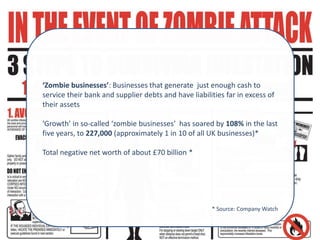

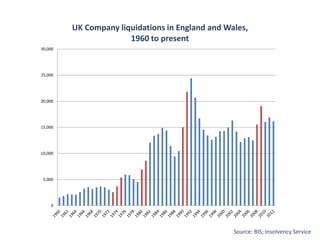

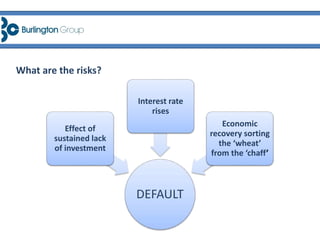

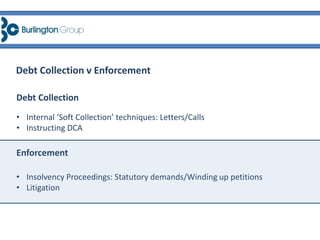

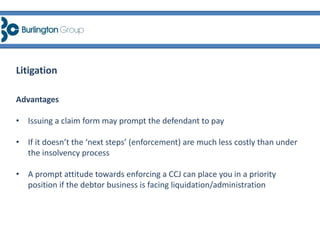

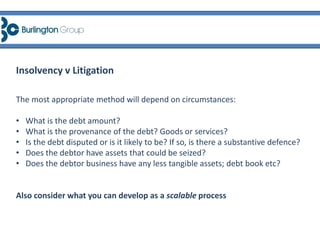

This document summarizes strategies for robust debt collection, including the use of statutory demands, insolvency procedures, litigation, and enforcement options. It notes that the number of "zombie businesses" with liabilities exceeding assets has increased significantly in recent years. When traditional debt collection fails, options like statutory demands, litigation to obtain judgments, and enforcement of judgments through means like High Court enforcement officers seizing business assets can help creditors prioritize recovery. The key is pursuing these strategies before other creditors to get repaid first.