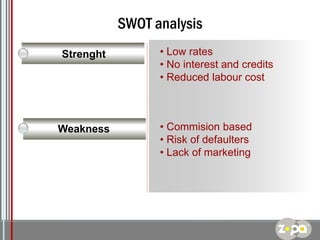

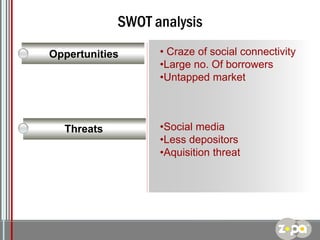

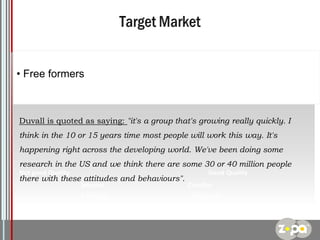

This document provides information about the online social lending service Zopa. It launched in 2005 and acts as a middleman, connecting borrowers and lenders directly. Zopa offers low-rate loans starting at £1,000 to £15,000. It uses a peer-to-peer lending model where individuals register and lend to others. Zopa also utilizes search engine marketing and relies on word-of-mouth recommendations as its main marketing strategies. A SWOT analysis identifies strengths like low rates and reduced costs, but also weaknesses like potential defaults and a lack of marketing. Opportunities exist in untapped markets and connectivity, but threats include competition and a lack of depositors.