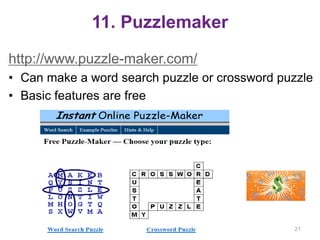

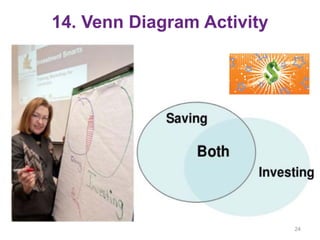

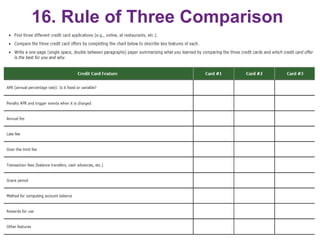

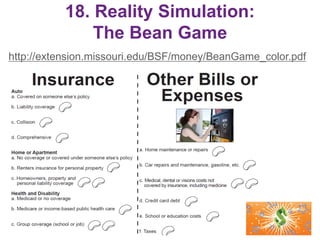

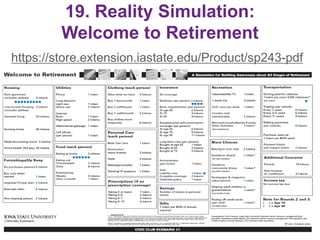

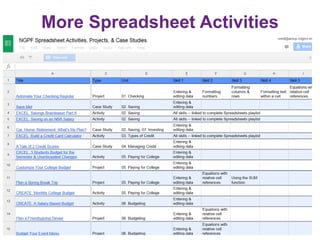

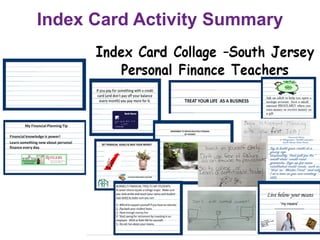

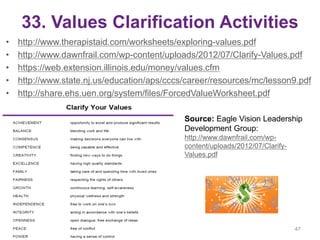

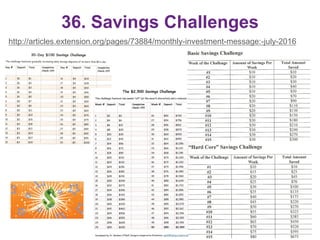

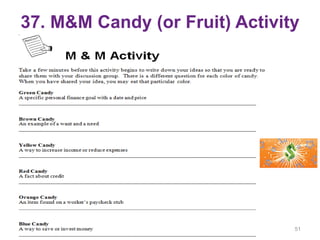

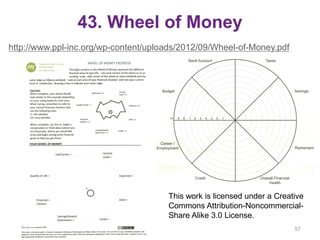

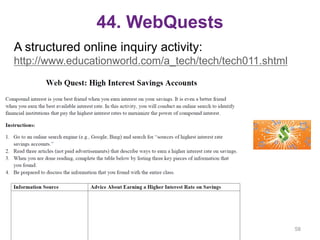

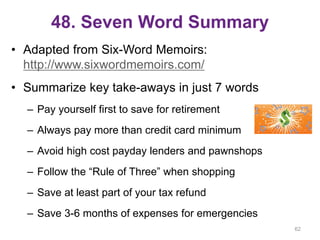

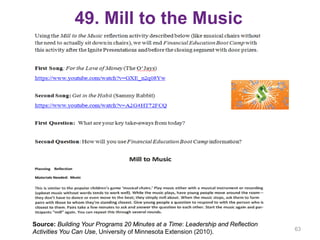

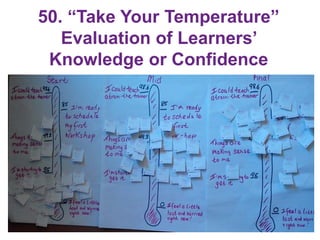

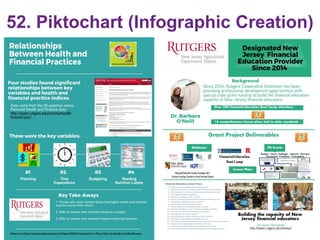

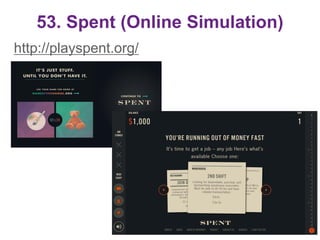

This document provides a summary of 55 interactive personal finance learning activities that were reviewed and curated by Barbara O'Neill, a financial education specialist. Some of the activities described include financial coat of arms, bingo, Jeopardy-style games, creating videos or songs about financial topics, case studies, simulations, quizzes, and activities to explore values and risk tolerance. The goal is to share effective personal finance educational resources and allow participants to discuss which activities they find most useful.