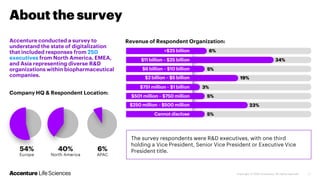

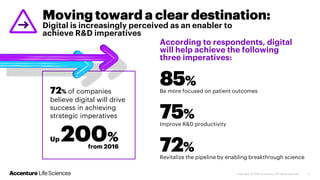

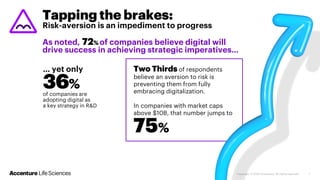

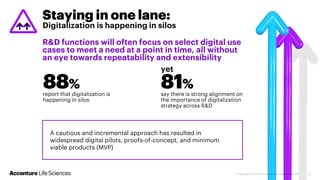

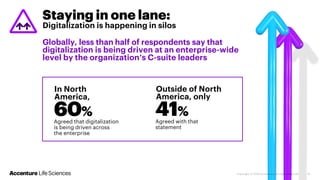

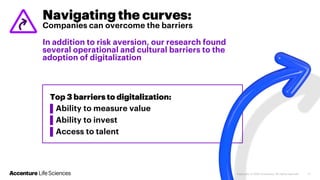

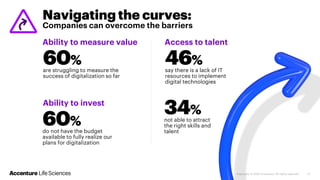

Accenture's survey on digitalization in biopharma R&D reveals that while 72% of executives believe digital will enhance strategic success, risk aversion hampers broader adoption, with many companies operating digital initiatives in silos. Key opportunities identified include utilizing real-world data and fostering open collaboration to improve R&D outcomes. To overcome barriers and accelerate digitalization, companies should prioritize it strategically, assess cultural readiness, foster collaboration, embrace iterative testing, and establish clear success metrics.