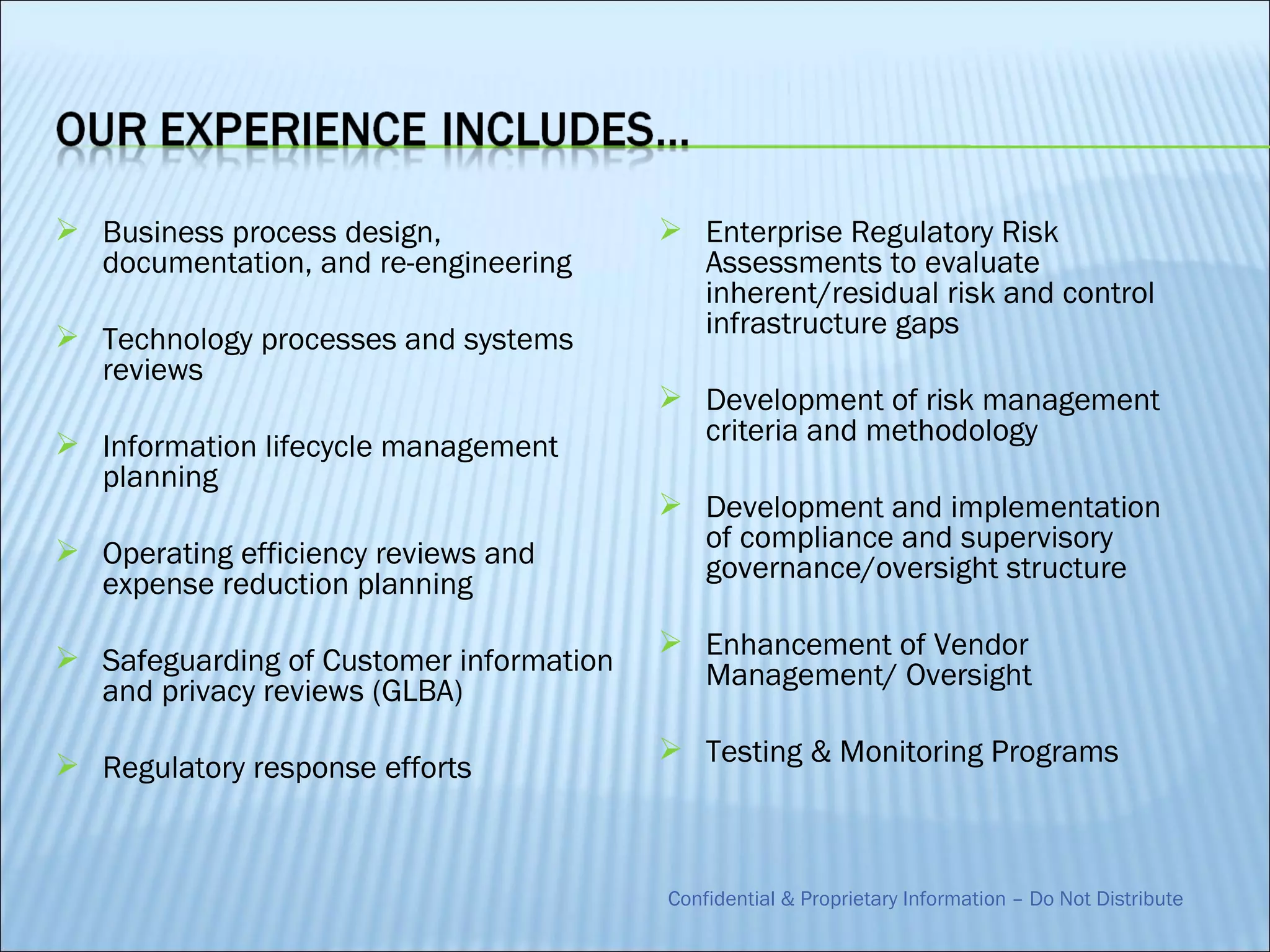

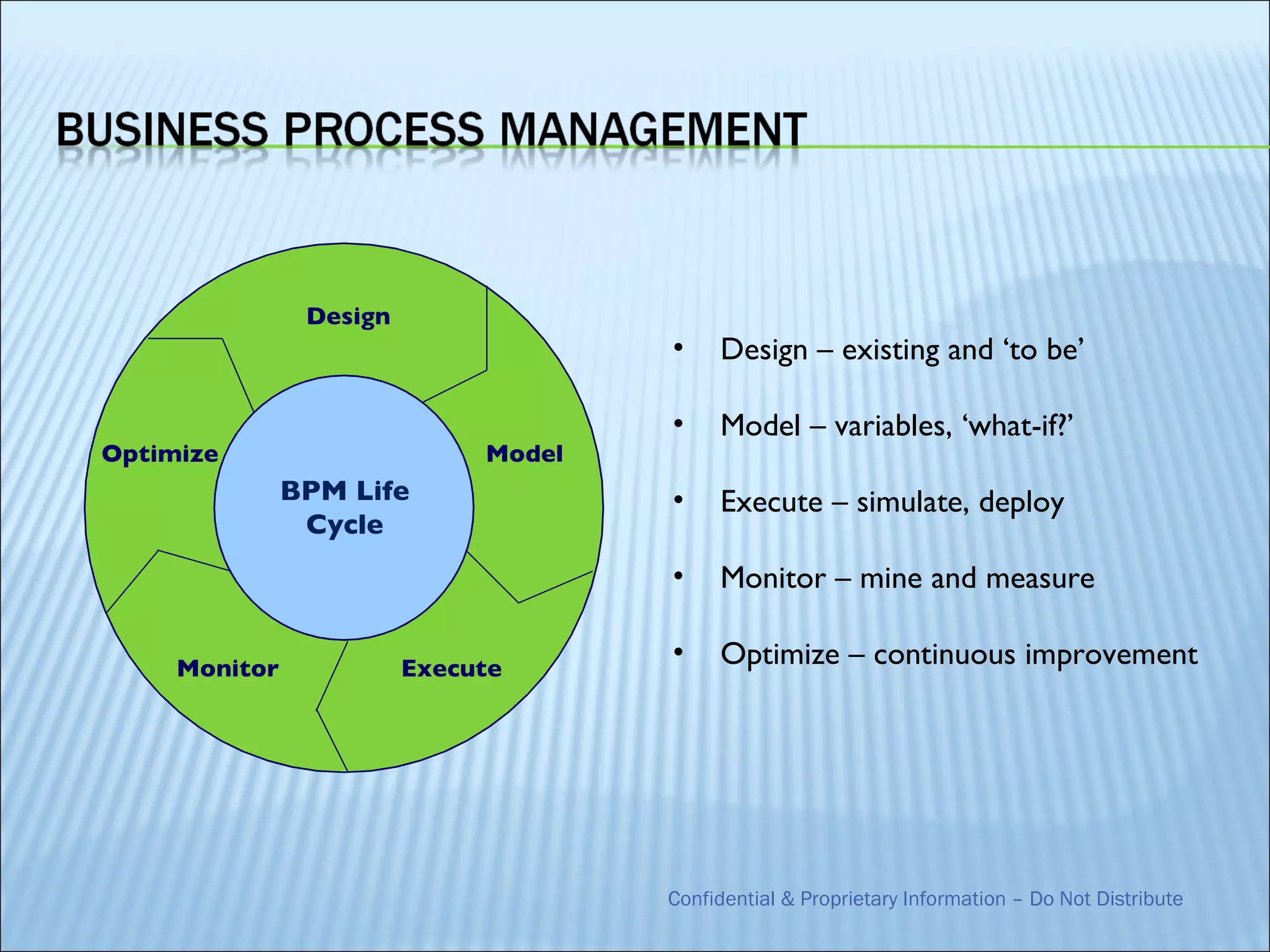

EnTrust Consulting Group provides management consulting services to financial services clients in areas like strategy, performance, technology, operations, and risk management. Their professionals are experienced executives from financial services who help clients address challenges in growing and managing their business. EnTrust helps clients with initiatives like revenue generation, regulatory compliance, business process improvement, and change management. They have worked with major companies across banking, insurance, and asset management.