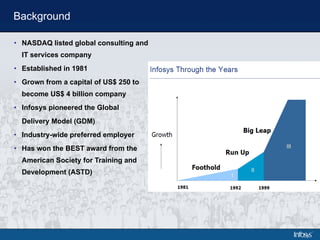

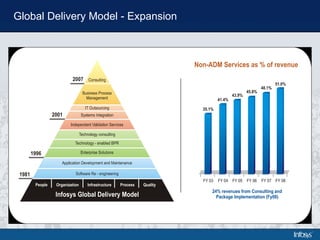

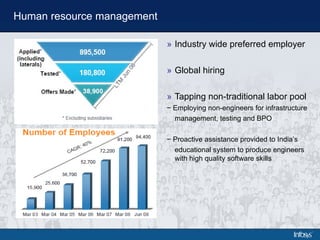

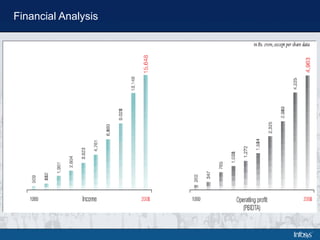

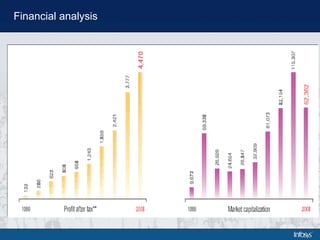

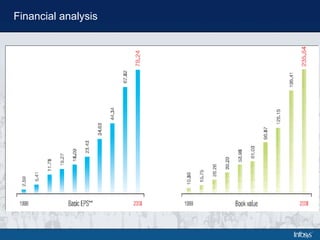

- Infosys is a global consulting and IT services company founded in 1981 that pioneered the Global Delivery Model. It has grown from $250 to $4 billion in revenue and is a preferred employer known for its innovative business models.

