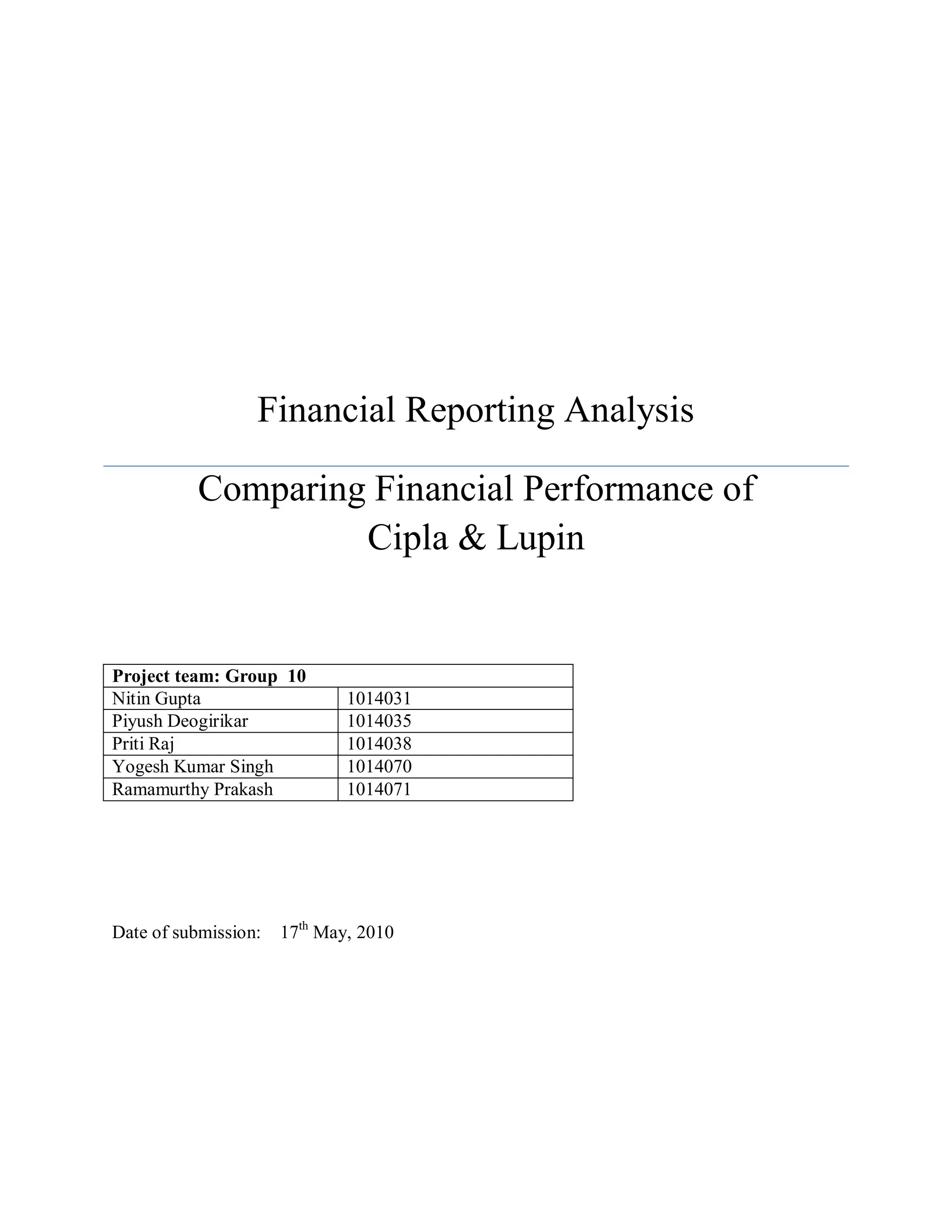

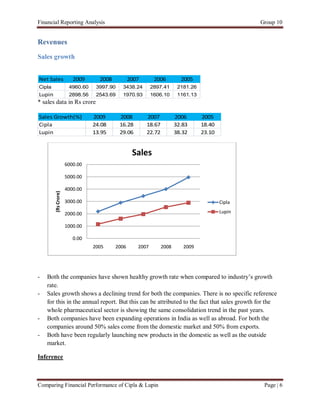

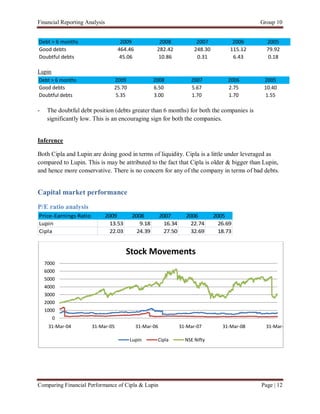

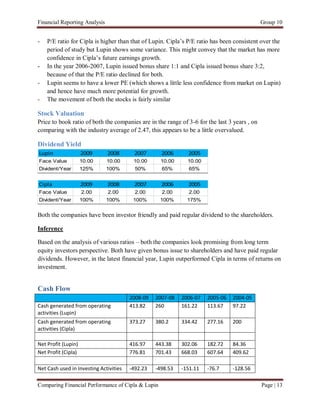

The document provides a financial analysis comparing the performance of pharmaceutical companies Cipla and Lupin over a 5-year period from 2004-2009. It analyzes their revenues, profitability, liquidity, capital market performance, and cash flows. Both companies showed healthy sales growth and increasing profits during this period. Their profit margins are around 15% with some declining trends in recent years likely due to increased costs. Both companies derive revenues through economies of scale in mass production. Overall the analysis finds that while both companies have performed well historically, Cipla may be slightly less risky due to maintaining profits through the economic downturn, though Lupin offers higher return potential.