1) The document discusses e-invoicing and measures to guarantee the authenticity and integrity of invoices from the perspective of businesses.

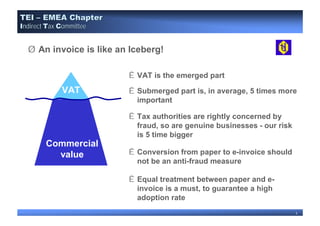

2) It provides an overview of the Tax Executives Institute (TEI) and notes that while VAT makes up the visible part of an invoice, the commercial value submerged below is on average 5 times more important.

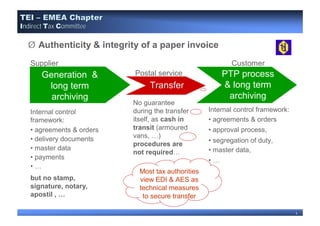

3) The chairman argues that converting from paper to e-invoices should not be an anti-fraud measure and that equal treatment between paper and e-invoices is needed for high adoption.