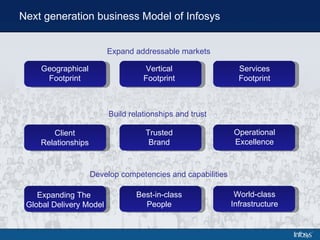

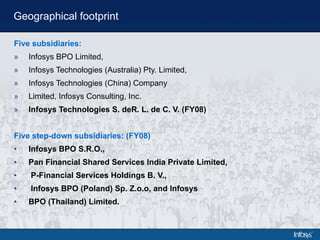

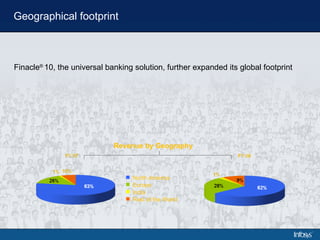

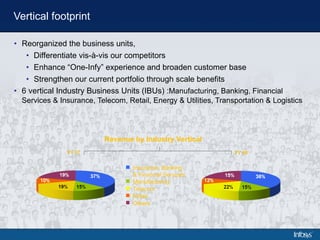

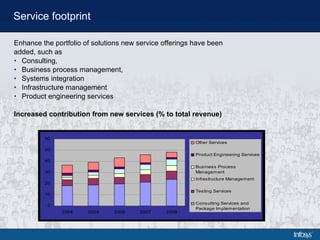

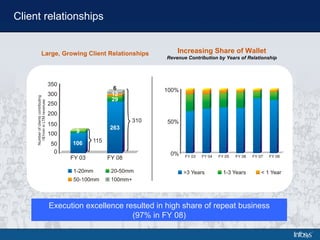

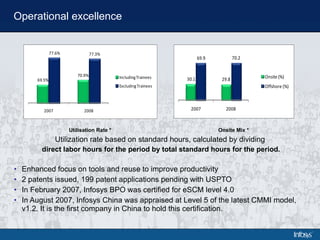

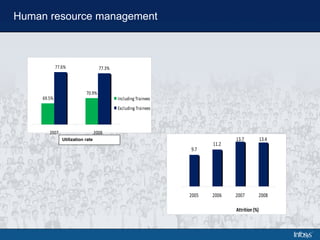

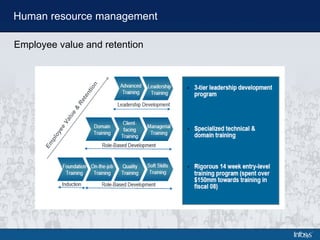

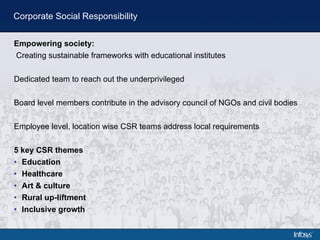

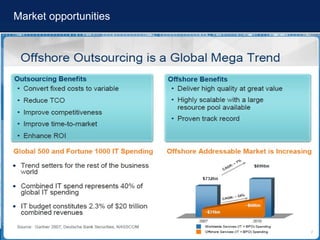

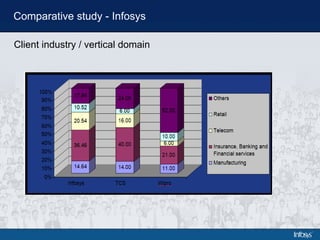

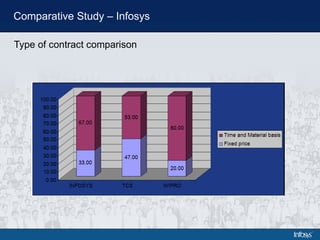

- Infosys has expanded its geographical and vertical footprint through subsidiaries and new service offerings like consulting, business process management, and systems integration. It focuses on operational excellence, talent retention, and a trusted brand.

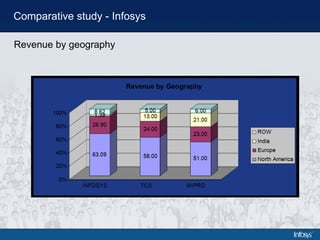

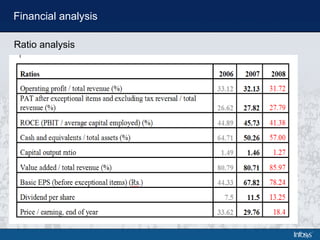

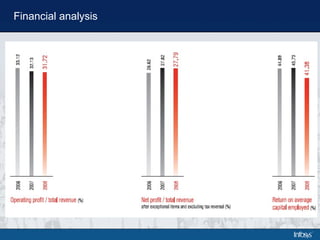

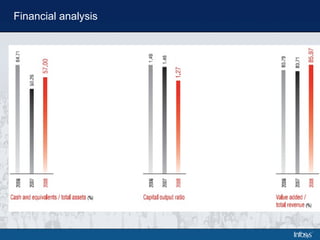

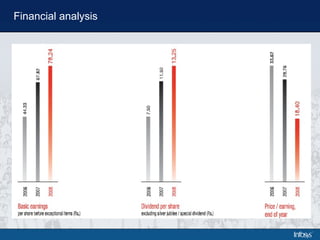

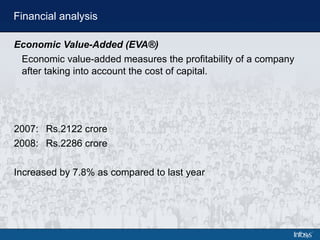

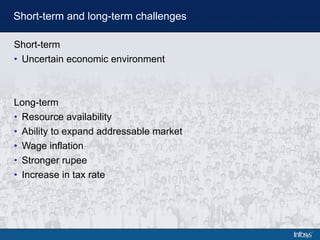

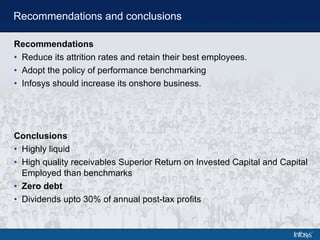

- While Infosys faces short-term challenges from economic uncertainty and long-term challenges around resources and market expansion, it has strong financials with high liquidity, quality receivables, and superior returns. It aims to reduce attrition and benchmark performance.