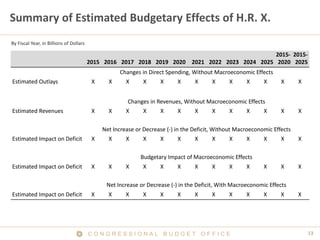

The document outlines the Congressional Budget Office's (CBO) new requirements to incorporate macroeconomic effects into legislative cost estimates for bills estimated to have large budgetary impacts. It describes CBO's models and approaches for estimating both short-term effects on economic output and long-term effects on potential output from changes in fiscal policies. The document also provides details on how CBO analyzes factors like demand multipliers, labor supply responses, investment effects, and more.