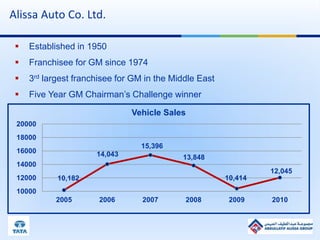

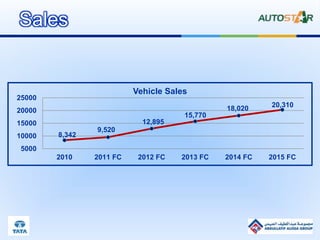

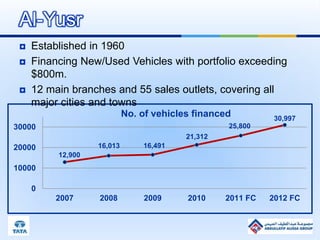

Alissa Group presented to TATA Motors about potential business opportunities in Saudi Arabia's automotive sector. Alissa Group is a major automotive company in Saudi Arabia with over 60 years of experience and dealerships representing brands like GM, Isuzu, and multi-franchise sales. The Saudi automotive market is growing significantly and expected to continue rising through 2015. Alissa expressed that a strategic alliance with TATA Motors could deliver strong mutual benefits by expanding both companies' presence in the promising Saudi market.