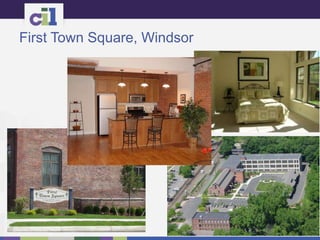

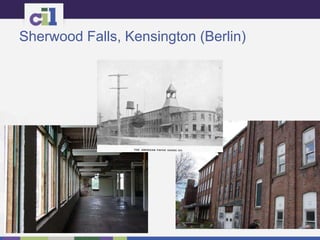

The document summarizes two projects developed by Corporation for Independent Living (CIL) using tax increment financing (TIF):

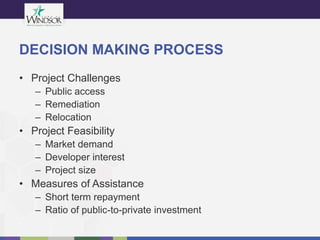

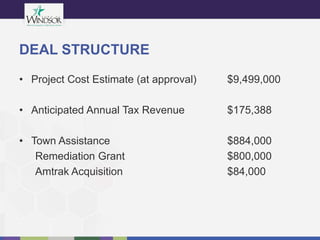

1) First Town Square in Windsor, CT involved renovating a historic but vacant building. TIF helped cover the project's $884,000 funding gap. The project preserved the building, leveraged private investment, and expanded the town's tax base.

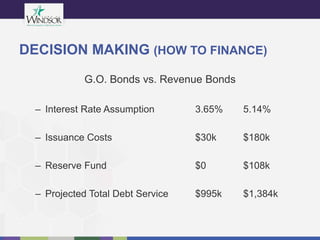

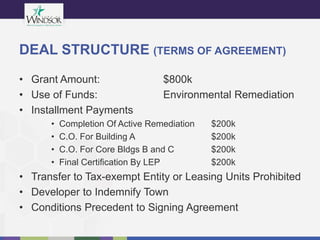

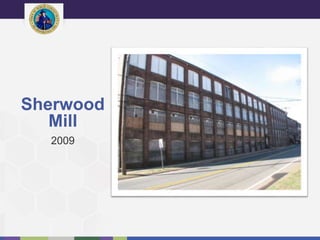

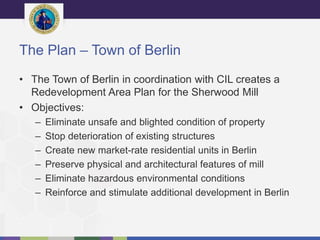

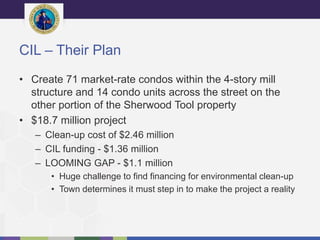

2) The Lofts at Sherwood Falls in Berlin, CT converted an abandoned mill into housing. Berlin provided $1.1 million in bonds to cover environmental cleanup costs, justified by the project increasing Berlin's tax revenue. The completed project includes 85 condo units that have increased Berlin's tax assessments. Both projects showed how municipalities and